While we've understood Federal Reserve Chair Jerome Powell's potential rhetoric, what about European Central Bank President Christine Lagarde's statement? That's much more complicated. The ECB's rate is below the Fed's, yet inflation in the European Union is higher. This single factor suggests that the ECB should agree to additional tightening. However, in recent months, we've repeatedly heard that a pause is necessary. A pause doesn't mean the end of the tightening process, but, in a manner of speaking, its a final stretch. If Lagarde hints at such a scenario in her speech, the euro will fall even further in the market.

The second crucial factor is the state of the European economy. GDP has been stagnant for almost four quarters, and PMIs keep falling. As a result, every new rate hike will push the European economy into an even deeper hole. It's important for the ECB to maintain a balance between the rate and the economy. Every subsequent ECB meeting is now a mystery. Some members of the Governing Council believe in another rate hike, while others insist on a pause. Lagarde is set to guide the market on Friday.

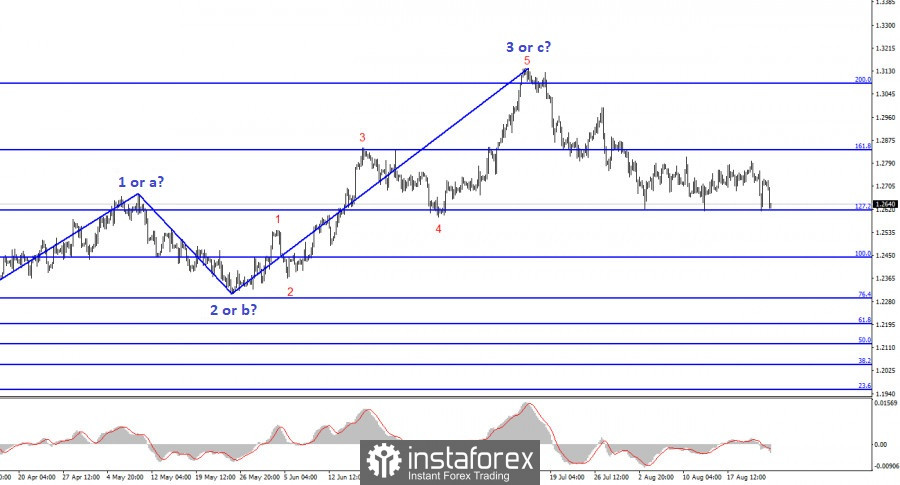

In my opinion, the chances of a dovish stance from Lagarde is much higher. Even if she announces that the current course will be maintained, it doesn't mean all members of the Governing Council will support her. From this perspective, the Fed appears to be a more cohesive entity, so the preliminary verdict is as follows: Powell's hawkish stance is more likely, while Lagarde's is "conditionally-hawkish". This means a further decline for the EUR/USD. As for the GBP/USD, a lot depends on the 1.2618 mark. A successful attempt to break through it will signal the market's readiness to continue selling, regardless of Powell's remarks in Jackson Hole.

Based on all the above, I don't expect the market sentiment to change on Friday. Both instruments might start forming corrective upward waves, but so far, there are no signs for either. Hence, it's too early to talk about a sharp increase in demand for the euro and the pound.

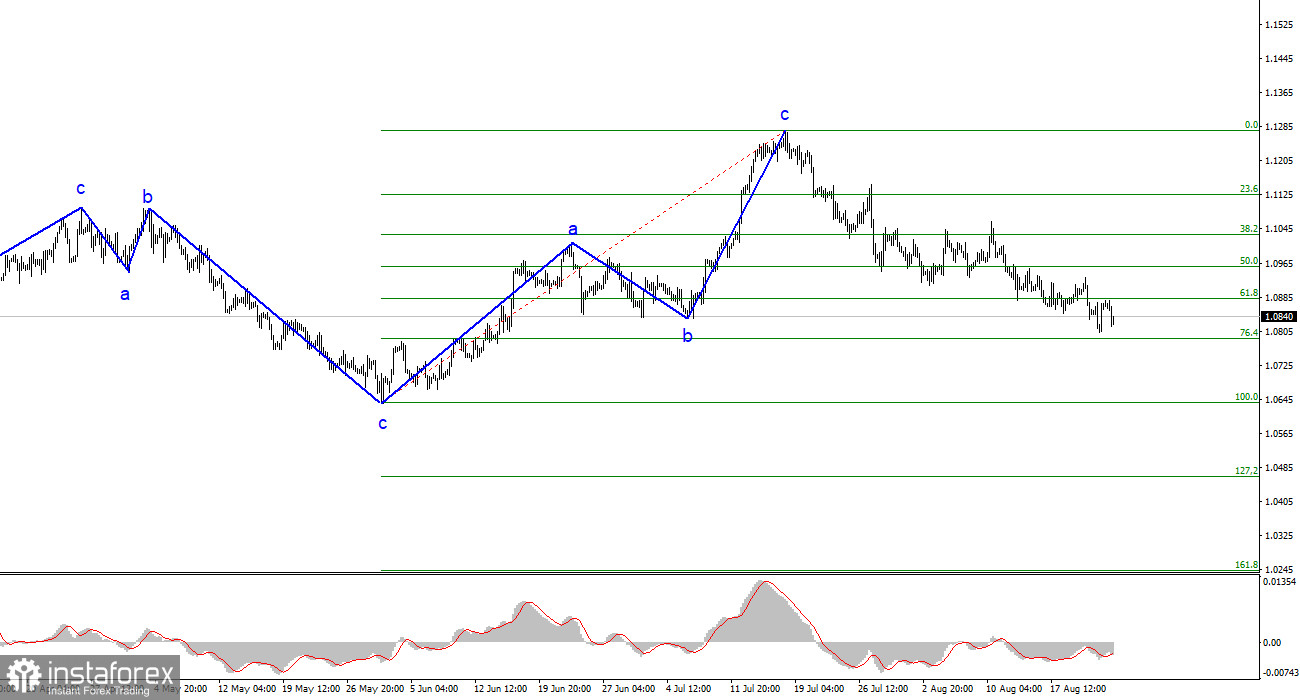

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite realistic, and with these targets in mind, I advise selling the instrument. The a-b-c structure appears complete and convincing. Therefore, I advise selling the instrument with targets set around the 1.0788 and 1.0637 marks. I believe that the bearish segment will persist, and a successful attempt at 1.0880 indicates the market's readiness for new short positions.

The wave pattern of the GBP/USD pair suggests a decline within the downtrend segment. There is a risk of ending the current downward wave if it is wave "d" and not "1". In that case, wave 5 could start from current levels. However, in my opinion, we are currently seeing the construction of a corrective wave within a new downtrend segment. If this is the case, the instrument will not rise much above the 1.2840 mark, and then a new downward wave will commence. We should brace for new short positions.