Tips for trading BTC

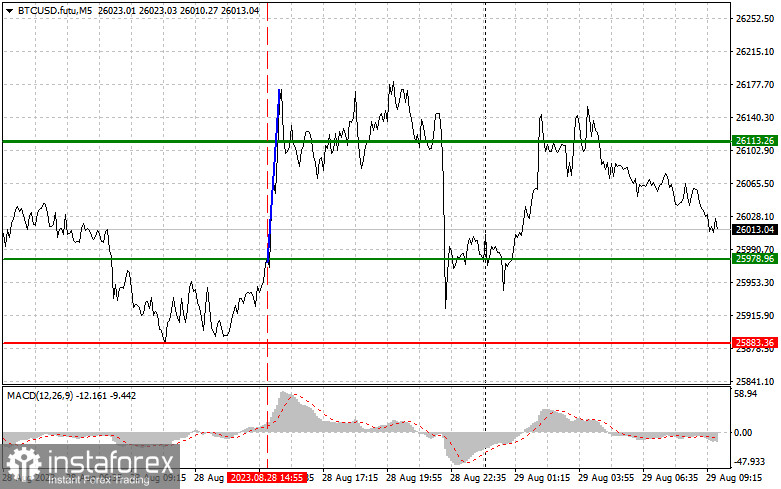

Yesterday, the test of the $25,978 price level coincided with the moment when the MACD was in the positive zone, starting its upward movement. This seemed like a promising signal to buy Bitcoin, leading to a surge toward $26,150. The fact that Bitcoin continues to trade within a new channel after the major sell-off earlier this month offers favorable entry points and surges from the channel's midpoint to its boundaries. An additional advantage for buyers is that Powell's Friday statements about high interest rates were disregarded. This suggests that Bitcoin may have reached its bottom, at least until the next Federal Reserve meeting scheduled for mid-September this year. It is better to act based on scenario 1.

Buy signal

Scenario 1: You can buy Bitcoin today if the price reaches the entry point near $26,081 (green line on the chart) with the target at $26,249 (thicker green line on the chart). It is better to close long positions and open short positions near $26,249. We can expect Bitcoin's rise today with the aim of updating the upper boundary of the sideways channel, coinciding with $26,250. Important! Before buying, make sure that the MACD indicator is above zero.

Scenario 2: One can also buy Bitcoin today if there are two consecutive price tests at $25,997. This will limit the downside potential of the trading instrument and lead to an upward reversal. We may also see growth towards the opposing levels of $26,081 and $26,250.

Sell signal

Scenario 1: One can sell Bitcoin today only after the level of $25,997 is breached (red line on the chart), resulting in a swift decrease in the trading instrument. Sellers' key target will be the level of $25,856, where it is better to close short positions and open long ones. Pressure on Bitcoin can intensify within the sideways channel and medium-term bearish market at any moment. Important! Before selling, make sure that the MACD indicator is below zero.

Scenario 2: Selling Bitcoin today is also an option if there are two consecutive price tests at $26,081. This will restrict the upside potential of the trading instrument and lead to a downward market reversal. We can expect a decrease toward the opposing levels of $25,997 and $25,856.

What's on the chart:

Thin green line – entry price for buying the trading instrument.Thick green line – projected price where one can set take-profit orders or lock in profits manually, as further growth beyond this level is unlikely.Thin red line – entry price for selling the trading instrument.Thick red line – projected price where one can set take-profit orders or lock in profits manually, as further decrease below this level is unlikely.MACD Indicator. When entering the market, it's important to consider overbought and oversold zones.Important. Novice cryptocurrency traders should exercise caution when making market entry decisions. It's best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without setting stop orders, you could quickly lose your entire deposit, especially if you're not using proper money management and trading with large volumes.Remember that successful trading requires a clear trading plan, such as the one presented above. Making impulsive trading decisions based on the current market situation is inherently a losing strategy for intraday traders.