Long-term perspective:

During the week, the GBP/USD currency pair continued its modest decline but couldn't confidently break through the Ichimoku cloud. This may be coincidental or not. The fact remains that the British pound still displays stronger resistance against the dollar. It rises more vigorously and falls more mildly. Therefore, while the European currency stabilized below the Ichimoku cloud, the pound did not. We only saw one day of the pound falling last week. This day was Thursday, and there wasn't any major or disappointing data for the pound. On that day, two contradicting reports were released in the US. For instance, when weak business activity data was released for the UK earlier, the pound barely declined.

From this, we can deduce the following: the pound remains heavily overbought, is priced too high, and there is no fundamental or macroeconomic backdrop to support such a high valuation of the British currency. Thus, we still believe that the pair should only be heading downward. Yes, the Bank of England might raise its rate several more times, unlike the Federal Reserve or the ECB. However, the pound has risen much more than the euro, and the dollar has been falling for 11 consecutive months, even though the Federal Reserve has been raising its rate and hasn't even finished this process yet. A target near the 19th level is ideal.

Turning to the fundamentals. On Friday, when the pound barely decreased, Jerome Powell stated at a symposium in Jackson Hole that the central bank would raise rates again if necessary. He expressed that inflation remains excessively high and the Federal Reserve will stay within its primary goal of price stability at around 2%. He noted that the economy has yet to fully respond to the rate hike to 5.5%, suggesting it might slow down and worsen labor market conditions. However, what concerns the Federal Reserve more is inflation. Hence, efforts to bring it back to the target level will continue.

There were no statements from Andrew Bailey, so there's no new information regarding the Bank of England, and Mr. Powell's hawkish rhetoric did not cause a strong rise in the US dollar.

COT Analysis.

According to the latest report on the British pound, the "Non-commercial" group opened 7.5 thousand buy contracts and closed 0.6 thousand sell contracts. As a result, the net position of non-commercial traders increased by 8.1 thousand contracts over the week. The net position indicator has been steadily increasing for the past 11 months and continues to rise. As it increases, so does the British pound (in the long term). We are approaching a point where the net position has grown too much to expect a continuation of the pair's rise. A prolonged and significant decline in the pound is imminent. While COT reports allow for slightly strengthening the British currency, believing in this becomes increasingly challenging daily. It's hard to say on what basis the market can resume purchases. Slowly, sell signals are emerging on 4-hour and 24-hour timeframes.

The British currency has grown by 2800 points from its absolute lows reached last year, which is quite substantial. Continuing this growth without a significant downward correction would be utterly illogical. We're not against an upward trend; we first believe a significant correction is required. The market views the fundamental backdrop unilaterally, often overlooking data favoring the dollar. The "Non-commercial" group currently has 98.0 thousand contracts open for purchase and 38.9 thousand contracts for sale. We remain skeptical about the long-term growth of the British currency, and the market has recently begun to pay some attention to sales.

Trading plan for the week of August 21 – 25:

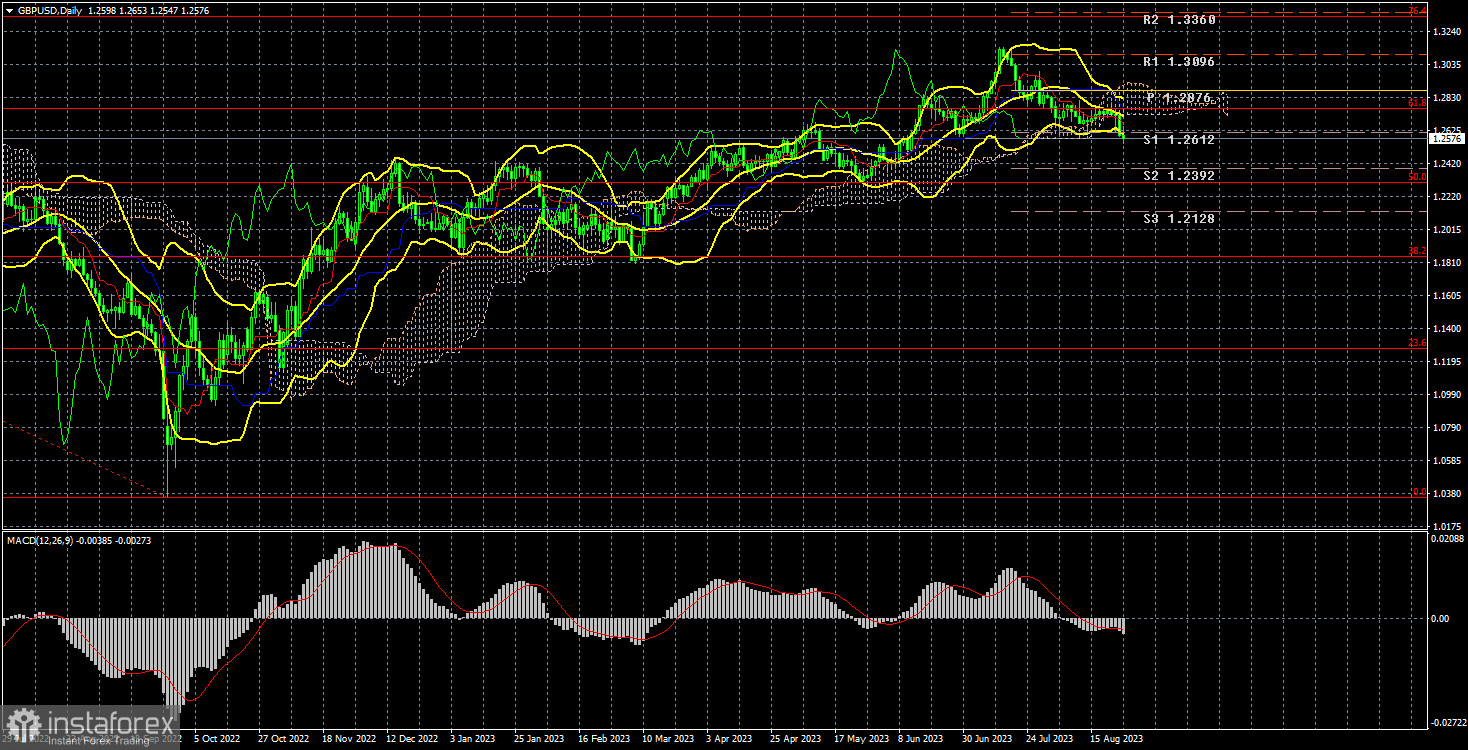

- The pound/dollar pair is attempting to form a new correction. Every new attempt at a correction has looked pitiable, but this time, we may see a move below the Ichimoku cloud. The price is below all the lines of the Ichimoku indicator, so long positions are irrelevant. If the price consolidates above the Kijun-sen line, it indicates a possible resumption of the upward trend. In this case, the target is the Fibonacci level of 76.4% at 1.3330.

- As for sales, there are currently reasons for them. However, we still need to figure out how to cross the Senkou Span B line. Therefore, selling is advisable since reversal signals have been formed recently, but one should be cautious. The nearest target is the Fibonacci level of 50.0% (1.2302).

Explanations for the illustrations:

Support and resistance price levels, Fibonacci levels – are the targets when opening purchases or sales. Around them, one can place Take Profit levels.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on COT charts – the net position size of each category of traders.

Indicator 2 on COT charts – the net position size for the "Non-commercial" group.