EUR/USD

Higher Timeframes

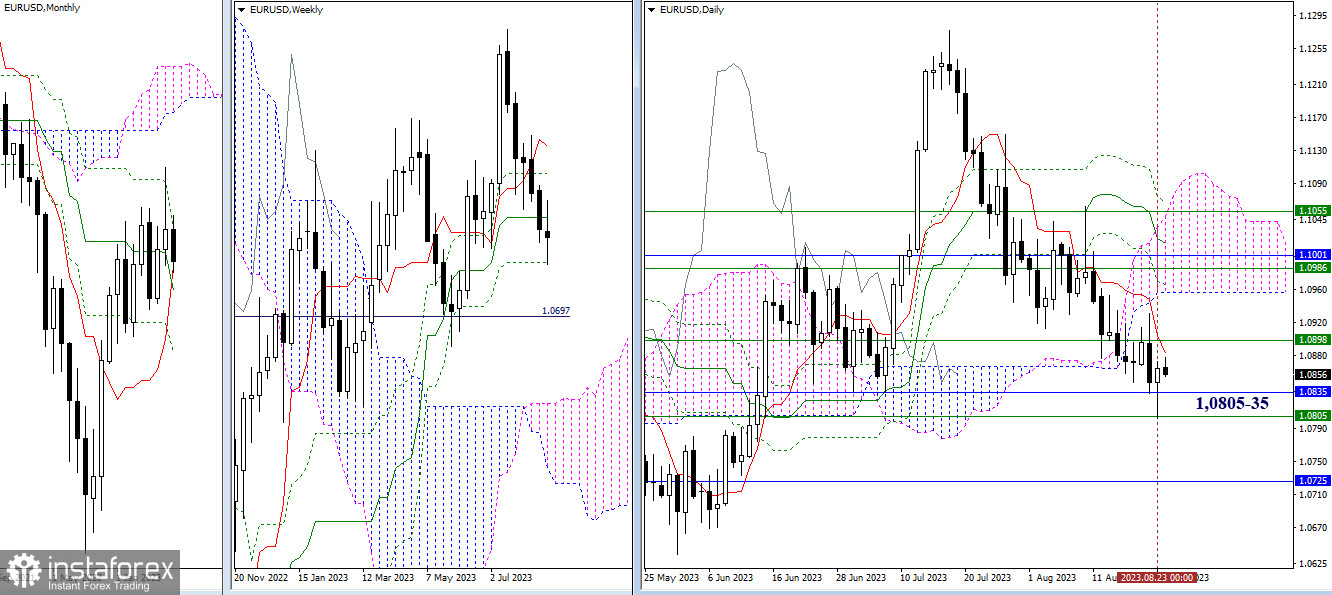

Yesterday's testing of the support zone (1.0835–05) led to a rebound on the daily timeframe. If this rebound is confirmed and the pair can soon take control of the daily short-term trend (1.0882) and the weekly medium-term trend (1.0898), then further recovery of bullish sentiment is possible. In this scenario, the next focus for the bulls would be the wide resistance zone, which currently combines multiple levels of different timeframes within the daily cloud, with the cloud's lower boundary at 1.0956. A lack of rise could lead to consolidation.

H4 – H1

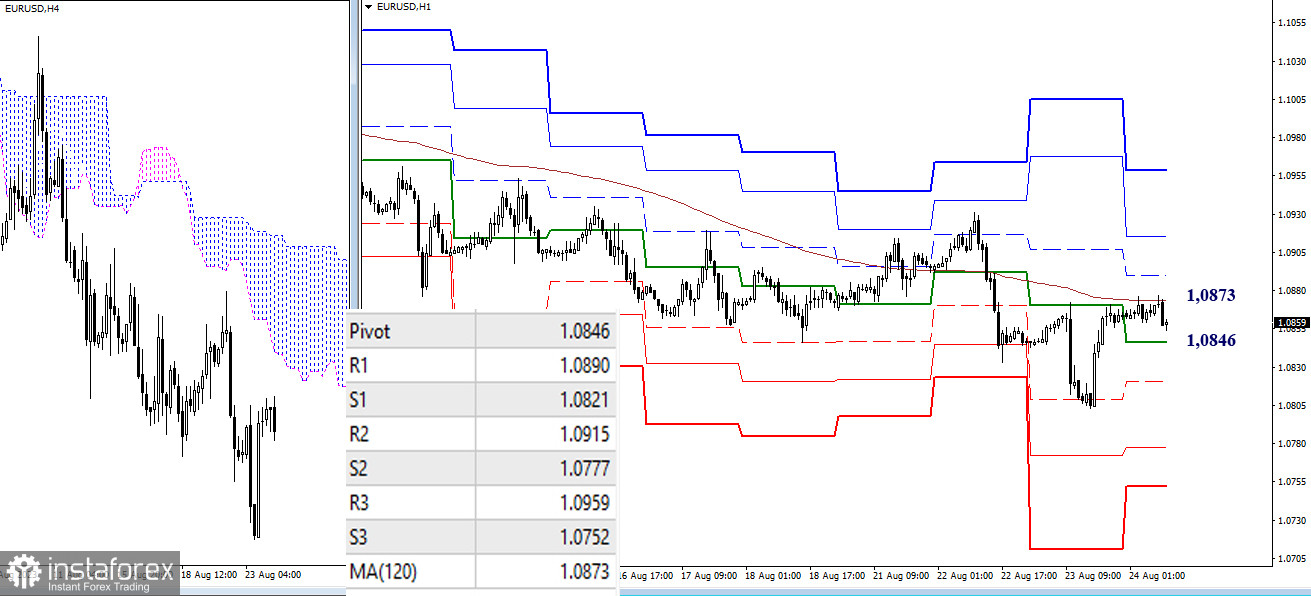

The euro is again testing the key level of the lower timeframes—the weekly long-term trend (1.0873). Taking on this level can offer a significant advantage. Thus, working above the moving average and its upward reversal will strengthen bullish players. Their next intraday targets are currently at 1.0890 – 1.0915 – 1.0959 (classic pivot points). Positioning below the weekly long-term trend and its bearish inclination will give the edge to the bears. Today, bearish targets can be marked at 1.0846 – 1.0821 – 1.0777 – 1.0752 (classic pivot points).

***

GBP/USD

Higher Timeframes

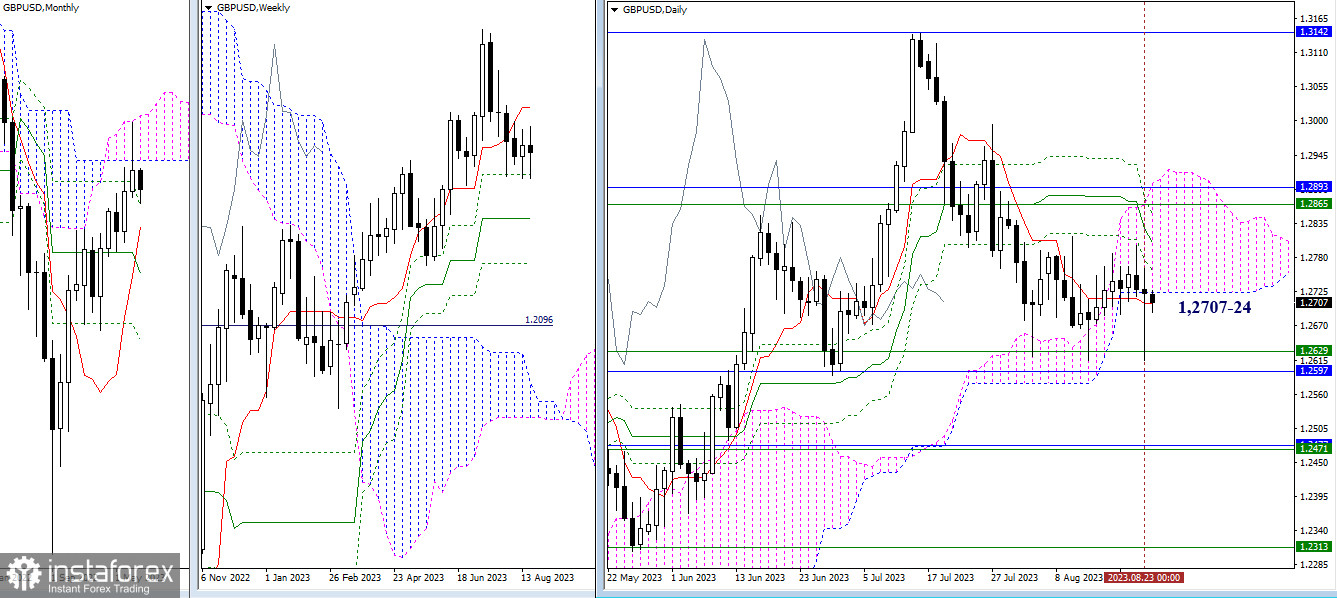

For the third time, when testing the support zone of 1.2629 – 1.2597, a considerably long lower shadow is formed on the daily candle, and the pair returns to the consolidation zone. Consequently, passing the weekly (1.2629) and monthly (1.2597) supports remain significant for new bearish prospects in this area. The current attraction is exerted by the 1.2707 – 1.2724 area (daily short-term trend + lower boundary of the daily cloud), serving as the center of attraction of the prevailing consolidation zone. To exit this zone, the bulls need to move beyond the daily cloud. Currently, its upper boundary (1.2899) is reinforced by the resistance levels of the weekly and monthly timeframes (1.2865–93). Intermediate resistance on this path can be provided by the levels of the daily Ichimoku cross (1.2759 – 1.2804 – 1.2849).

H4 – H1

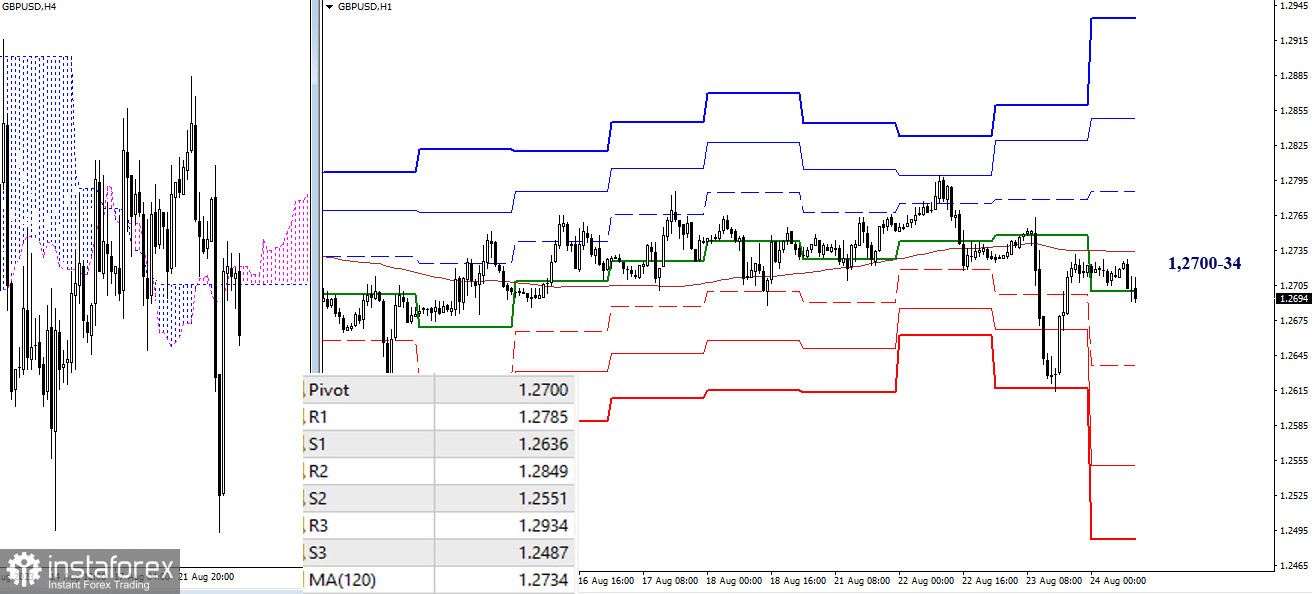

After testing the final pivot point yesterday, the pair has returned to the key thresholds and is now operating within their area of attraction. Key levels today converge around 1.2700 – 1.2734 (central pivot point + weekly long-term trend). Another rebound and a new phase of decline will allow bears to once again consider testing the significant support zone of the higher timeframes (1.2629 – 1.2597). Meanwhile, support for lower timeframes today are at 1.2636 – 1.2551 – 1.2487 (classic pivot points). Consolidation above 1.2700 – 1.2734 and a reversal of the moving average will lay the groundwork for strengthening bullish sentiment and advantages, with intraday targets at 1.2785 – 1.2849 – 1.2934 (classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)