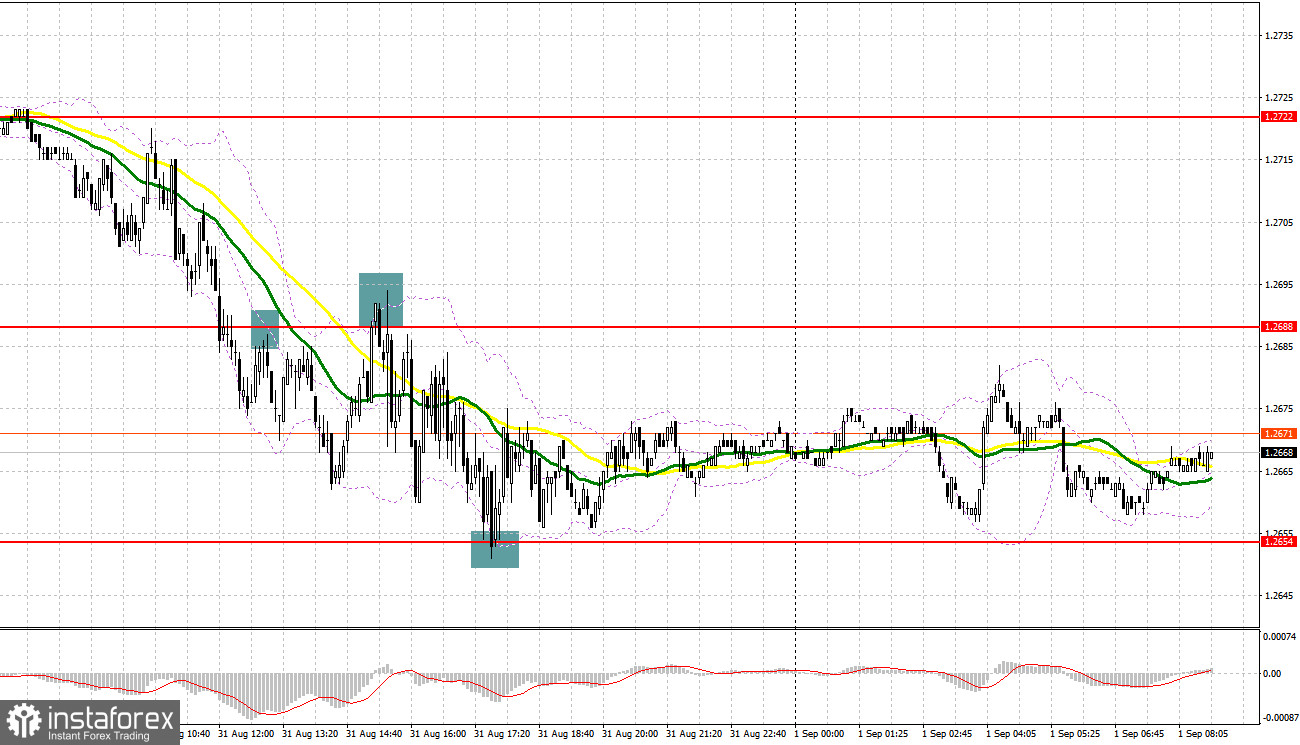

Yesterday, the pair formed several entry signals. Let's look at the 5-minute chart and see what happened there. In my morning forecast, I mentioned the level of 1.2688 as a possible entry point. No false breakout was formed at this level, but its break and a subsequent retest provided an excellent entry point for going short. As a result, the pair dropped by more than 30 pips. A false breakout near the 1.2654 support level provided an entry point for opening long positions in the second half of the day, yielding about 20 pips in profit.

For long positions on GBP/USD

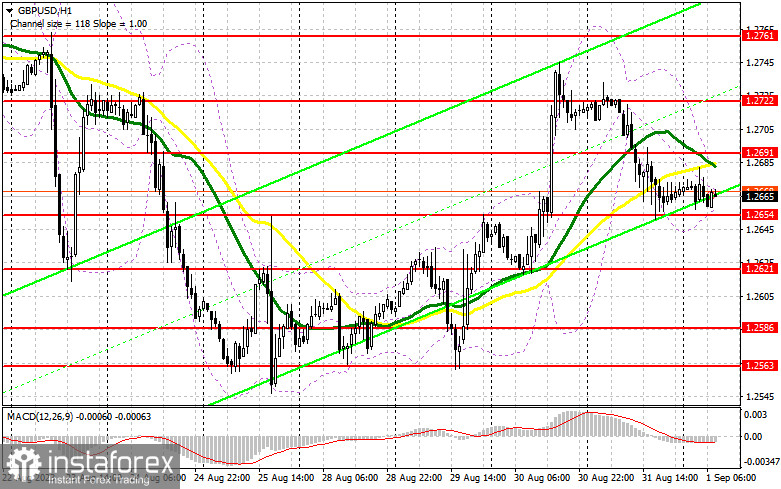

Data indicating the persistence of high price pressure in the US has strengthened the position of the US dollar ahead of significant labor market reports scheduled for today. We will discuss them in more detail in the second half of the day. During the European session, pressure on the pound may significantly increase after the release of the UK manufacturing sector business activity index, which has been underperforming lately, and also after a speech by the Bank of England MPC member, Hugh Pill. It is possible that after the reports are released, GBP/USD may correct towards the nearest support level of 1.2654. I plan to act on a false breakout there, hoping to get a buy signal with a recovery prospect towards 1.2691. Moving averages, currently favoring the sellers, are located there. A breakthrough and consolidation above this range will reinforce the buyers' confidence, maintaining the possibility of reaching 1.2722. An ultimate target would be the 1.2761 area, where I will be taking profit. If there is a drop to 1.2654 and no bullish activity there, the pressure on the pound will increase, as will the likelihood of a significant pair decline. In such a scenario, only the protection of the 1.2621 area, as well as its false breakout, will give a signal to open long positions. I plan to buy GBP/USD immediately on a bounce from the low of 1.2586, with a correction target of 30-35 pips within the day.

For short positions on GBP/USD

Bears need to defend the nearest resistance at 1.2691, where the moving averages are located. I will act only after unsuccessful consolidation, which will serve as a sell signal with the downward target at the interim support of 1.2654. A breakout and a downward retest of this range will deal a more severe blow to the bulls' positions. If so, bears will have a chance to win back earlier losses and retest the level of 1.2621. The next target remains at the low of 1.2586, where I will be taking profit. If GBP/USD rises and there is no activity at 1.2691, buyers will try to re-enter the market even before the US statistics release. In that case, I will postpone selling the pair until a false breakout at 1.2722. If there is no downward movement there either, I will sell the pound immediately on a bounce from 1.2761, but only expecting a downward correction of 30-35 pips within the day.

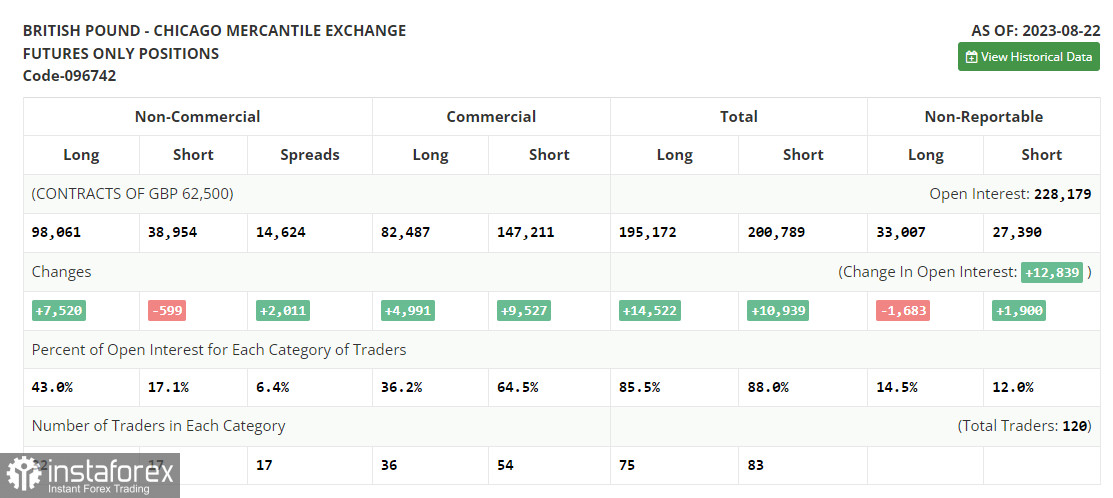

COT report

The Commitments of Traders report for August 22 indicates a rise in long positions and a drop in the short ones. Traders continued to accumulate long positions as the pound fell following recent positive GDP data from the UK. However, the whole picture was overshadowed by the PMI data. A decrease in the indicator, along with a speech by Federal Reserve Chairman Jerome Powell indicating that the key rate is likely to be raised again, made the pair renew its monthly lows. However, buyers quickly took advantage of this: the lower the pound, the more attractive it becomes for medium-term purchases. The difference in policies of the central banks will continue to positively impact GBP/USD. The latest COT report indicates that non-commercial long positions increased by 7,520 to 98,061, while non-commercial short positions decreased by 599 to 38,954. As a result, the spread between long and short positions jumped by 2,011. The weekly closing price went up to 1.2741 from the previous value of 1.2708.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.2654 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.