Analysis of transactions and tips for trading EUR/USD

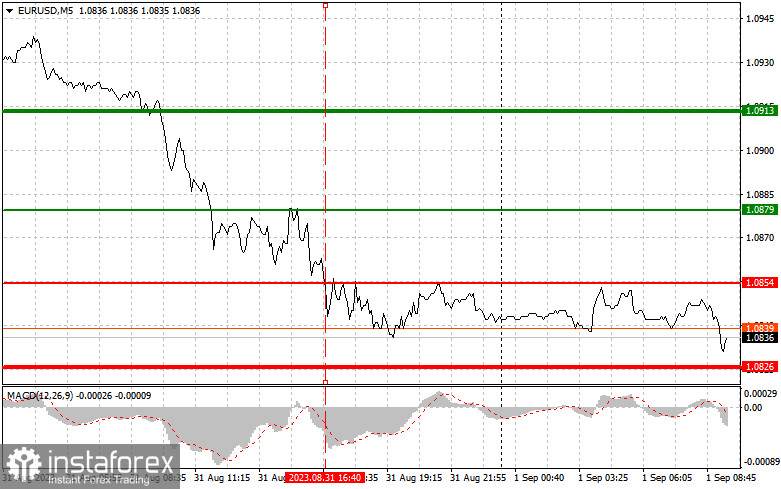

Further decline became limited because the test of 1.0854, which happened on Thursday afternoon, coincided with the drop of the MACD line away from zero.

Risk appetite fell after the latest inflation data in the eurozone indicated that core price pressure eased, allowing the ECB not to rush with further rate hikes. Then, the bearish momentum extended in the afternoon, as the data from the US led to another surge in dollar demand.

Today, during the European session, reports on business activity in the eurozone will come out, where a reduction will lead to immediate sell-offs in EUR/USD. However, the movement will not be massive because the unemployment situation in the US remains more critical than Europe's manufacturing activity indicators.

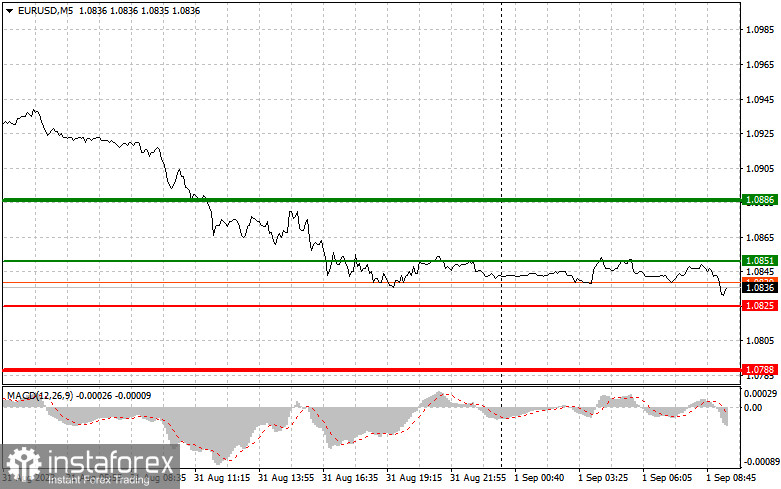

For long positions:

Buy when euro hits 1.0851 (green line on the chart) and take profit at the price of 1.0886. Growth may occur today since no important data will come out. However, when buying, ensure that the MACD line lies above zero or just starts to rise from it.

Euro can also be bought after two consecutive price tests of 1.0825, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0851 and 1.0886.

For short positions:

Sell when euro reaches 1.0825 (red line on the chart) and take profit at the price of 1.0788. Pressure will increase in the event of poor manufacturing activity indicators. However, when selling, traders must ensure that the MACD line lies below zero or drops down from it.

Euro can also be sold after two consecutive price tests of 1.0851, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0825 and 1.0788.

What's on the chart:

Thin green line - entry price at which you can buy EUR/USD

Thick green line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

Thin red line - entry price at which you can sell EUR/USD

Thick red line - estimated price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line- it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decision based on the current market situation is an inherently losing strategy for an intraday trader.