The upcoming week's news background will be much stronger. This means that trading volumes might increase, and we may see some sudden movements. Take note that both instruments are currently in a state where an ascending correction wave could start at any moment. And if the news background stops supporting the demand for the US currency, this wave might begin as early as next week. There will be plenty of important events to watch.

I'll start with the less important reports. The euro area will release another inflation report for August. Why do I consider this report the least important? In my opinion, the European Central Bank is preparing to leave the rate unchanged in September. If this is the case, it won't matter even if inflation falls. On the contrary, it will mean that the ECB was right not to rush with new rate hikes. Recall that last year, the Federal Reserve's rhetoric was about getting inflation back to 2% in the shortest possible time. The ECB's stance was simply to return inflation to 2%. In other words, the ECB is in no hurry, so it may not rush to raise the rate.

Inflation in the European Union might slow down to 5%, which is far from the target mark. But even ECB President Christine Lagarde has already noted that we shouldn't expect 2% before 2025. I find the US reports more significant. For instance, JOLTS reports, unemployment claims, ADP employment changes, and GDP can be considered secondary. I expect them to impact the dollar only if their values are unexpected for the market, which happens rather infrequently.

However, unemployment reports, Nonfarm Payrolls, and the ISM manufacturing index can be considered as leading indicators, and there is a 90% chance that the movements of both instruments after their release will be significant. The number of payrolls in August might be 170,000, indicating a further decline in the figure. The unemployment rate could remain at 3.5%, and the ISM index could rise to 47. At first glance, it might seem that the reports will be weak in any case, but I expect them to support the US dollar, as it won't be difficult to exceed the market's expectations.

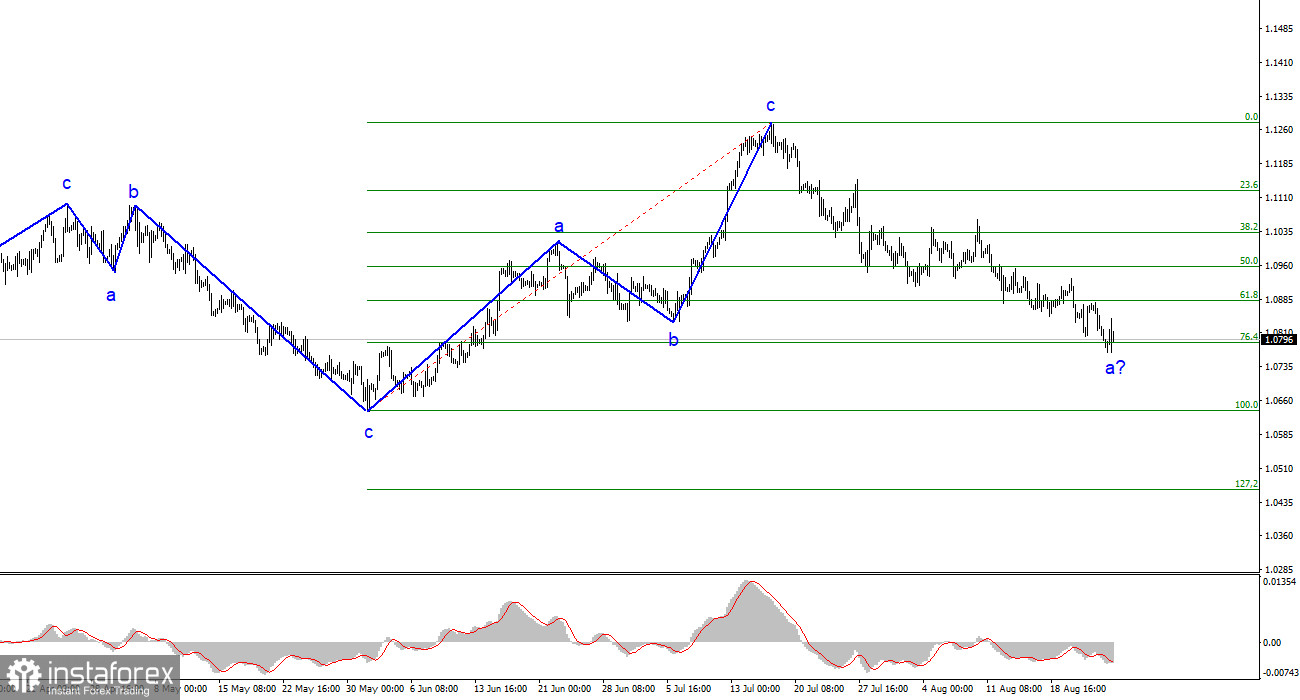

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite realistic, and with these targets in mind, I advise selling the instrument. The a-b-c structure appears complete and convincing. Therefore, I advise selling the instrument with targets set around the 1.0788 and 1.0637 marks. I believe that the construction of a downtrend segment will continue, but a corrective wave might begin soon.

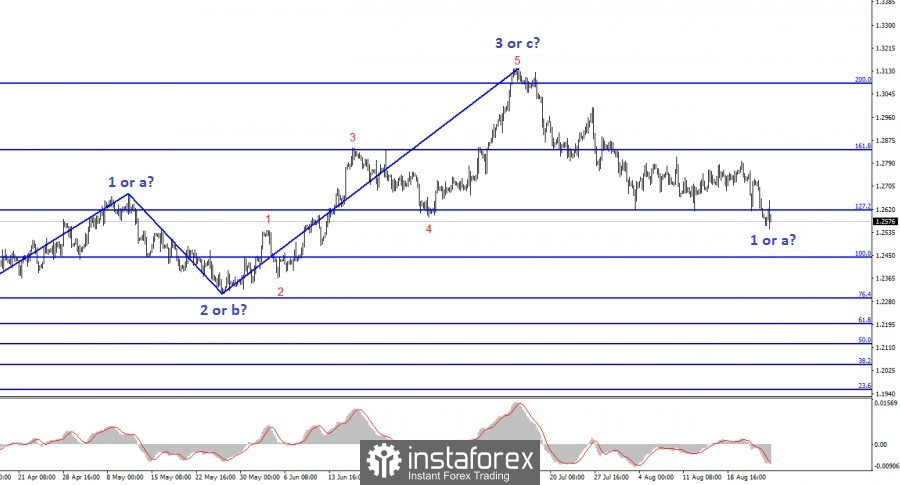

The wave pattern of the GBP/USD pair suggests a decline within the downtrend segment. There is a risk of ending the current downward wave if it is wave "d" and not "1". In that case, wave 5 could start from current levels. However, in my opinion, we are currently witnessing the construction of the first wave as part of a new downtrend segment. A successful attempt to break through the 1.2618 mark, corresponding to 127.2% Fibonacci, indicates the market's readiness for new short positions.