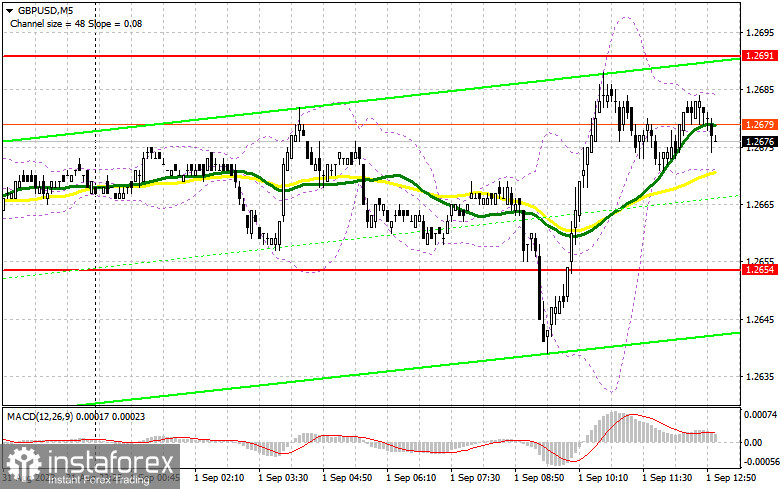

In my morning forecast, I emphasized the 1.2654 level and recommended using it as a reference for market entry decisions. Examining the 5-minute chart, we can see what transpired. The 1.2654 level was breached, but following a retest, the bulls regained control over this range, so there was no opportunity to enter a short position. The technical picture was revisited for the latter half of the day.

For initiating long positions on GBP/USD, you'll need to:

Following the revised positive Manufacturing Sector PMI index from the UK, the market's future direction will be influenced by the US non-farm employment change and unemployment rate data. These figures are important in the immediate and medium-term context as they guide the Federal Reserve's future interest rate decisions. Reducing employment figures larger than economists anticipate will lead to a weakening dollar and a strengthening pound. If the figures exceed economists' forecasts, there might be a more significant drop in GBP/USD in the latter half of the day.

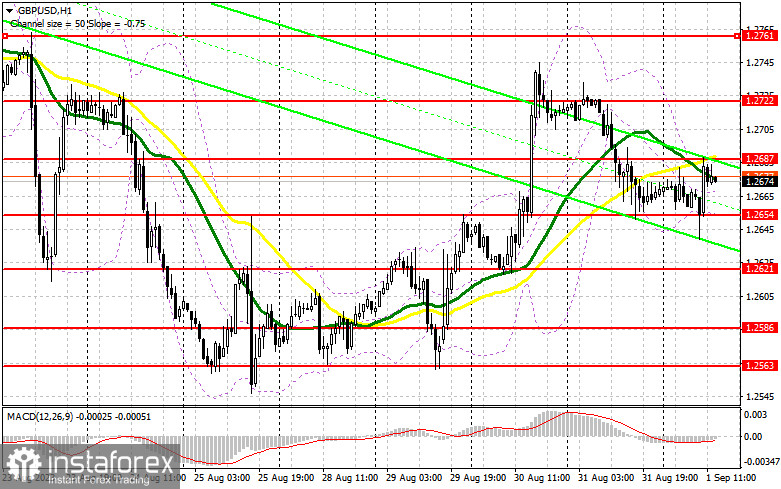

Defending the immediate support level at 1.2654 is the main objective for buyers. I plan to act on a false breakout there, which couldn't be achieved in the first half of the day since the pound declined significantly below this level. If a buy signal forms, the new target will be the resistance at 1.2687, where the moving averages in favor of sellers lie. A breakthrough and consolidation above this range will boost buyers' confidence, maintaining the chance to reach 1.2722. A further target is the 1.2761 area, where I intend to take profits. If there's a decline to 1.2654 and an absence of buyers in the second half of the day - especially if the US data is strong - the pressure on the pound will increase, as will the probability of a further major drop in the pair. In this case, only the defense of the next zone at 1.2621 and a false breakout there will signal the initiation of long positions. I plan to buy GBP/USD immediately on a rebound only from the 1.2586 low with a correction target of 30-35 points within the day.

For initiating short positions on GBP/USD, you'll need to:

Bears must still defend the immediate resistance at 1.2687, where the moving averages are located. I will act there only after a failed consolidation, signaling a sell with the prospect of a retest of around 1.2654. A breakthrough and a bottom-up retest of this range, which I didn't see in the first half of the day, would deal a more severe blow to the bullish positions, offsetting the pound's weekly gains and updating the 1.2621 level. A further target remains at the low of 1.2586, where I will take profits. Buyers will attempt to re-enter the market if GBP/USD rises and there's no activity at 1.2687 in the second half of the day. In that case, I will delay sales until a false breakout at 1.2722. If there's no downward movement, I will sell the pound immediately on a rebound from 1.2761, aiming only for a pair correction of 30-35 points within the day.

Indicator signals:

Moving Averages:

Trading occurs around the 30 and 50-day moving averages, indicating a sideways market trend.

Note: The author analyzes the moving average periods and prices on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decrease, the lower boundary of the indicator, around 1.2654, will act as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Highlighted in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Highlighted in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages). Fast EMA with a period of 12. Slow EMA with a period of 26. SMA with a period of 9.

• Bollinger Bands. Period 20.

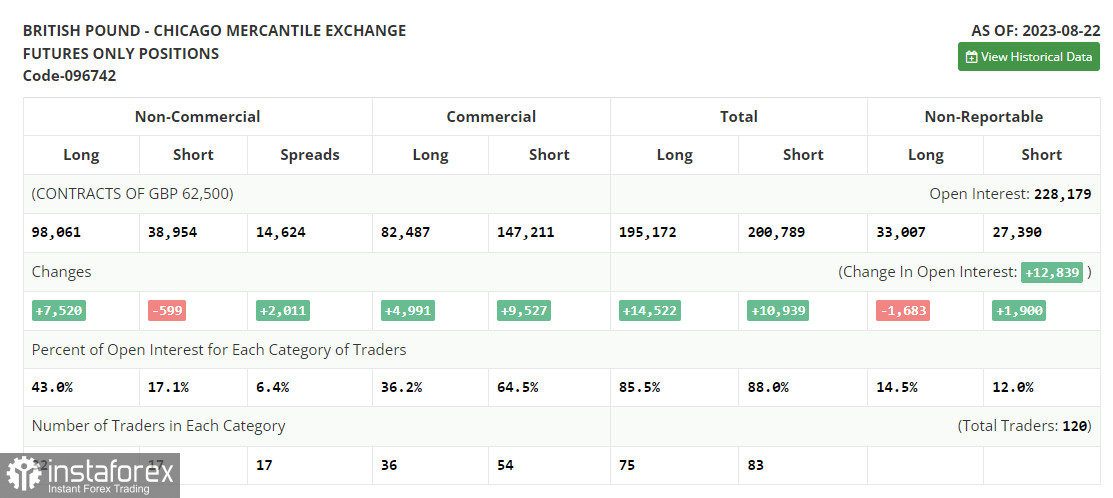

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, that use the futures market for speculative purposes and meet specific requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.