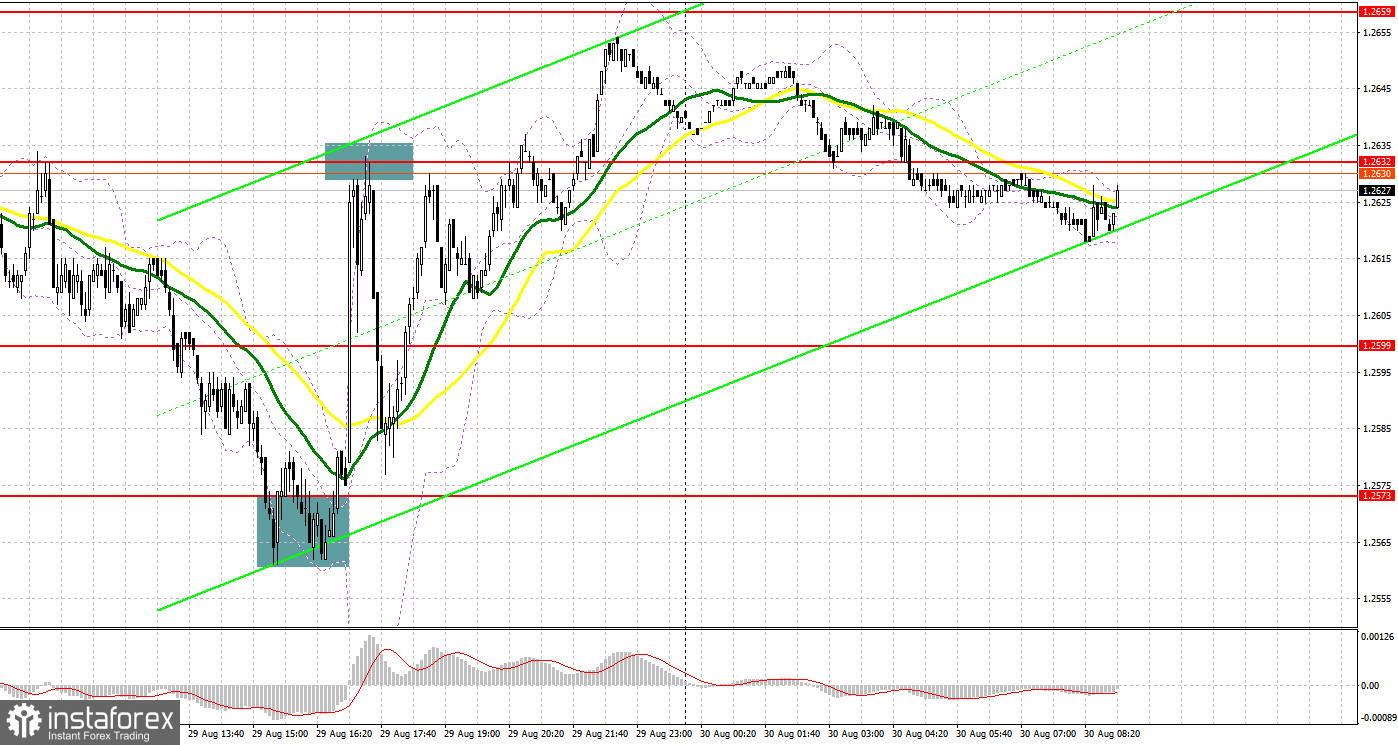

Yesterday, the currency pair produced several market entry signals. Let's look at the 5-minute chart and see what happened there. In my previous forecast, I paid attention to the level of 1.2606 and recommended making decisions on entering the market with this level in focus. The decline and a false breakdown at this level created an excellent entry point for buy positions, but after all, the pound sterling failed to develop an active recovery. In the afternoon, a false break at 1.2573 generated a buy signal. As a result, the pound sterling shot up by more than 60 pips. After unsuccessful consolidation at 1.2623 and a signal to sell, the instrument fell by 40 pips.

What is needed to open long positions on GBP/USD

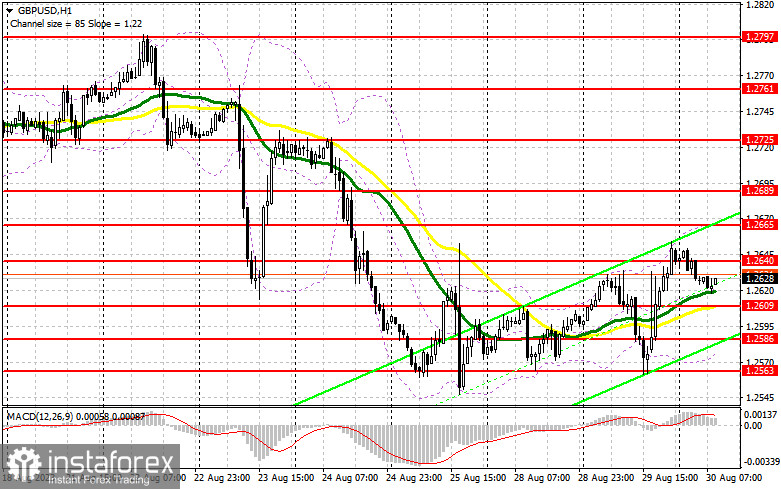

Weak data on the US economy triggered higher volatility, but as we can see on the chart, the sellers are not going to give up so easily. Today, the economic calendar reminds us about the M4 aggregate of the money supply, the number of approved applications for a mortgage loan, and the volume of net loans to individuals in the UK. For the buyers, it is very important that UK lending does not begin to decline amid high interest rates because bad data could undermine GBP's strength during the day. The best scenario for buying is a decrease and a false breakdown near the new support at 1.2609, where the moving averages pass. This will provide an entry point into long positions with the prospect of a further recovery of GBP/USD and the return to the nearest resistance at 1.2640. The buyers will revive their confidence after a break and consolidation above this range. The odds will be for a climb to 1.2665. A higher target will be the area of 1.2689, where I will take profits. With a scenario of a decline to 1.2609 and no buyers there, pressure on the pound sterling will return. Thus, I see the likelihood of a new bear market. In this case, only protection of the next area 1.2586, as well as a false breakdown on it, will give a signal to open long positions. I plan to buy GBP/USD immediately during a dip only from the low of 1.2563, bearing in mind a 30-35-pips upward intraday correction.

What is needed to open short positions on GBP/USD

It is very important for the bears not to let the pair climb above the resistance of 1.2640, formed on the basis of yesterday's results. I will enter the market there only after an unsuccessful consolidation, which will give a signal to sell with the prospect of a decline to the area of 1.2609. A break and reverse test from the bottom-up of this range will deal a more serious blow to the bulls' positions, providing an opportunity to make up for yesterday's growth and develop a bear market with an update of 1.2586. A more distant target remains a low of 1.2563, where I will take profits. With the scenario of GBP/USD's growth and no activity at 1.2640, the buyers will gain full control over the market. In this case, I will postpone selling until a false breakdown at 1.2665. If there is no downward movement, I will sell the pound sterling immediately during a rebound from 1.2689, bearing in mind a 30-35-pips downward intraday correction.

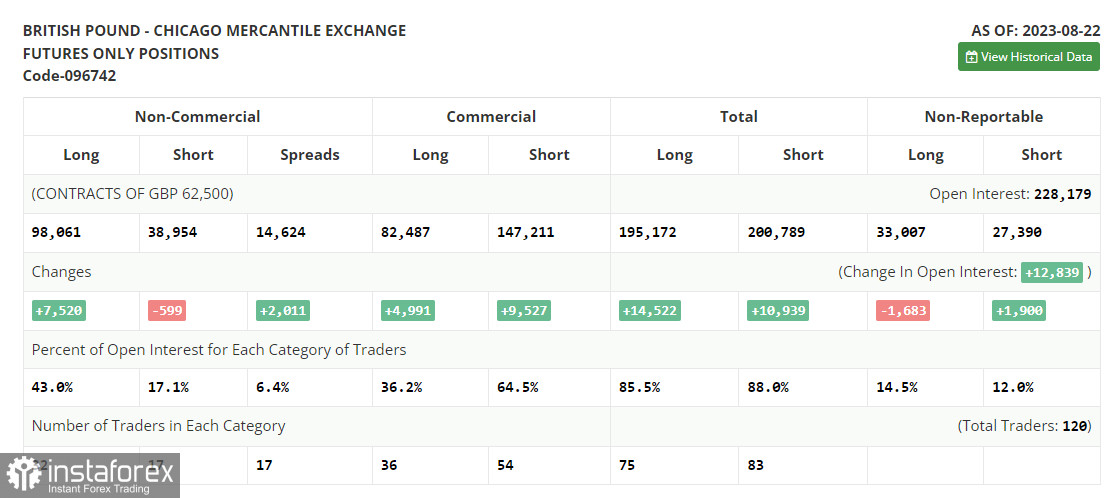

The COT report (Commitment of Traders) for August 22 logs an increase in long positions and a decrease in short ones. Traders continued to ramp up buying as the pound sterling declined after the recent decent UK GDP data. However, the whole picture was overshadowed by statistics on PMIs. Poor indices alongside the speech of Fed Chairman Jerome Powell that interest rates in the US will certainly be raised again created the conditions for the sterling to update one-month lows. However, the buyers took advantage of this very quickly. Indeed, the lower the pound, the more attractive it is for buying and holding in the medium term. The difference in the policies of central banks will continue to have a positive effect on GBP/USD. The latest COT report says that long non-commercial positions rose by 7,520 to 98,061, while short non-commercial positions decreased by 599 to 38,954. 1.2708. As a result, the spread between long and short positions jumped by 2,011. GBP/USD closed last week higher at 1.2741 against 1.2708 a week ago.

Indicators' signals

Moving Averages

The instrument is trading above the 30 and 50-day moving averages. It indicates that the buyers are making an attempt to seize the market.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD goes up, the indicator's lower border at about 1.2570 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.