In 2022, Britain managed to avoid a recession despite the energy crisis, the armed conflict in Ukraine, and the panic caused in the country's financial markets by the government of Liz Truss. Will they be lucky this time? The aggressive tightening of monetary policy is starting to impact business activity and even the labor market, causing GBP/USD to decline.

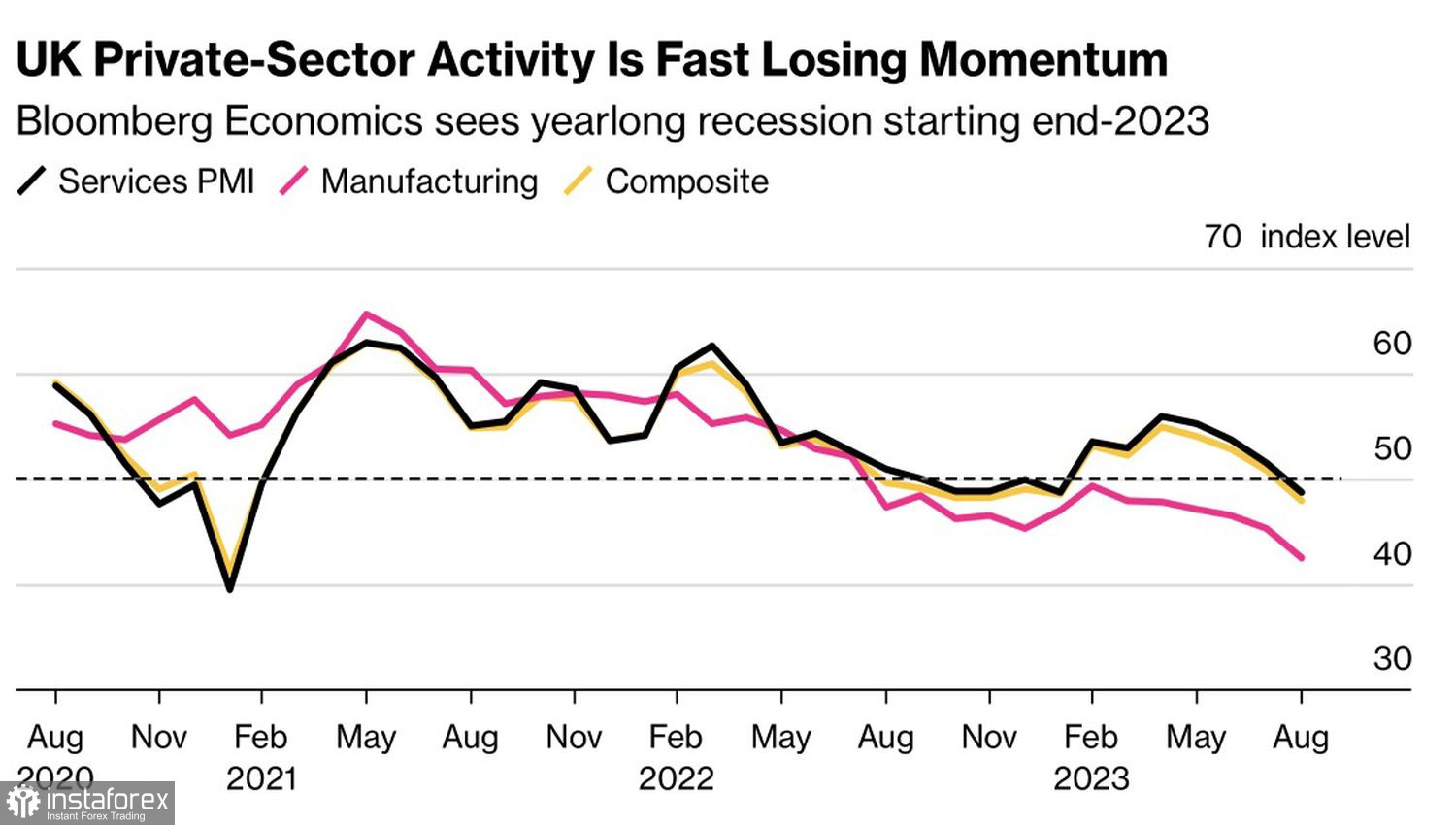

Dynamics of business activity in Britain

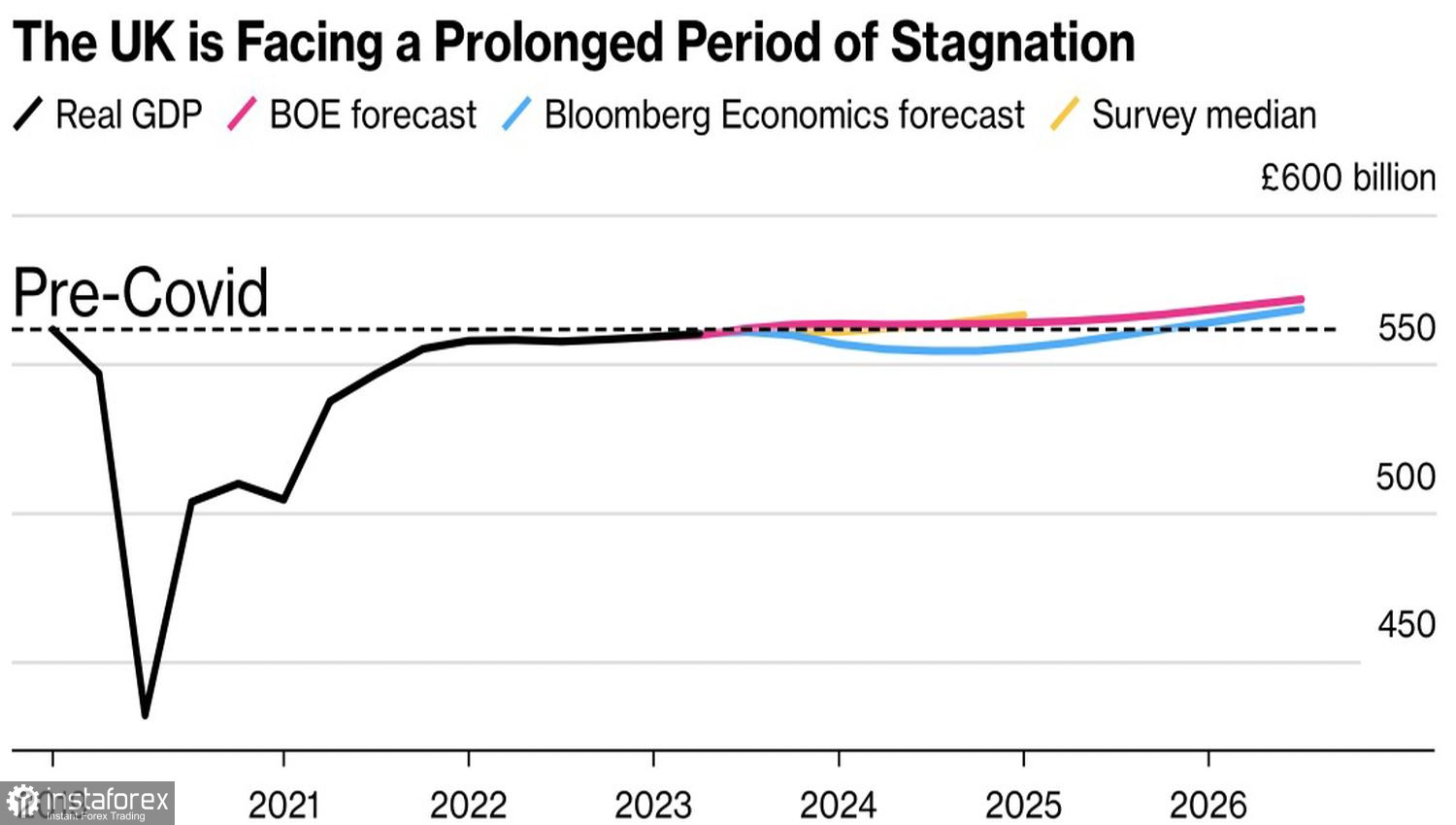

Very poor statistics from purchasing managers forced investors to revisit the long-forgotten topic of a downturn in the British economy. The problem is that experts from Bloomberg, the Bank of England, and other forecasters are betting on stagnation, not a recession. If a recession occurs, it will be a blow to GBP/USD.

Indeed, markets rise or fall on expectations. It was Britain's ability to avoid contraction that became the catalyst for the pound's rally, which still leads the G10 currency race. If moderate optimism turns to disappointment, trouble awaits.

Forecasts for the British economy

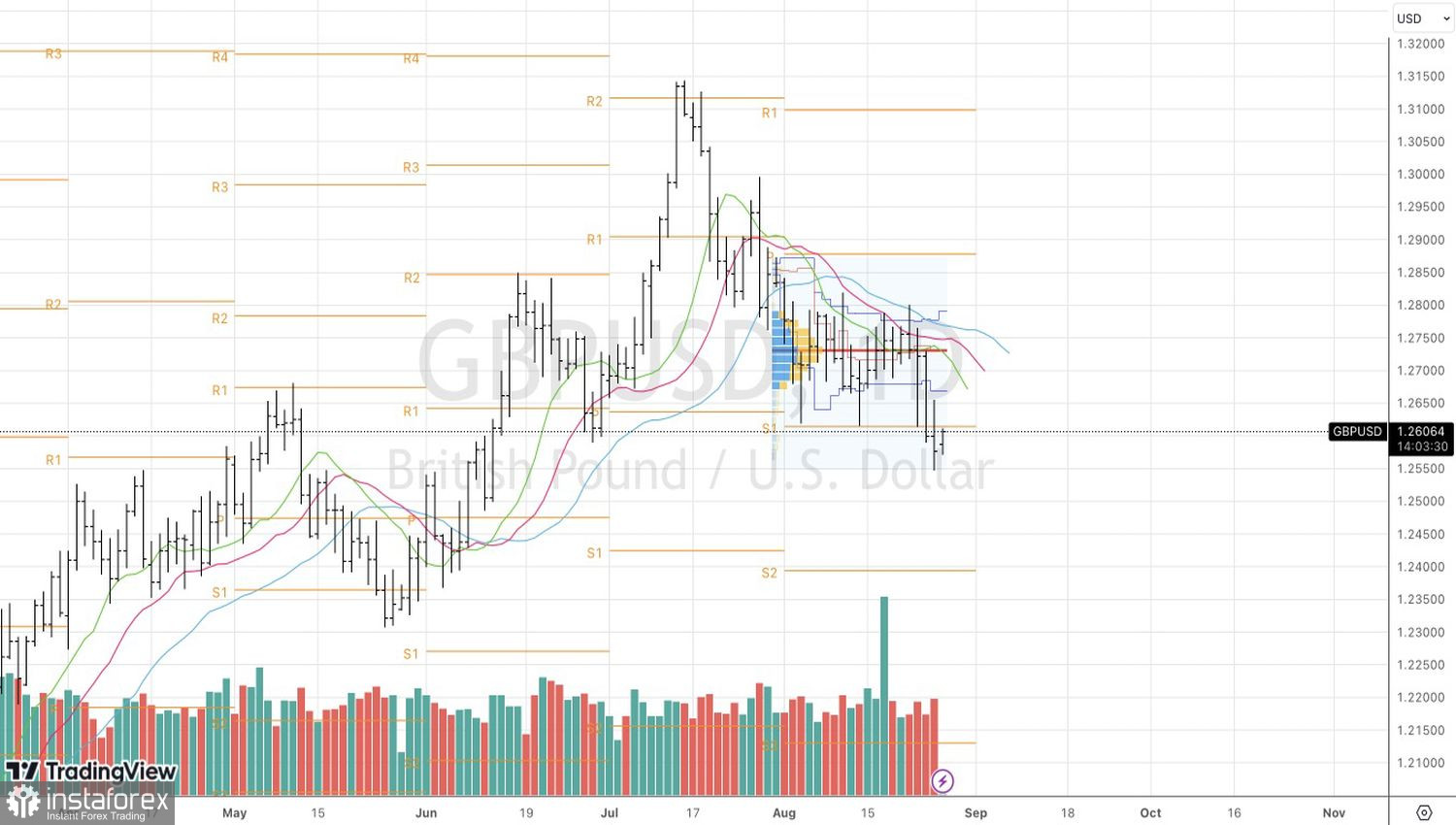

Meanwhile, an unpleasant surprise from business activity led to a reduction in the presumed repo rate ceiling from 6% to 5.75% and the worst bond yield drop for Britain in five months. As a result, GBP/USD plummeted to its lowest point since mid-June.

The question is whether the market's reaction to a single report was overly explosive. MPC member Ben Broadbent believes that borrowing costs will remain elevated for a long time. The Bank of England needs to curb imported inflation. It's a lengthy process, as the effects that led to its rise are unlikely to dissipate quickly. The battle against high prices will drag on, necessitating an extended period of stringent monetary policy.

Moreover, in any currency pair, there are always two currencies. Fed Chair Jerome Powell's hints about raising the federal funds rate affected the GBP/USD peak no less than the disappointing British business activity statistics. However, the factor of the potential resumption of the monetary tightening cycle is already priced into the U.S. dollar, setting the stage for speculators to book profits on the American currency and a sterling rebound.

The tightening of monetary policy works with a time lag. The U.S. economy will likely start to cool down over the next six months. Disappointing macro statistics will drop Treasury bond yields and halt the upward movement of the USD index. Can GBP/USD, backed by the weak economy of Britain, take advantage of this? If the BoE is ready to sacrifice it to defeat inflation, then yes.

Technically, on the daily chart of the analyzed pair, the 'Spike and Ledge' pattern was realized. However, if the quotes return to the boundaries of the previous consolidation range of 1.2615–1.28, the risks of its transformation into a false breakout will increase. As a result, breaking through resistances at 1.2615 and 1.2635 will become a basis for buying GBP/USD.