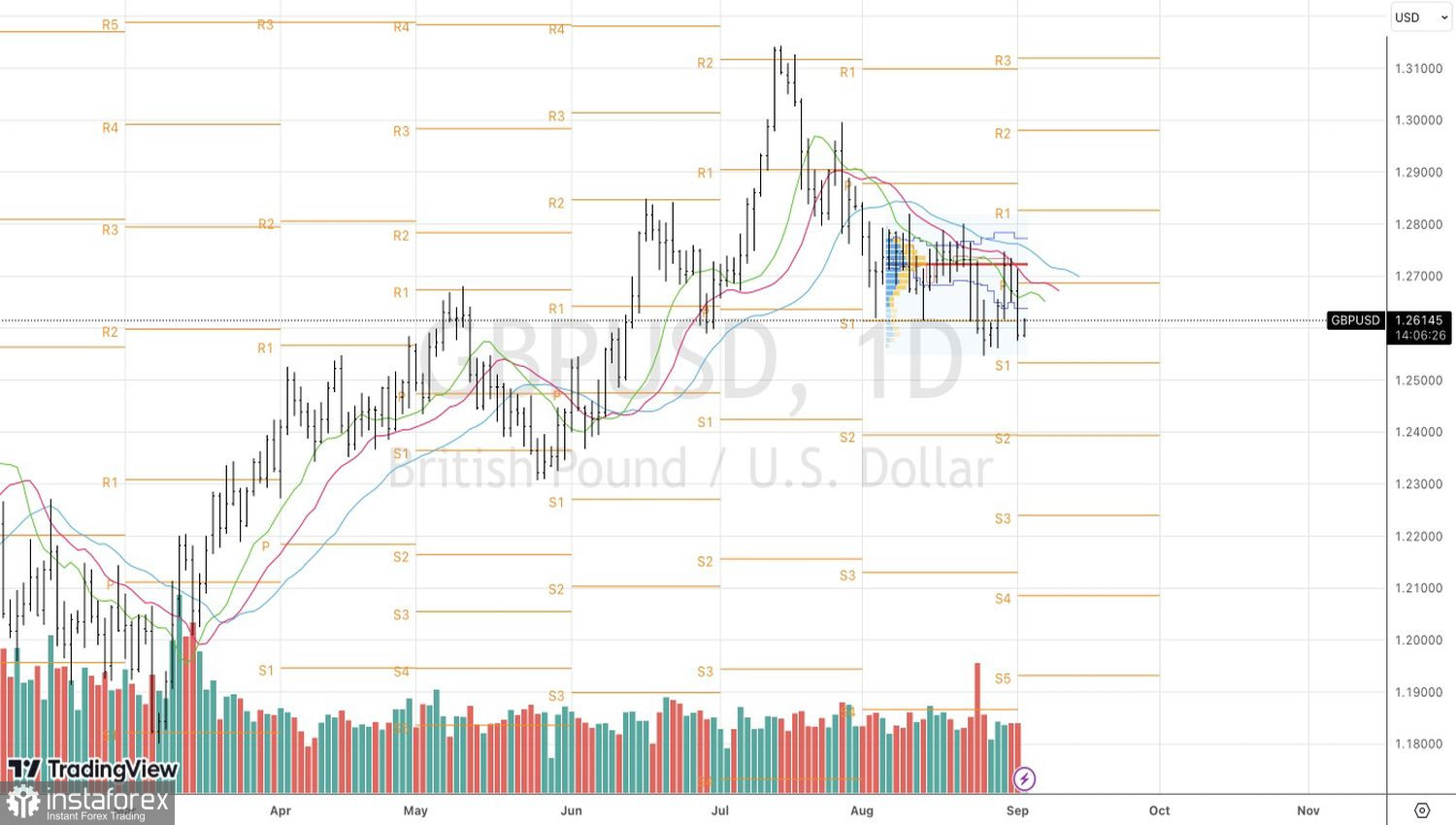

Despite the double blow from the Bank of England and the U.S. labor market report for August, the British pound managed to withstand the attacks of the dollar. The strategy of buying GBP/USD on a return above 1.2615 is bearing fruit and is likely to continue to do so. Amid numerous shocks for the pair, discipline is important. Sooner or later, it will come full circle. So, is there a need to be nervous?

For a long time, investors couldn't understand why, having the weakest economy among the G7 countries, the pound is competing for the title of the best performer of the year among the major currencies. It actively battles with the Swiss franc for the yellow jersey of the leader. Is the Bank of England's aggressive monetary policy tightening to blame? But the Fed has raised rates just as aggressively as its British counterpart.

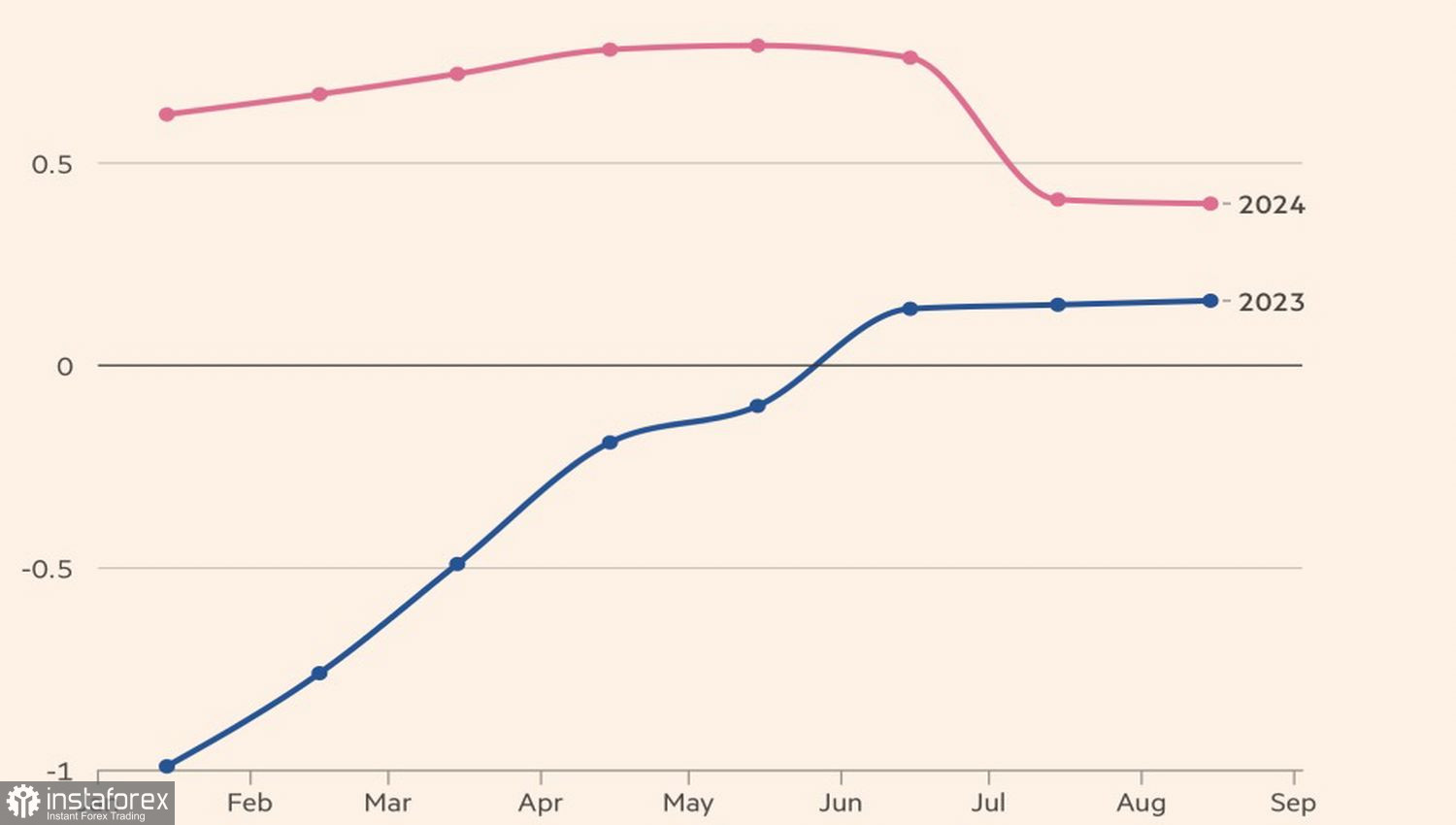

The latest data from the Office for National Statistics provided a hint. As it turns out, the UK's economy returned to its pre-pandemic level at the end of 2021. Economic growth in Britain is proceeding at the same pace as in France, outpacing Germany. It is not surprising that experts at Consensus Economics have regularly revised their GDP forecasts for the United Kingdom in 2023 upwards.

Dynamics of forecasts for UK GDP

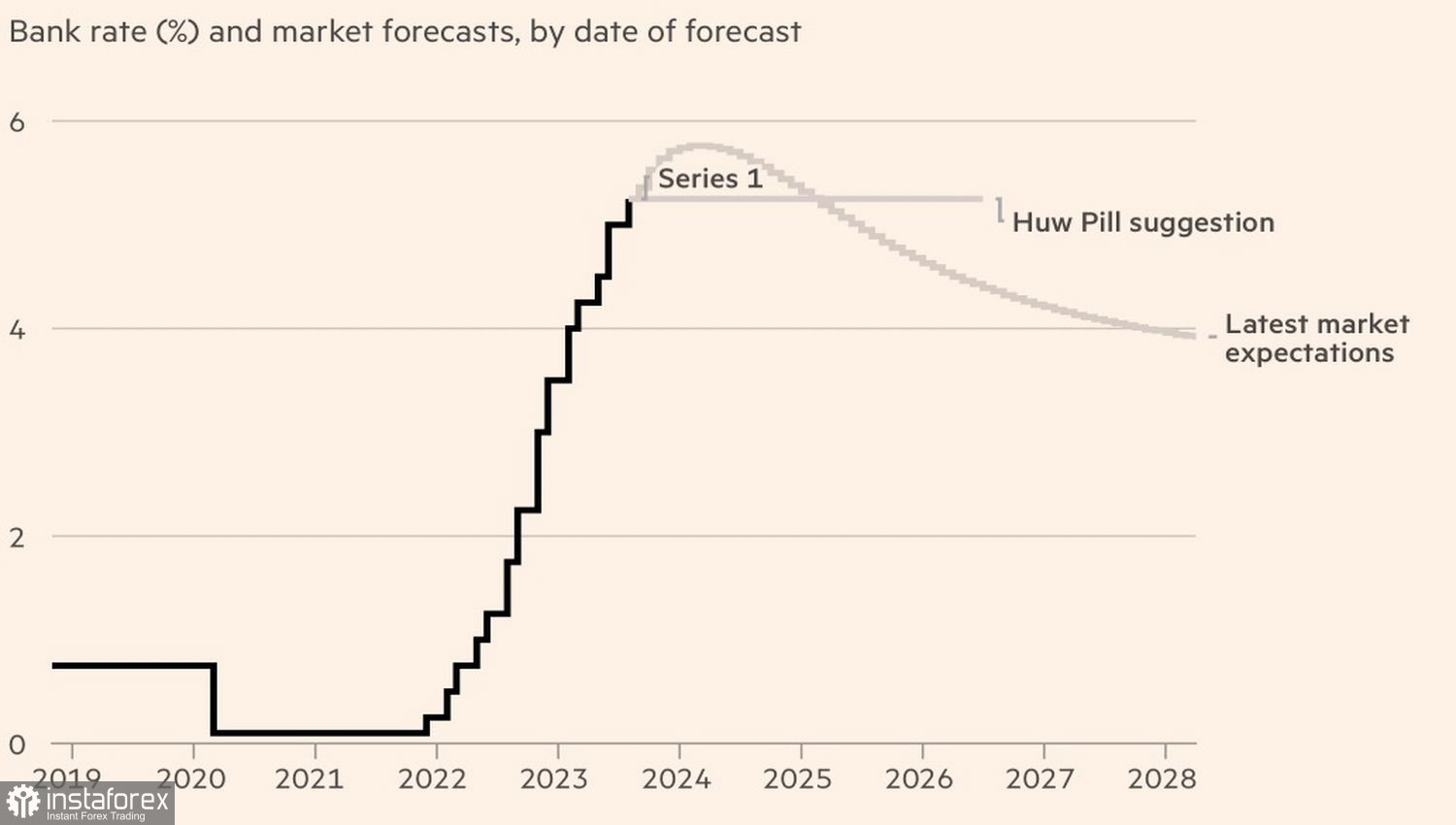

However, any optimism has its limits. Inflation in the UK is still high, higher than in the U.S. and the eurozone. And the BoE's policy, despite the most aggressive monetary tightening in decades, appears less effective than that of the Fed. The question is how it will deal with high prices. Bank of England chief economist Huw Pill attempted to answer this question. He believes that there are two possible paths in the fight against inflation. Either sharply raise the repo rate and then lower it just as sharply. Or avoid extremes, keep the borrowing cost at 5.25%, and hold it at that level for a very long time.

Pill supports the second approach. In his view, maintaining the repo rate at a high level will lead to a return of inflation to the 2% target in 2025. In contrast, the futures market expects it to rise to 5.75%, with subsequent reduction to 4.25% by 2025.

Dynamics of the repo rate and options for its change

If the Bank of England does not tighten its monetary policy further, theoretically, this should lead to a decline in GBP/USD quotes. However, in practice, things can be different. After the U.S. labor market report, derivatives do not believe in an increase in the federal funds rate to 5.75%. If both London and Washington continue to sit on the sidelines, it is not possible to confidently predict a downward move for the analyzed pair.

Technically, the GBP/USD bulls attempted to play the Fakeout pattern, but testing the fair value of 1.272 proved to be an insurmountable task. However, buyers are not discouraged. Upon retesting resistance at 1.2685 and 1.272, traders will have the opportunity to build on the long positions formed from the 1.2615 level.