There were plenty of important economic reports, and a bulk of it came from the United States. I believe that most of the reports should be considered weak for the US dollar, and the market likely shares this opinion, as the figures were unambiguous. However, it wasn't logic that prevailed but rather the market's desire to sell, sticking to the current trend and wave analysis. As I have mentioned before, constructing a downward wave for both instruments appears to be the most likely scenario for the next week.

However, on Friday, there were other important events that remained in the shadow of the U.S. reports. One of the members of the Governing Council, Boris Vujcic, stated that economic activity is slowing down faster than expected, and labor market resilience presents an upward risk to inflation. He also added that the European Central Bank does not know the peak rate level right now, hinting that decisions will be made from meeting to meeting, taking all incoming data into account. Vujcic's speech can be considered neutral to favorable for the euro.

Meanwhile, his colleague Francois Villeroy de Galhau also made a similar conclusion but added some other crucial remarks. Villeroy confirmed that rate decisions will be made at each meeting, and there are quite a few options. The ECB is not ready to announce the end of its monetary tightening yet, but it's also not prepared to make statements about two or three more rate hikes. He noted that April's inflation value is likely the peak, but that's not enough for the central bank. The ECB is keen to see core and underlying inflation reaching 2%. "Interest rates are near their high points," Villeroy said.

However, Villeroy noted that the question of reducing interest rates is not currently on the agenda. "The duration matters more than the level," one of the ECB executives believes. I think the last two statements have a dovish tone, which could create additional problems for the euro. The ECB clearly hopes to achieve a reduction in inflation by keeping the rate at a high level for an extended period, rather than continually raising it.

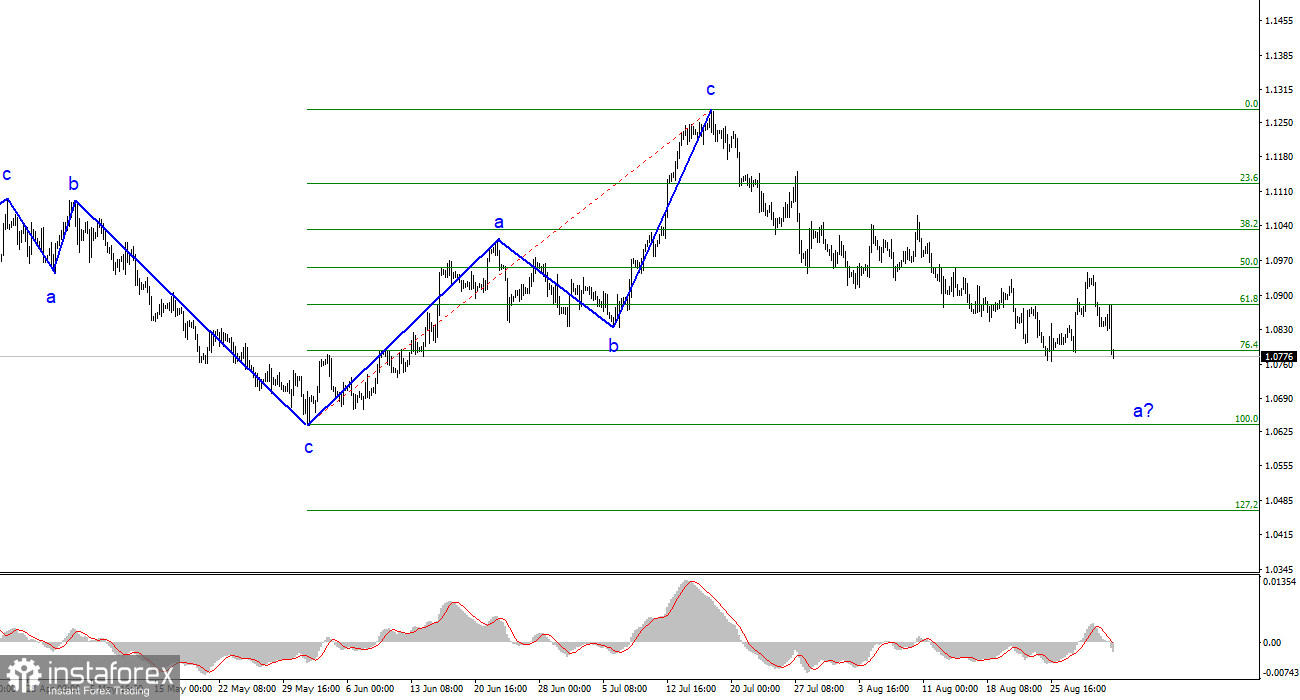

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite realistic, and I recommend selling the instrument with these targets in mind. I will continue to sell the instrument with targets located near the levels of 1.0637 and 1.0483. A successful attempt to break through the 1.0788 level will indicate the market's readiness to sell further, and then we can expect the aforementioned targets, which I have been talking about for several weeks and months.

The wave pattern of the GBP/USD pair suggests a decline within the downward segment of the trend. There is a risk of completing the current downward wave if it is d, and not wave 1. In this case, the construction of wave 5 might start from the current marks. But in my opinion, we are currently witnessing the construction of the first wave of a new segment. Therefore, the most that we can expect from this is the construction of wave "2" or "b". I still recommend selling with targets located near the level of 1.2442, which corresponds to 100.0% according to Fibonacci.