To be honest, the market has been behaving irrationally lately, and on Friday, this irrationality turned into something absurd. According to the US Department of Labor's report, not only were there only 187,000 new non-farm jobs created, but the unemployment rate also jumped from 3.5% to 3.8%. It was expected to remain unchanged. However, when fewer than 200,000 new jobs are created for three consecutive months, and about 250,000 are needed each month to maintain labor market stability, unemployment will inevitably rise. It's astonishing how it could have been decreasing before this. This raised many questions about the reliability of labor market data. And what happened next? The dollar continued to rise. This defies any reasonable explanation.

In any case, after such significant movements, there should be a rebound. Just not today, as the United States is celebrating Labor Day, making it a public holiday in the country. Considering that American investment funds control a significant portion of the capital traded in financial markets, this means that trading volumes will be sharply lower. Moreover, the calendar is basically empty. Even if something is published, it falls under the category of indicators that market participants have never even heard of.

Such a respite will be beneficial for the market. It provides time to contemplate what's happening right now. Hopefully, thanks to this, the market can return to normalcy. The longer markets ignore reality, the further they distance themselves from it, breeding countless imbalances. Afterward, a collision with reality is inevitable. And it always happens. It's just a matter of time.

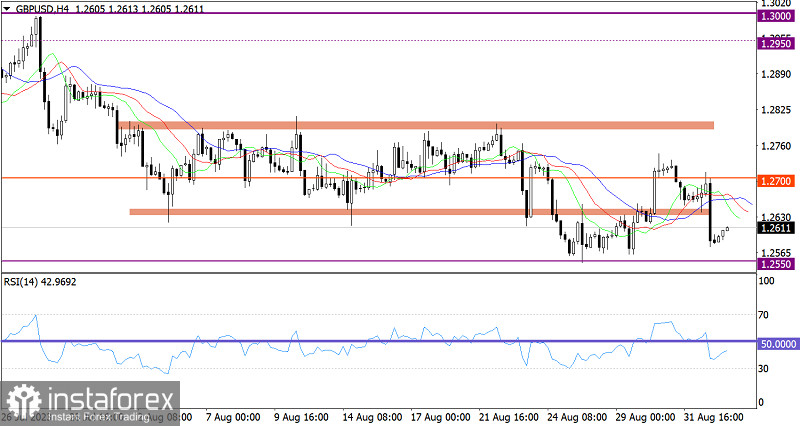

The GBPUSD resumed its negative trading on Friday. As a result, the exchange rate nearly reached the local low of the corrective cycle.

On the short-term timeframes, the RSI technical indicator is showing that the pound is oversold.

On the four-hour chart, the Alligator's MAs are still headed downwards, which corresponds to the pair's direction. The change in the MA's direction happened when the volume of short positions had increased.

Outlook

After such a sharp change in price, we witnessed an excessive amount of short positions on the British pound, indicating a possible rebound. The support level is around 1.2550.

The complex indicator analysis suggests a retracement in the short-term period. In the intraday period, the indicators are still focused on the recent downward cycle.