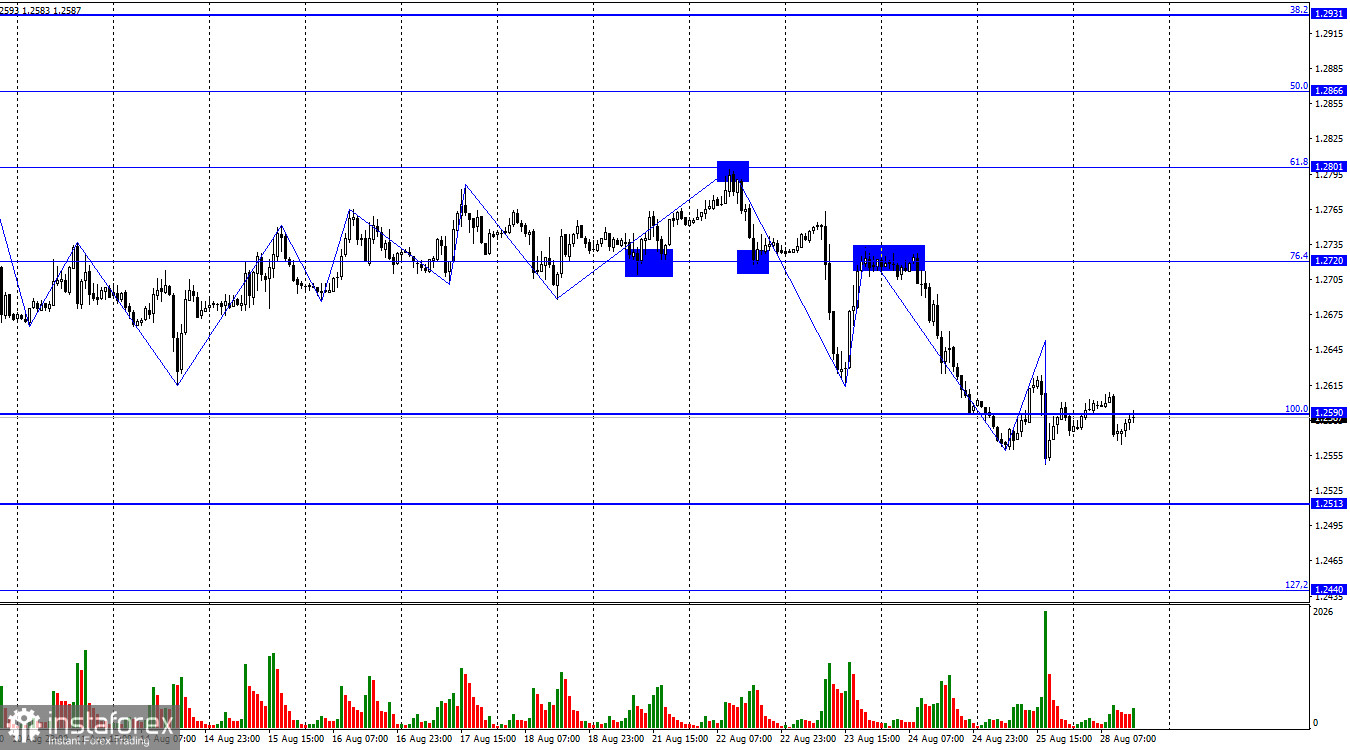

On the hourly chart, the GBP/USD pair on Friday turned in favor of the British pound, a slight increase, a reversal in favor of the US dollar, and a new decline. The corrective level of 100.0% (1.2590) currently appears weak - the price hardly notices it. Therefore, I advise against using it for trading. On Monday, there's almost no movement, which often happens at the beginning of the week. The wave pattern is more interesting and informative right now.

The waves point to a bearish trend, but there's one nuance. The latest wave down only broke the low of the previous wave by a few points. Thus, I can't definitively say that the bearish trend will continue this week. We are observing relatively weak movements for now, and traders aren't trying to break beyond Friday's lows and peaks. If the new upward wave confidently breaches Friday's peak, it will be the first sign of a trend change.

On Friday, as I already mentioned, Federal Reserve Chairman Jerome Powell spoke. Much has been written about this, so I will focus only on key points. Powell stated at the symposium in Jackson Hole that the interest rate might increase by the end of 2023 if inflation doesn't decrease or continues to grow. Powell assured the market that inflation remains the Fed's top priority, with all other economic goals and tasks being secondary. At the same time, the Fed Chairman did not announce what decision might be taken in September. The FOMC has shifted to raising rates once every two meetings, so there should be a new pause in September. However, even if the rate increases again in November, this is still more than traders expected. The dollar had a good background on Friday but faced new challenges this week - the labor market and unemployment reports.

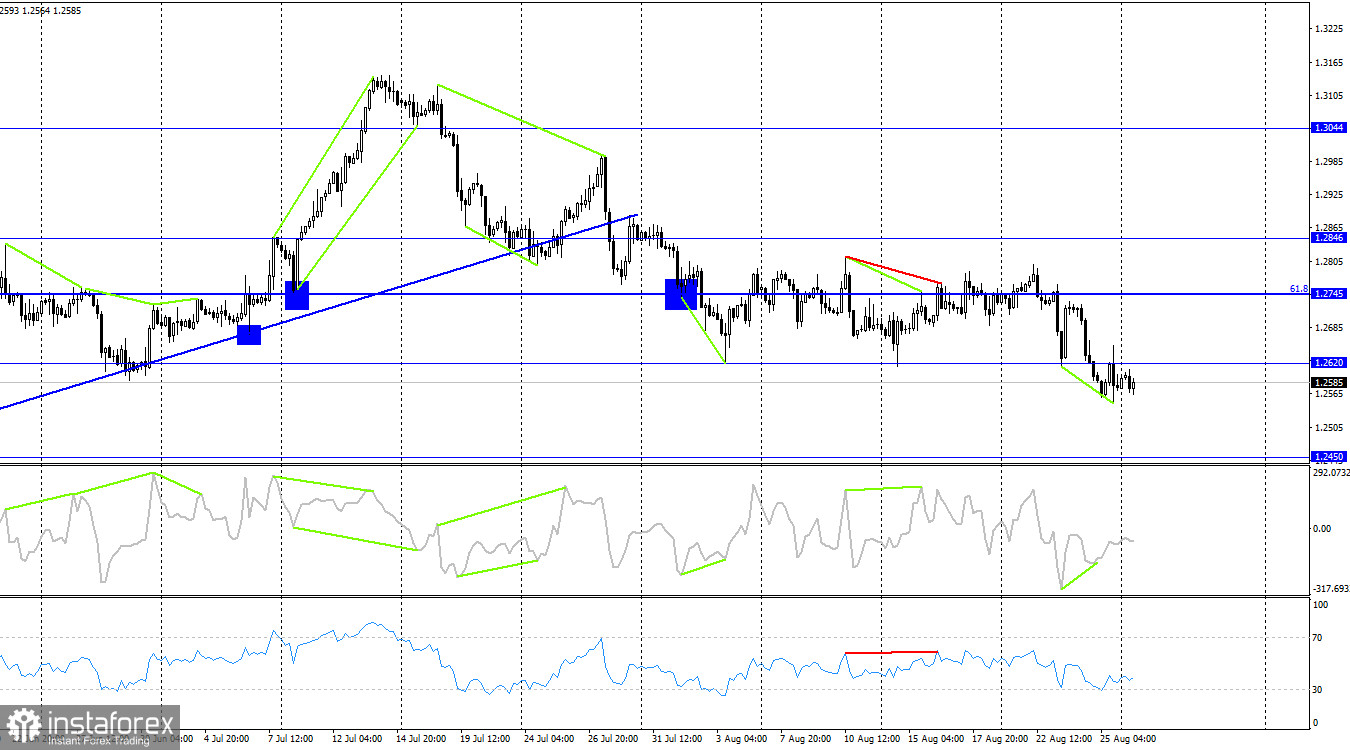

On the 4-hour chart, the pair declined to the 1.2620 level, the third time in the past few weeks, but on the fourth attempt, this level was finally breached. Thus, the pair has left the horizontal corridor, and the decline in quotations may continue toward the next level of 1.2450. The CCI indicator has formed a bullish divergence, so we can expect the pair to rise shortly. However, a closure above the 1.2620 level is also needed.

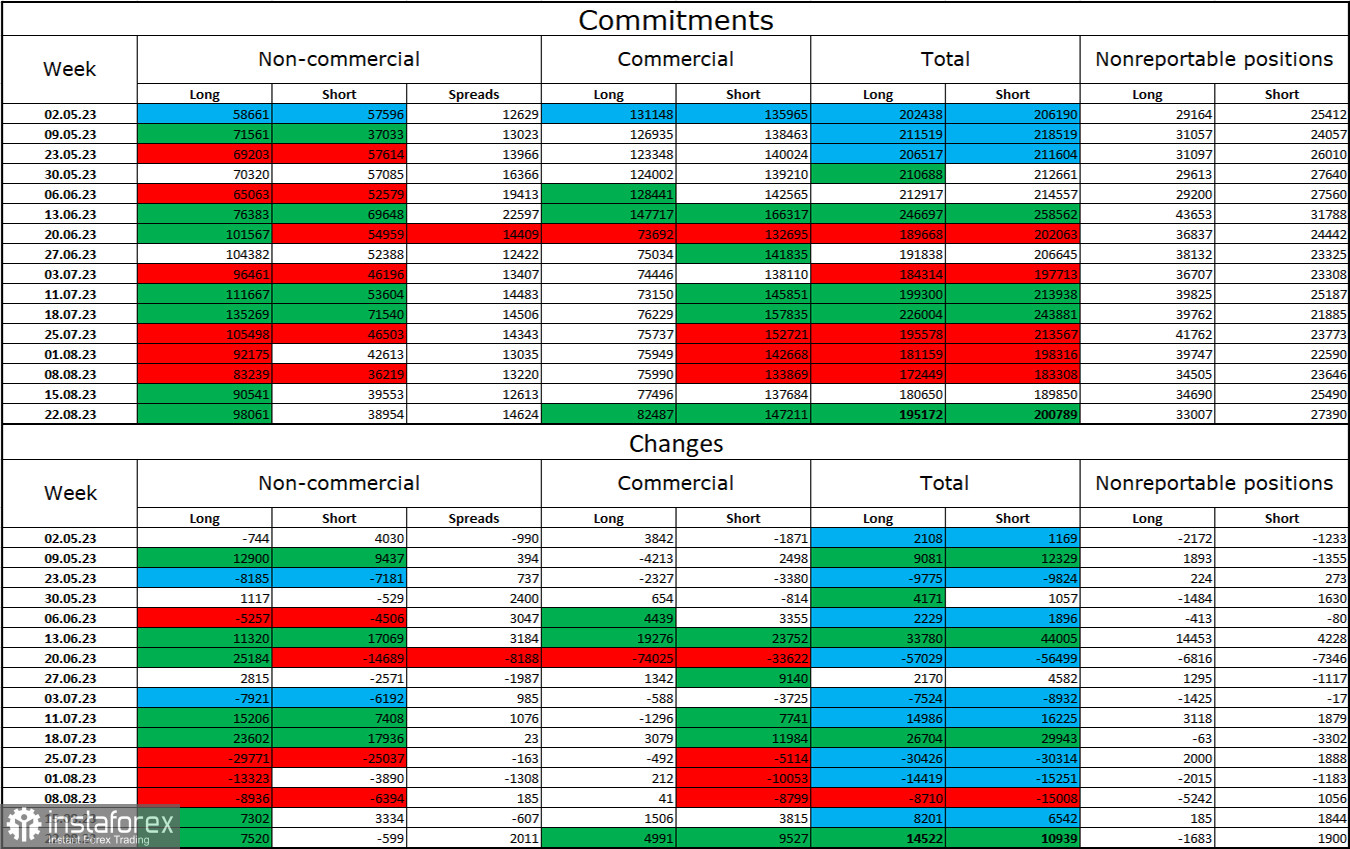

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category of traders became more bullish over the last reporting week. The number of long contracts held by speculators increased by 7,520 units, while the number of short contracts decreased by 599. The overall mood of major players remains bullish, with more than a two-fold gap between the number of long and short contracts: 98,000 against 39,000. The pound had decent prospects for continued growth a few weeks ago, but now, many factors have favored the US dollar. Expecting a new strong rise in the pound is very challenging. Nevertheless, bulls are not hurrying to dispose of buy positions, hoping the pound can still show growth.

News calendar for the US and UK:

On Monday, the economic events calendar doesn't contain any noteworthy entries. The influence of the news background on the market sentiment will be absent for the rest of the day.

GBP/USD forecast and trading advice:

Selling the pound was possible upon closing below the 1.2720 level on the hourly chart or bouncing off it from below. The nearest target of 1.2590 has been reached. New sales upon bouncing off the 1.2620 level from below, with targets at 1.2513 and 1.2440. Only one signal is possible for purchases today – a consolidation above 1.2620. The target is 1.2720.