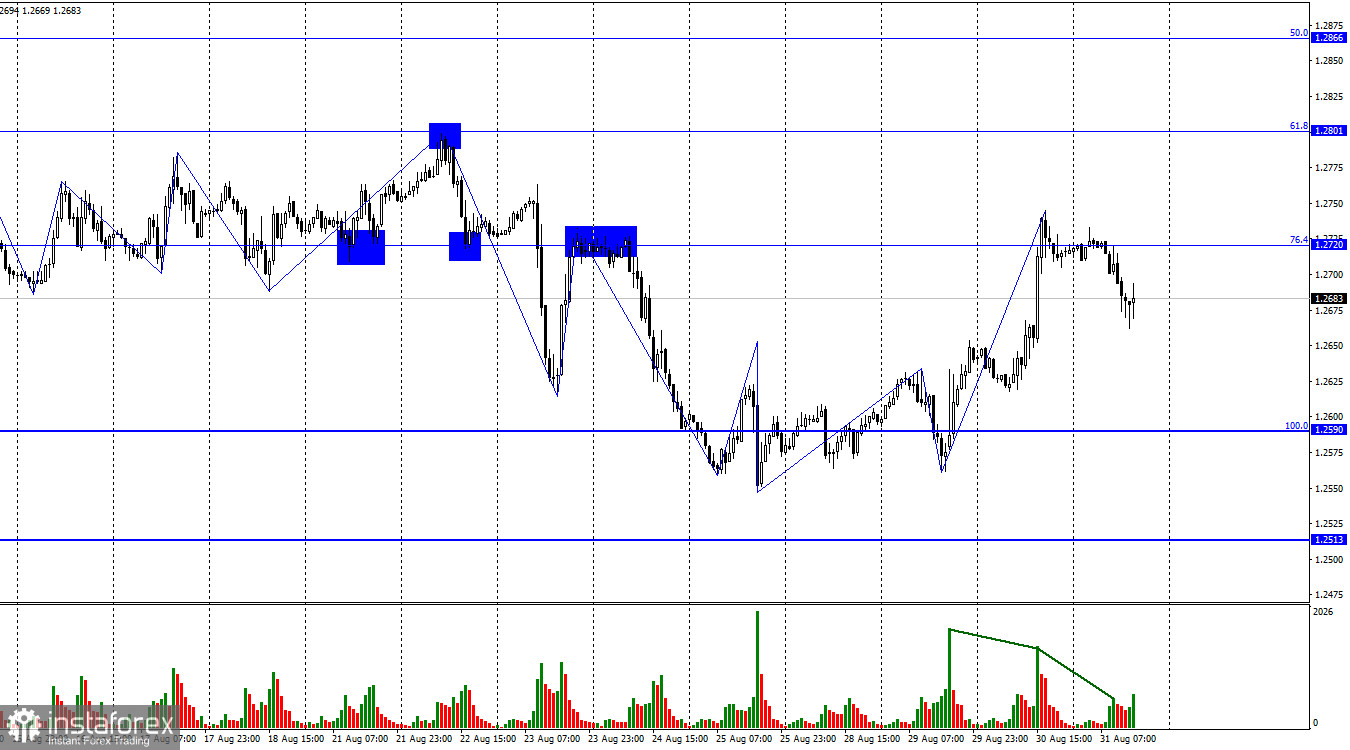

On the hourly chart, the GBP/USD pair on Thursday reversed around the corrective level of 76.4% (1.2720) and began to fall towards the Fibonacci level of 100.0% (1.2590). I do not expect any new signals in the coming hours, as no levels are close to the current price.

The waves over the past few days have changed the graphical picture. Now, there is a bullish trend, as indicated by the last three waves. And now this trend must be broken to anticipate a new bearish one, which I still find more likely. However, this will be challenging. A new downward wave needs to break the low of the day before yesterday at 1.2562. By the time it is breached, most of the decline will already have occurred and profiting from it will be difficult. There's also a simpler scenario: the next upward wave should not surpass yesterday's peak. But this scenario also requires some time.

In addition to inflation in the European Union, several reports were released in the US today that traders might have dreaded. Three US reports this week turned out to be too weak, and the dollar retreated. However, today's statistics boasted their "neutral status," strengthening the US currency throughout the day. The core personal consumption expenditure index stood at 0.2%, US personal income increased by 0.2%, and personal spending by 0.8%. All three indicators were in line with expectations. There was also a report on unemployment benefit claims, which also matched expectations. Hence, four reports and not a single weak one that could trigger a further dollar decline. The US currency has to survive Friday.

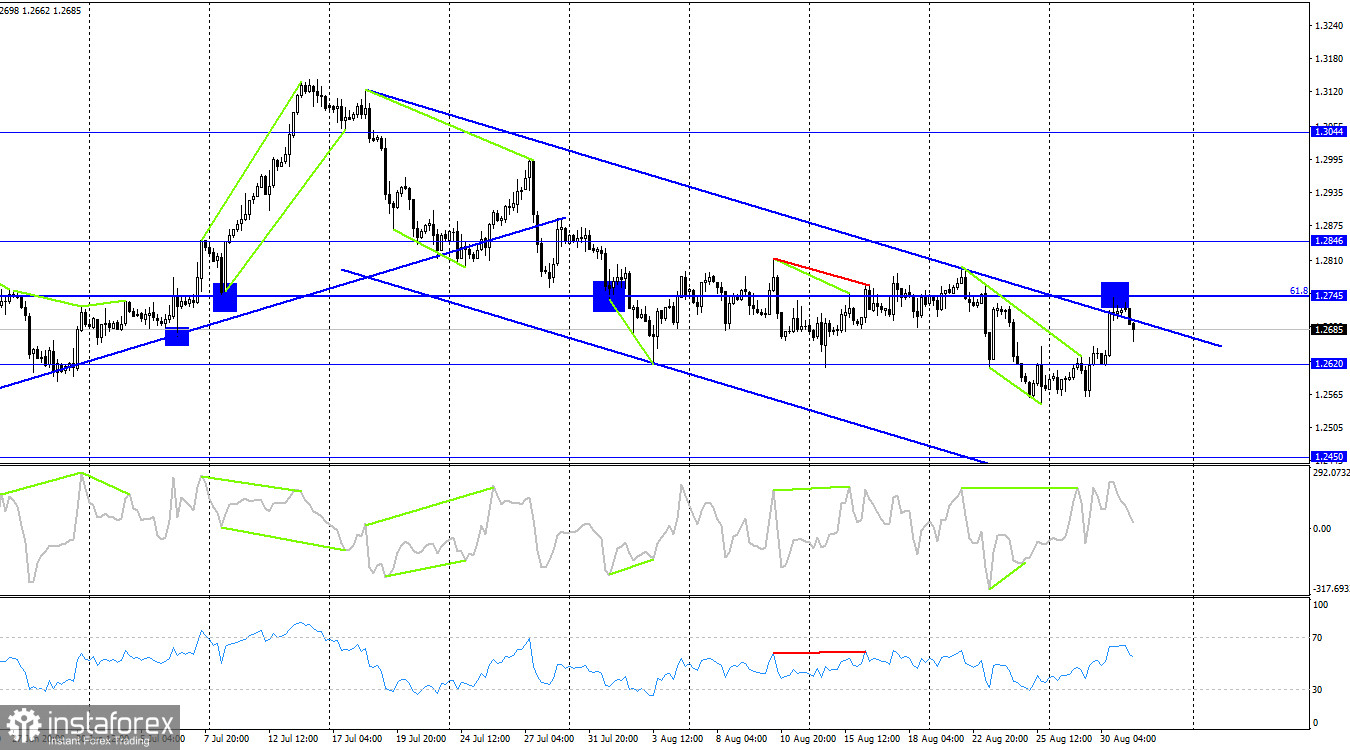

On the 4-hour chart, the pair retraced to the 1.2745 level and consolidated above the descending trend corridor. However, the price rebound from this level benefited the US currency, and a resumption of the decline towards the 1.2620 level is expected. At the moment, the likelihood of the pair falling further is higher than rising. Consolidating the pair above the 1.2475 level will confirm an exit from the descending corridor and increase the chances of a continued rise toward 1.2846.

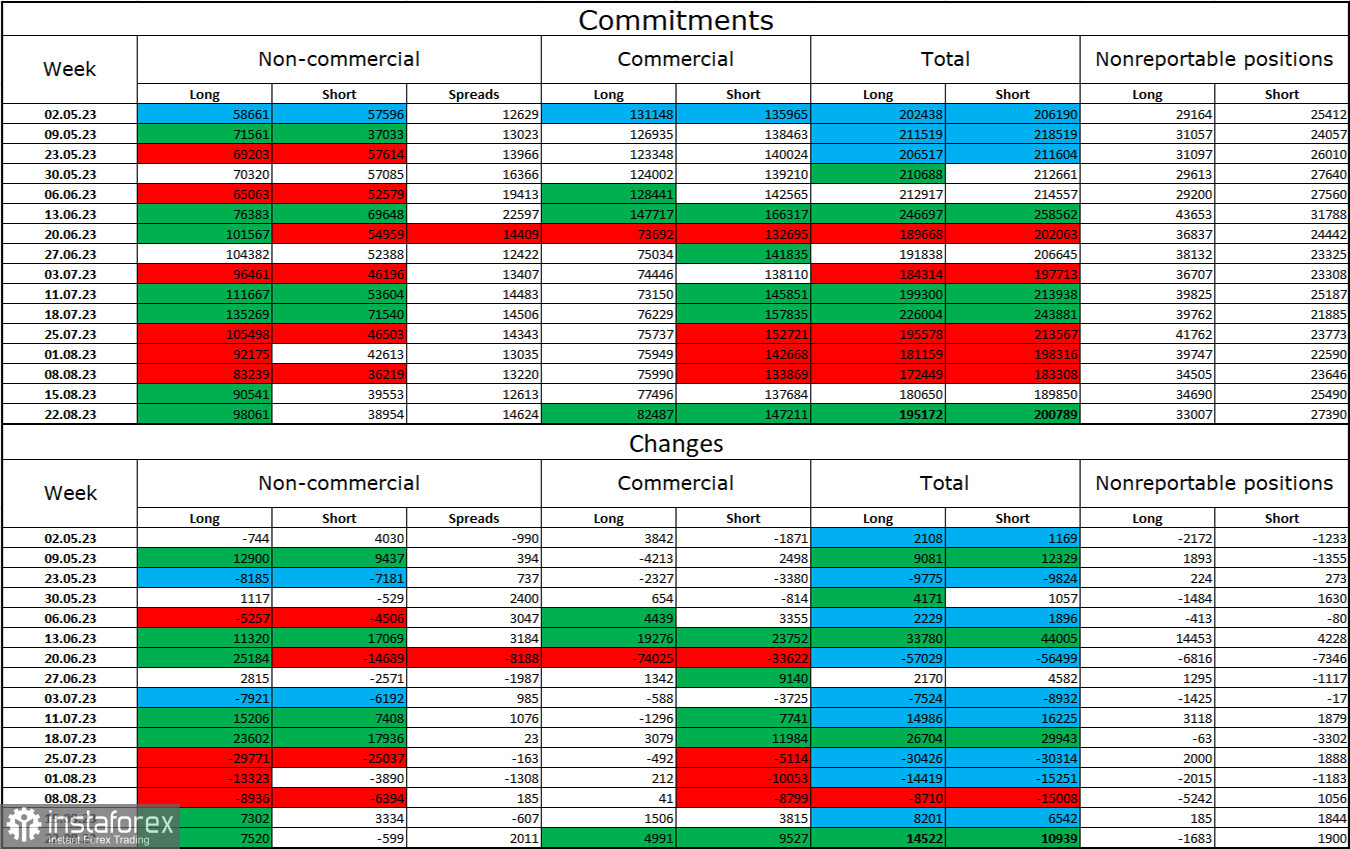

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category has become more bullish over the past reporting week. The number of long contracts held by speculators increased by 7,520 units, while the number of short contracts decreased by 599. The overall sentiment of major players remains bullish, with the number of long contracts more than double that of short contracts: 98,000 against 39,000. The British pound had good prospects for continued growth a few weeks ago, but now many factors have turned in favor of the US dollar. Betting on a strong rise in the pound sterling now seems challenging. Nevertheless, the bulls quickly shed their buy positions, expecting the pound to show some growth.

News calendar for the US and UK:

USA - Core Personal Consumption Expenditures Price Index (12:30 UTC).

USA - Initial Unemployment Benefit Claims (12:30 UTC).

USA - Personal Income and Expenditures (12:30 UTC).

On Thursday, the economic events calendar contains three entries, all from the USA and already known. For the remainder of the day, the influence of the informational background on market sentiment will be absent.

GBP/USD Forecast and Advice for Traders:

Selling the pound was possible when rebounding from the 1.2745 level on the 4-hour chart with a target of 1.2590. I consider only one signal possible for purchases – a consolidation above 1.2745. The target is 1.2846.