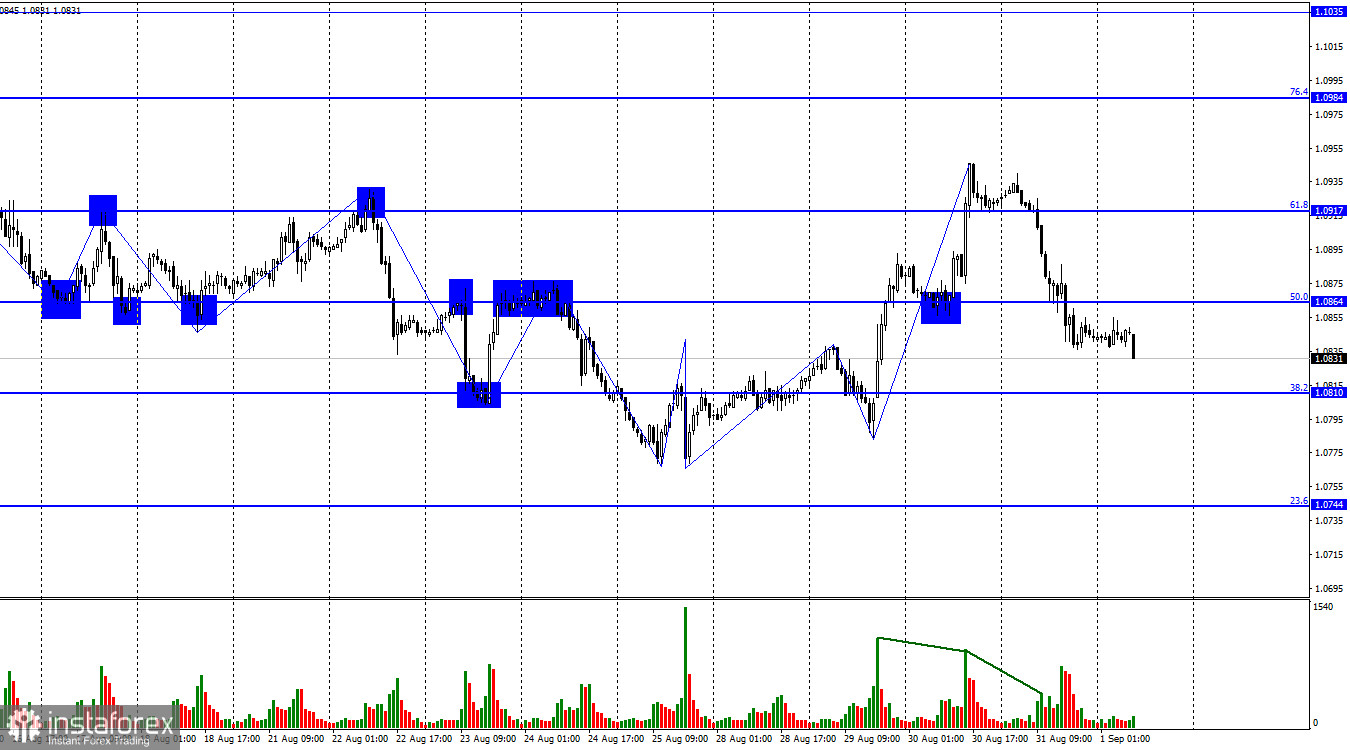

Yesterday, the EUR/USD pair underwent a reversal in favor of the American currency and closed below the 1.0917 mark and subsequently below the corrective level of 50.0% (1.0864). As a result, the decline in quotes might continue toward the next Fibonacci level of 38.2% (1.0810). A rebound from this level will favor the European currency, indicating some growth towards the 1.0864 level. A closure below 1.0810 will increase the likelihood of a further decline towards the corrective level of 23.6% (1.0744).

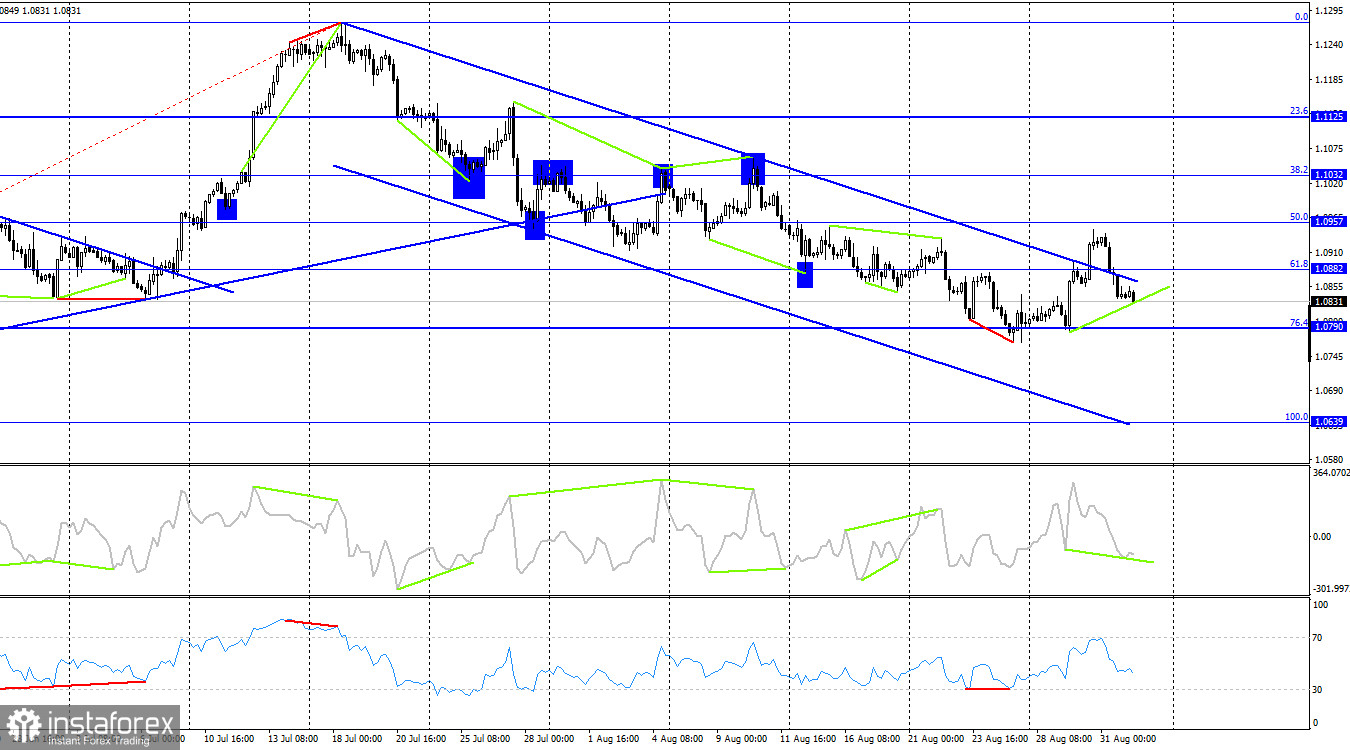

Yesterday's wave movements remained consistent. I warned that it would be challenging to promptly and timely understand that the bullish trend is over after three upward waves. Considering the intensity of the news backdrop this week, this scenario was quite probable. The pair declined yesterday and today, but the new downward wave has yet to breach the previous wave's low. Hence, I can't conclude any signs of a trend reversal. Today's news background will again be intense, so the bullish trend might persist.

Yesterday's inflation report in the European Union disappointed both bulls and bears. The value for August neither increased nor decreased. Core inflation dropped to 5.3%, exactly the number traders anticipated. The euro declined all day, but this might not be linked to the Consumer Price Index. The market might have started preparing for today's US unemployment and labor market data. And the dollar's strengthening doesn't mean its growth will continue today, even if strong values are present. I'm flexible to conclude the end of the bullish trend and wouldn't like to guess the possible movements for the latter half of the day.

On the 4-hour chart, the pair has settled above the descending trend corridor, which greatly concerns me. In essence, this suggests a change to a bullish trend, but I'd refrain from drawing quick conclusions. The decline may resume this or next week. We should wait for clarification and a clearer picture of the 4-hour chart.

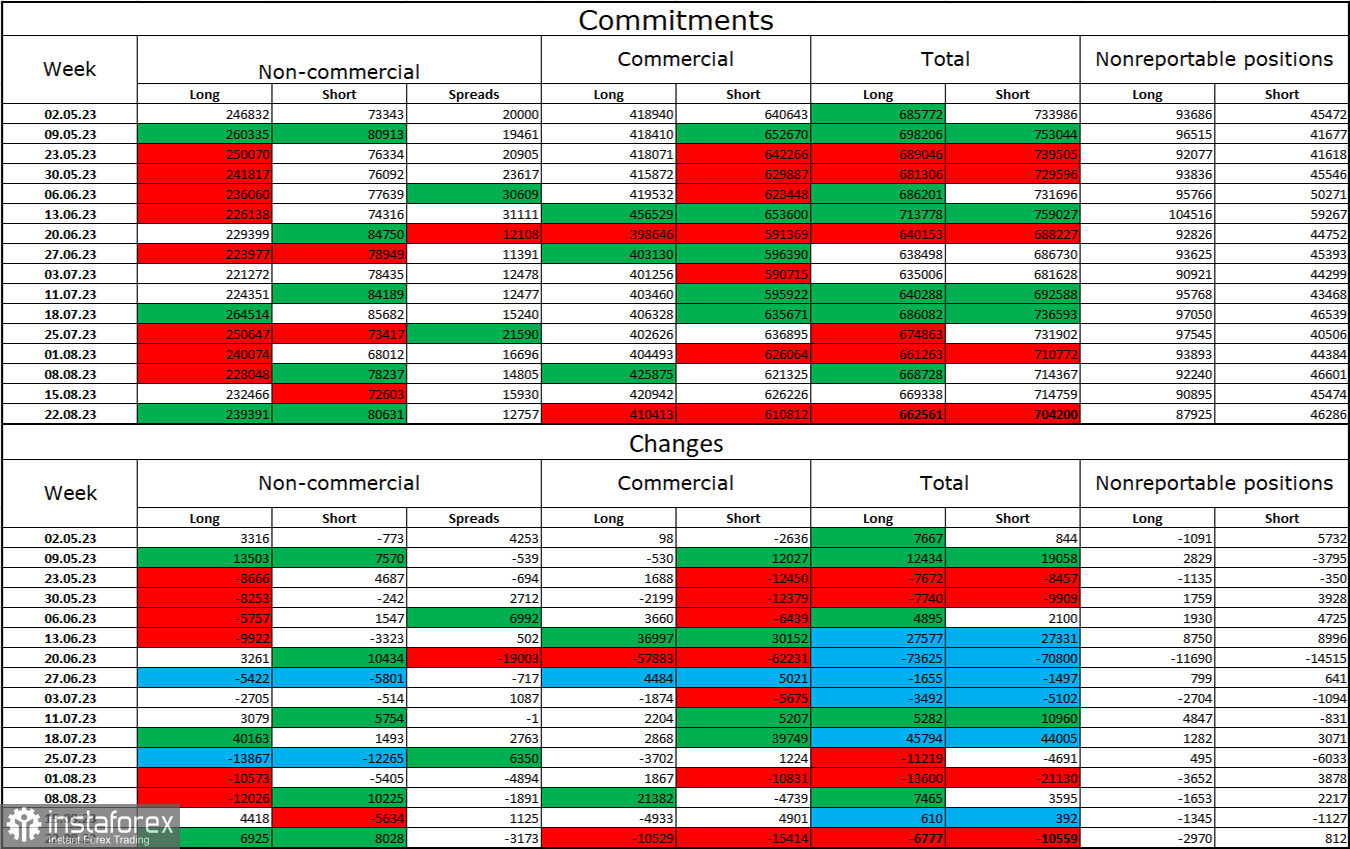

Commitments of Traders (COT) Report:

During the last reported week, speculators opened 6,925 long contracts and 8,028 short contracts. The sentiment of major traders remains bullish and isn't significantly weakened. The total number of long contracts speculators hold now is 239,000, while short contracts are 80,000. The situation will reverse over time, but bearish traders aren't aggressively challenging the bulls for now. The high number of open long contracts suggests buyers might close them soon - a significant current bias towards bulls. The current figures allow for the continued decline of the euro in the coming weeks. The ECB is increasingly signaling the end of the QE tightening procedure.

News Calendar for the US and the European Union:

European Union - Germany's Manufacturing Sector Business Activity Index (PMI) (07:55 UTC).

European Union - Manufacturing Sector Business Activity Index (PMI) (08:00 UTC).

USA - Average Hourly Earnings (12:30 UTC).

USA - Change in Non-Farm Employment (12:30 UTC).

USA - Unemployment Rate (12:30 UTC).

USA - ISM Manufacturing Sector Business Activity Index (PMI) (14:00 UTC).

The economic events calendar for September 1 contains six rather significant entries. The influence of the news background on trader sentiment for the remainder of the day will be strong.

EUR/USD Forecast and Advice for Traders:

Sales could have been initiated upon closure below 1.0864 on the hourly chart, with targets at 1.0810 and 1.0744. Purchases are possible upon a rebound from the 1.0810 level with targets at 1.0864 and 1.0917 or upon securing above 1.0864.