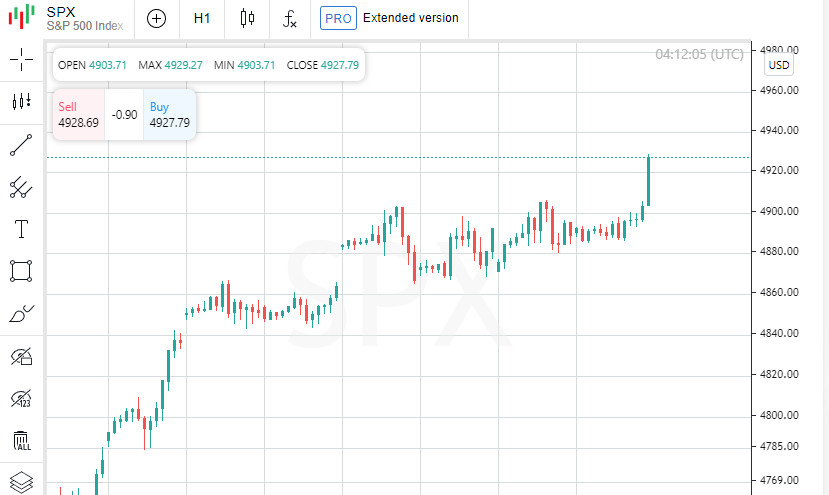

U.S. stock indices showed growth on Monday. Investors prepared for a busy week, expecting a large number of financial reports from high-market-cap companies, new economic data, and a Fed meeting dedicated to monetary policy. All three major U.S. stock indices showed growth, with the high-tech Nasdaq (.IXIC) index growing the most. The S&P 500 index (.SPX) reached a new record closing level. After the main index rose by 3.3% in the first month of 2024, BlackRock revised its assessment of U.S. stocks, raising it.

In anticipation of upcoming reports, investors' attention is focused on high-profile companies in technology and related sectors. A number of key companies, including Alphabet Inc (GOOGL.O), Microsoft Corp (MSFT.O), and Qualcomm Inc (QCOM.O), are preparing to publish their financial results, starting from Tuesday and peaking on Thursday with reports from giants such as Apple Inc (AAPL.O), Amazon.com (AMZN.O), and Meta Platforms Inc (META.O). Also of interest are the results of other significant companies: General Motors Inc (GM.N) on Tuesday, Boeing Co (BA.N) on Thursday, as well as leading oil corporations Exxon Mobil Corp (XOM.N) and Chevron Corp (CVX.N), which will present their reports on Friday.

The main event of the week for investors is the press conference of the chairman of the Federal Reserve (Fed) Jerome Powell and the results of the two-day meeting of the U.S. central bank, scheduled for Wednesday. Additionally, the publication of U.S. unemployment data is expected on Friday. There is speculation that the Fed will maintain its key interest rate at 5.25%-5.50%. However, some investors do not rule out that the central bank may deviate from its plans to raise rates.

Fed Chairman Jerome Powell and other members of the policy leadership have already stated that a reduction in interest rates should not be expected until inflation falls to the annual target level of 2%. They also emphasized their readiness to take a flexible approach in response to changing economic data. The list of economic reports this week includes labor market data, including job vacancies and workforce turnover research, the ADP report, fourth-quarter employment cost data, productivity metrics, layoff plans, and the January employment report, to be published on Friday.

In addition to the aforementioned reports, this week will also see the release of the Case-Shiller home price index, consumer confidence indicators, the Purchasing Managers' Index from the Institute for Supply Management, construction spending statistics, and information on manufacturing orders. Recent positive economic data, including impressive gross domestic product and personal consumer expenditure figures released last week, have, on one hand, alleviated concerns about a possible recession, and on the other hand, reduced the likelihood of the Federal Reserve cutting interest rates soon, possibly as early as March.

The industrial Dow Jones index (.DJI) increased by 224.02 points (0.59%) to 38,333.45. The S&P 500 index (.SPX) gained 36.96 points (0.76%) to 4,927.93, and the Nasdaq Composite index (.IXIC) rose 172.68 points (1.12%) to 15,628.04. Out of the 11 sector indices of the S&P 500, ten showed growth. The largest increase was in the consumer discretionary index (.SPLRCD), which grew by 1.37%, followed by a 0.97% increase in the information technology sector (.SPLRCT). The energy sector (.SPNY) was the only one to show a decline. Microsoft (MSFT.O), a company that drew market attention to the field of artificial intelligence thanks to its partnership with Open AI in 2023, is expected to report a 15.8% increase in quarterly revenue. Its shares closed up by 1.4%.

Tesla Inc (TSLA.O) shares rose by 4.2% following the electric car manufacturer's announcement of capital investment plans. Shares of robot vacuum maker iRobot (IRBT.O) fell by 8.8% as the company and Amazon abandoned merger plans due to opposition from EU antitrust authorities. Meta Platforms (META.O) shares increased by 1.7% after brokerage firm Jefferies raised its target price from $425 to $455.

Shares of Warner Bros Discovery (WBD.O) lost 1.2%, as brokerage firm Wells Fargo downgraded the streaming platform's rating to 'equal weight'. Financial technology company SoFi Technologies (SOFI.O) shares jumped by 20.2% following the announcement of profits in the fourth quarter. On the NYSE, there were 397 new highs and 50 new lows.

On the Nasdaq, 2975 stocks rose and 1314 fell, as the number of rising stocks outnumbered falling ones by approximately a 2.3 to 1 ratio. The S&P 500 index set 45 new 52-week highs and did not find any new lows, while the Nasdaq recorded 226 new highs and 101 new lows. The trading volume on U.S. exchanges was relatively small, with 10.3 billion shares traded compared to the average of 11.5 billion shares over the previous 20 sessions.

Investors were also sensitive to geopolitical risks related to the rise in oil prices following a missile attack in Kauta, which caused a fire on a fuel tanker in the Red Sea, and a drone attack in Jordan.