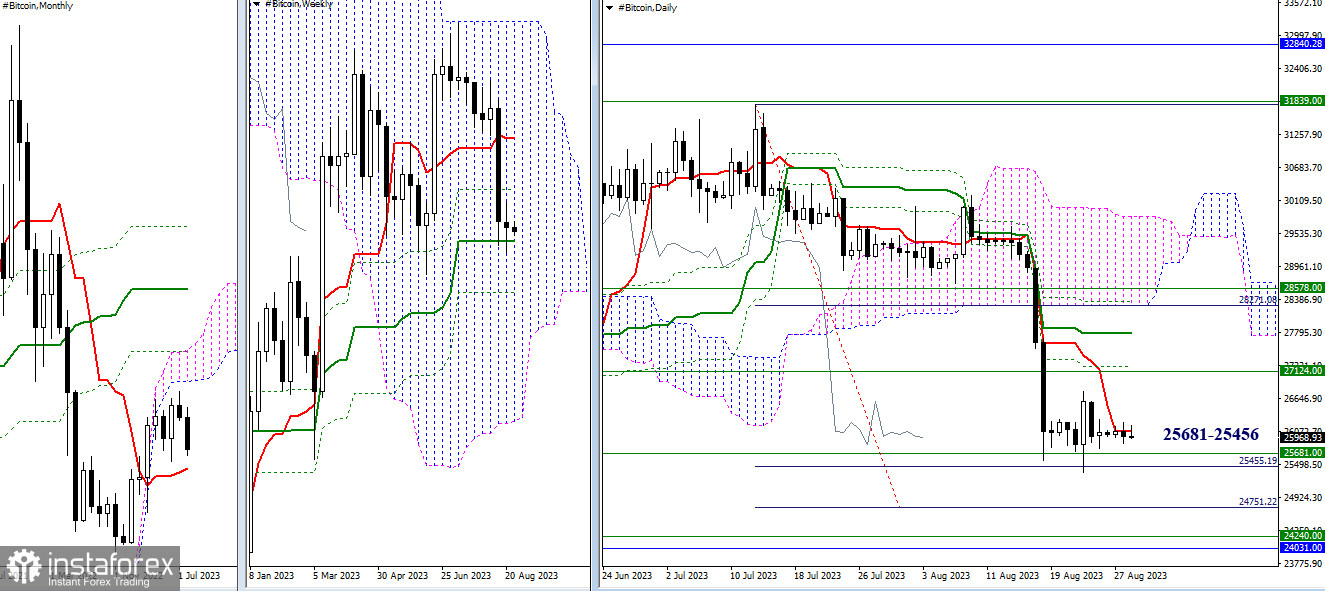

Higher timeframes

Bitcoin has been losing ground lately. The decline has led to the fulfillment of the daily target for breaking the Ichimoku cloud at the first target point (25,456). This boundary is strengthened by the weekly medium-term trend (25,681). As a result of testing the encountered supports, the pair indicated a slowdown and consolidation. In case of breaking the supports and renewed bearish activity, the focus will shift on reaching the next targets at 24,751 (100% fulfillment of the daily target) and the area of 24,240 – 24,031 (final level of the weekly golden cross of Ichimoku + monthly short-term trend).

However, if the current supports manage to stabilize the situation, and the bulls can regain their positions in the near future, the focus will shift towards interacting with resistances. At present, the nearest resistances are the weekly Fibo Kijun (27,124) and the daily medium-term trend (27,777).

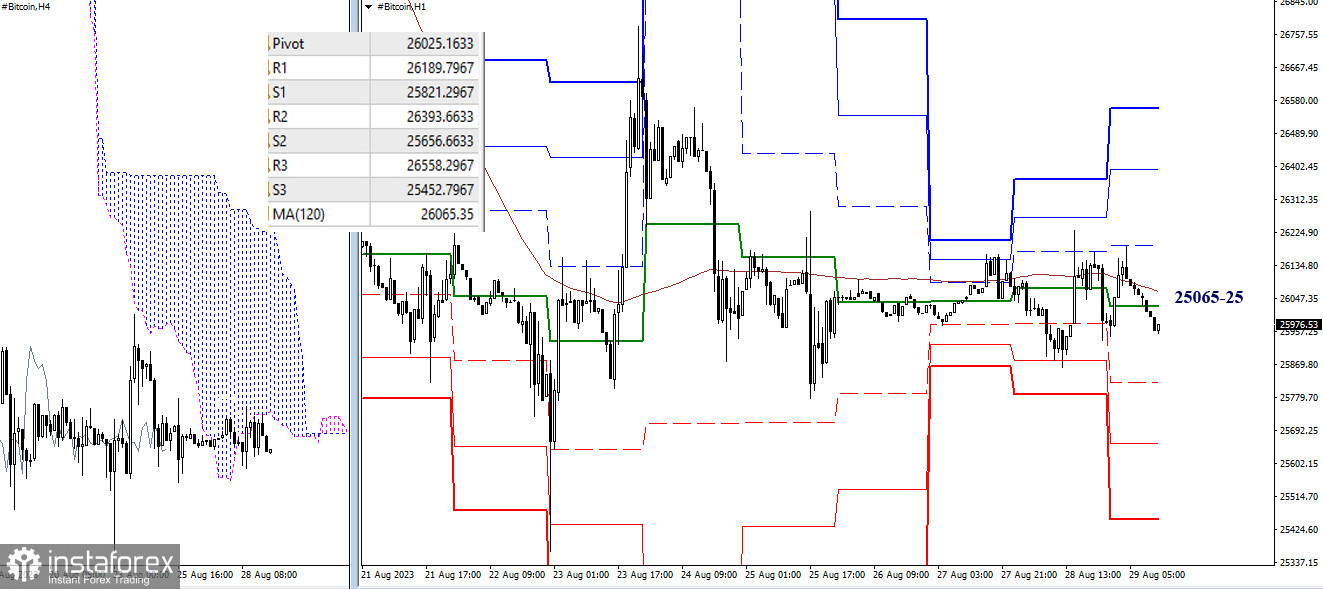

H4 – H1

On the lower timeframes, there has been a sideways movement for a prolonged period. The key levels are almost horizontal and are slightly separated from each other. Thus, working in their area of attraction will maintain uncertainty. Today, the key levels of lower timeframes combine their efforts around 25,065–25 (central pivot point + weekly long-term). If one side becomes active, the classic pivot points may come into play within the day. For the bears, the supports at 25,821 – 25,657 – 25,453 might be significant, while for the bulls, resistances at 26,190 – 26,394 – 26,558 will be crucial.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)