EUR/JPY continues its upward trajectory, in part due to the divergence in monetary policies between the ECB and the Bank of Japan. Favoring buyers in yen trading and the EUR/JPY pair is the so-called "carry-trade," where a more expensive currency is bought using a cheaper one.

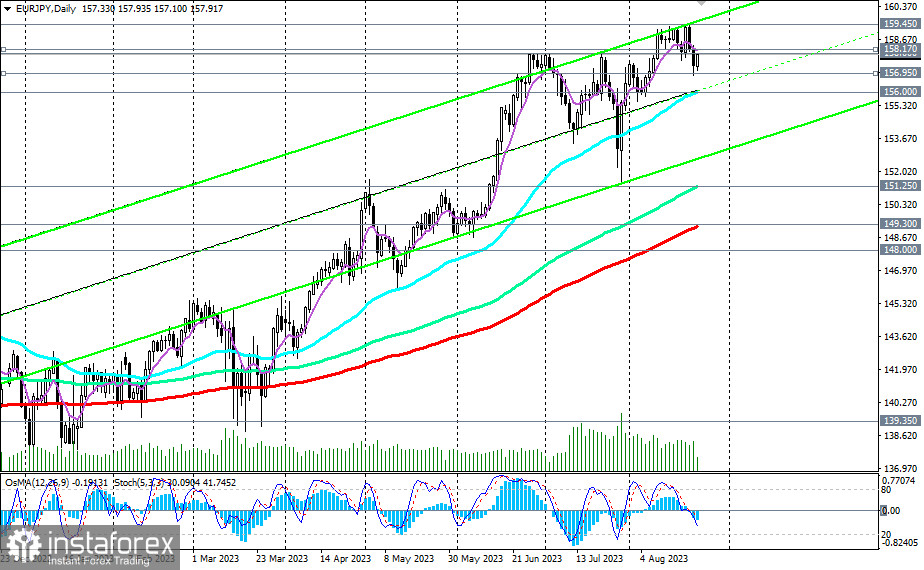

The first signal to increase long positions will be a break of the significant short-term resistance level at 158.17 (200 EMA on the 1-hour chart).

However, breaking through the recent high of 159.45 (this mark also intersects with the upper boundary of upward channels on daily and weekly charts) may trigger further growth of the pair, which continues to trade within the context of a long-term bullish trend.

In an alternative scenario, the first signal to open short positions would be a break of the recent local low and the crucial short-term support level at 156.95 (200 EMA on the 4-hour chart).

If this scenario unfolds, a breach of the support level at 156.00 (50 EMAon the daily chart) could induce further decline towards key support levels at 151.25 (144 EMA on the daily chart), 149.30 (200 EMA on the daily chart). Breaking these could disrupt the medium-term bullish trend of the pair, which would still remain within the long-term bullish trend, above the support levels of 139.35 (144 EMA on the weekly chart) and 136.65 (200 EMA on the weekly chart).

For now, a consistent bullish trend and strong upward momentum prevail. Betting on such a decline for the pair is not recommended. Long positions remain preferable.

Support Levels: 156.95, 156.00, 151.25, 149.30, 148.00

Resistance Levels: 158.00, 158.17, 159.00, 159.45.