Pyrrhic victory. This was the final outcome of the court's recognition of the Securities and Exchange Commission's (SEC) unlawful rejection of Grayscale's application to create an ETF with Bitcoin as the underlying asset. The judiciary termed the SEC's actions arbitrary and capricious, as the defendant couldn't explain its differential treatment of similar products. Initially, the BTC/USD quotes jumped by 7%, but the "bulls" quickly lost the advantage.

Turning point. Crossing the Rubicon. That's how Bitcoin enthusiasts referred to the court's verdict on Grayscale. According to Vedder Price, it deals a near-fatal blow to the SEC's intention to reject similar ETF applications in the future. The plaintiff called this judicial decision a monumental step forward for American investors. In theory, the functioning of such products could reignite interest in the crypto industry, which has recently been lost.

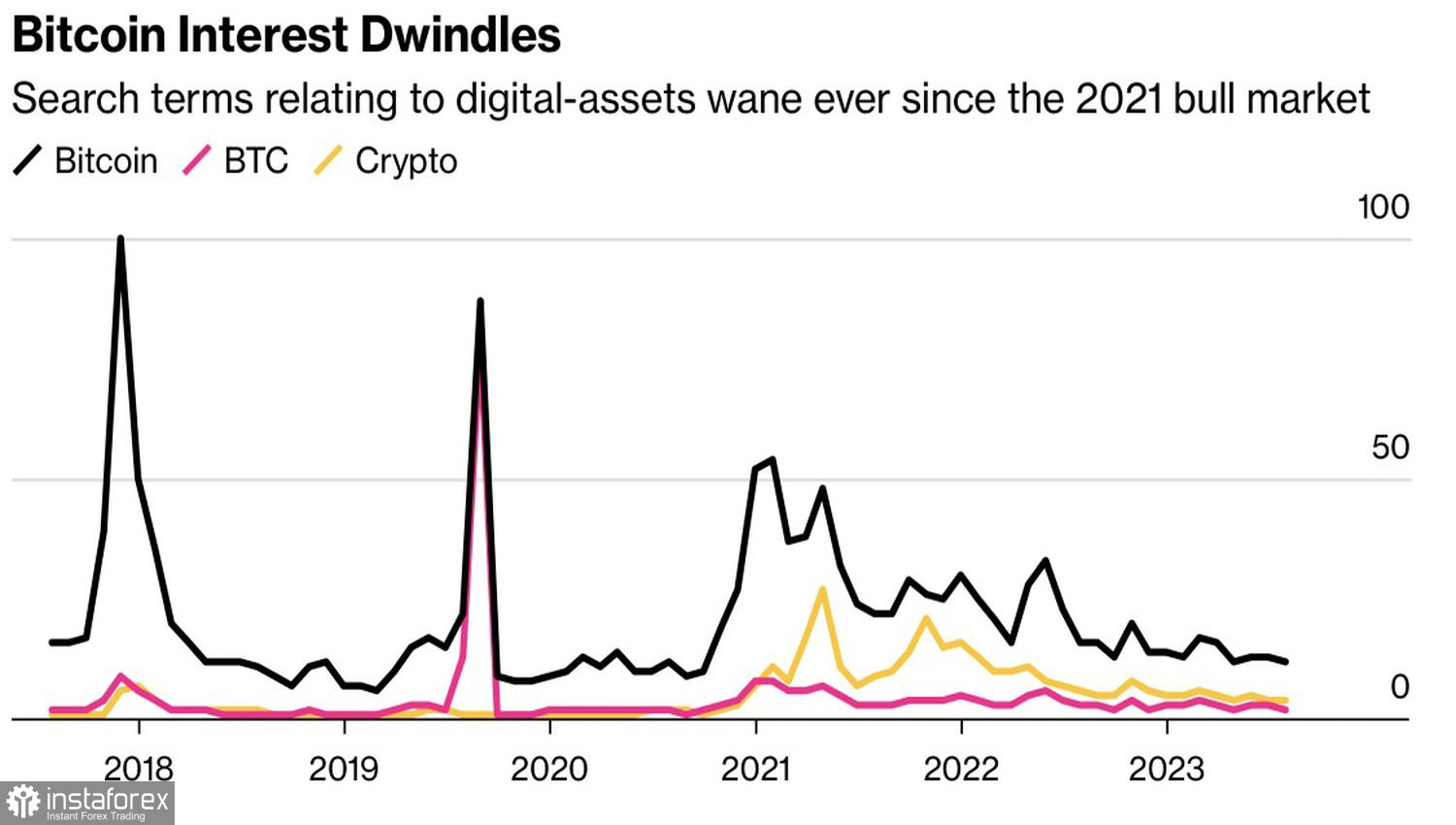

FRNT Financial notes that almost all market indicators, including volatility, volumes, and others, are significantly lower. Apart from a handful of traders and miners, nobody is interested in crypto assets, as evidenced by the decline in related online searches. There was hope that the approval of a Bitcoin-based ETF would attract major players to the market. The latter, amidst increasing Treasury bond yields and falling U.S. stock indices, are looking for assets to diversify their portfolios.

Dynamics of online searches for crypto assets

In fact, even Grayscale is unsure if it will reapply. It's one thing to oppose the SEC, another to go against big business sharks with assets worth $17 billion. The company will be forced to reduce its storage fee, which currently stands at 2%. For comparison, the fee for U.S.-traded specialized ETFs is 0.54%, and for crypto-related ETFs, it's 1.48%. Moreover, competitors will include BlackRock, Invesco, and Fidelity Investment, known for their affordable product lines.

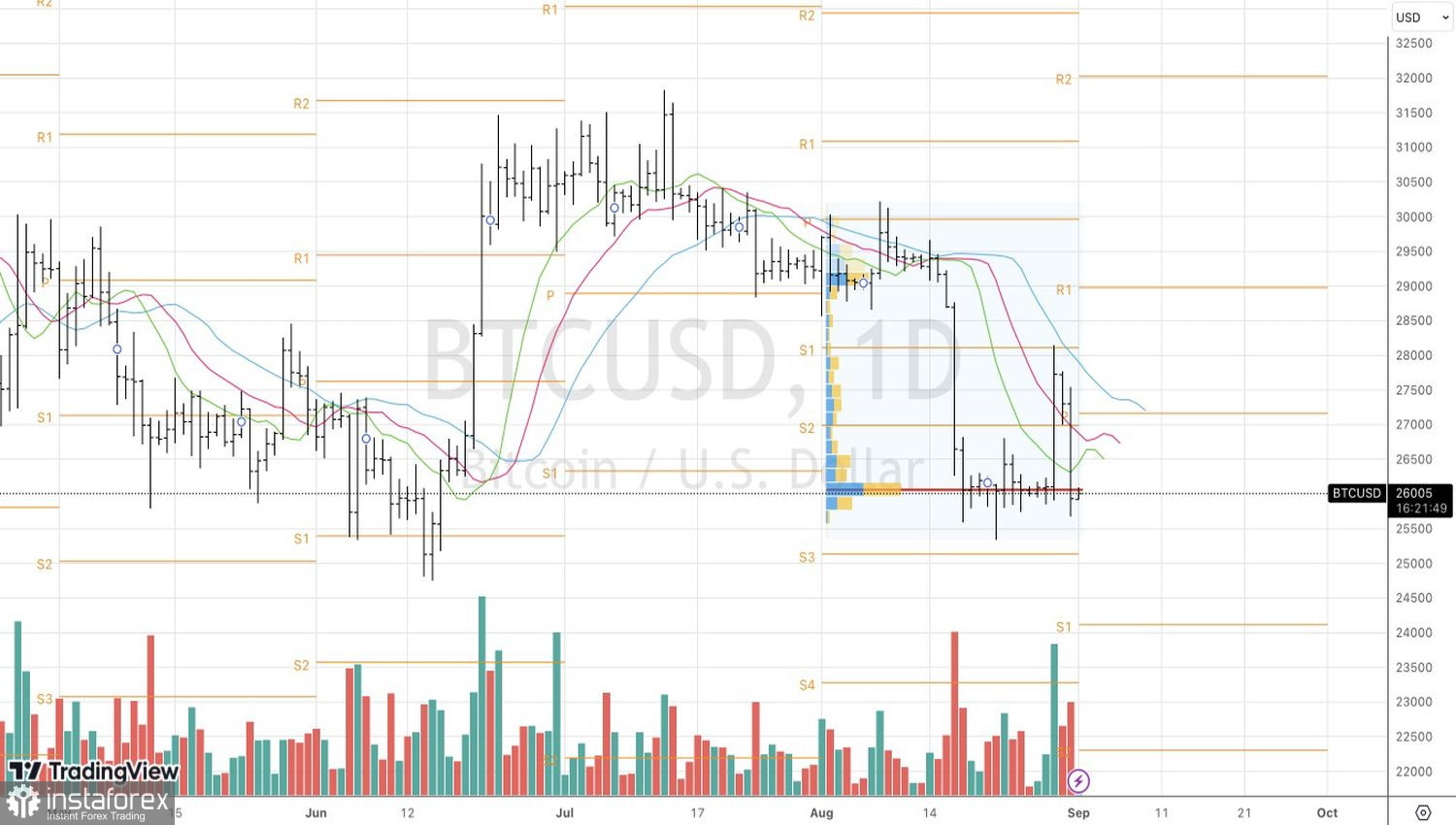

The court's verdict did not particularly impress the Securities and Exchange Commission. On September 1, decisions were expected for applications from BlackRock, Bitwise, VanEck, Invesco, Valkyrie, and WisdomTree. However, what transpired was similar to the ARK Investment Management application a few days earlier. The verdict on them was postponed, leading to a crash in Bitcoin prices back to levels seen before Grayscale's court victory.

Thus, the court's verdict turned out to be a Pyrrhic victory for the BTC/USD bulls. The SEC continues to evade application approvals. It's not certain that their approval will increase investor interest in an industry tainted with fraudulent operations.

Technically, on Bitcoin's daily chart, there is a false breakout pattern. After a sharp rise in quotes upon exiting the short-term consolidation range of 25,500–26,700, there was a retreat. A drop in BTC/USD below 25,690 will be a reason to sell.