Euro and pound rose all day on Monday despite the empty macroeconomic calendar and nondescript outcome of the Jackson Hole symposium. The movement seems to be a rebound after a fairly significant decline from earlier last week.

As for today, the report on the number of job openings in the US will come out, and forecasts say it will show a decrease of around 12,000. One reason points to the unavailability of hands in the labor market, as employers cannot find new workers needed for business expansion and development. Another reason could be the quick creation of new jobs to meet labor market needs. Since both explanations oppose each other, market players should not expect the data to have any influence.

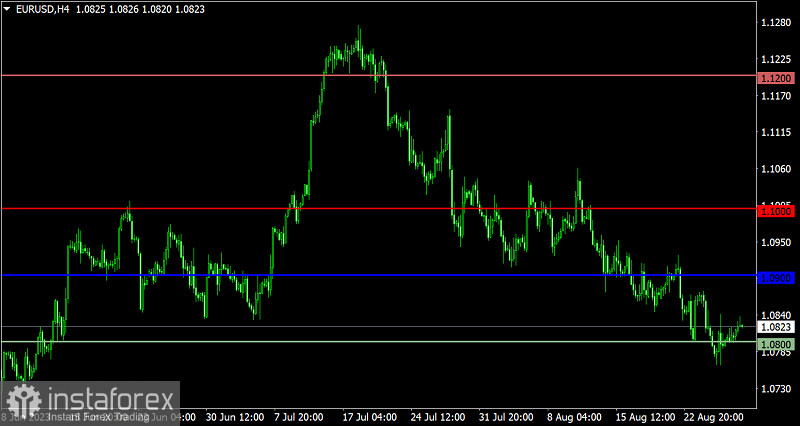

EUR/USD bounced back from the local low, returning above 1.0800. However, no significant changes occurred in the market, so the movement may just be a phase for short positions to regroup. This means that a dip below 1.0800 will lead to a surge in short positions, while the holding of the price above 1.0850 will be a signal for a further increase in the pair.

GBP/USD reached 1.2550, but then the volume of short positions decreased, leading to a rebound. This caused a return to the lower boundary of the range of 1.2650/1.2800, where 1.2650 acts as resistance. Pound will recover only under certain technical conditions.