Details of the Economic Calendar on September 1

The report from the United States Department of Labor has triggered a wave of speculation in the financial markets. In August, the number of new jobs in the USA increased compared to July; however, the unemployment rate also rose to 3.8%. These data indicate some easing in the labor market situation and reinforce expectations that the Federal Reserve will not raise interest rates this month.

Analysis of Trading Charts from September 1

During the inertia-driven speculative movement, the EUR/USD currency pair depreciated by nearly 90 points throughout Friday. As a result, the quote returned to the base of the downward cycle, where the volume of short positions immediately decreased.

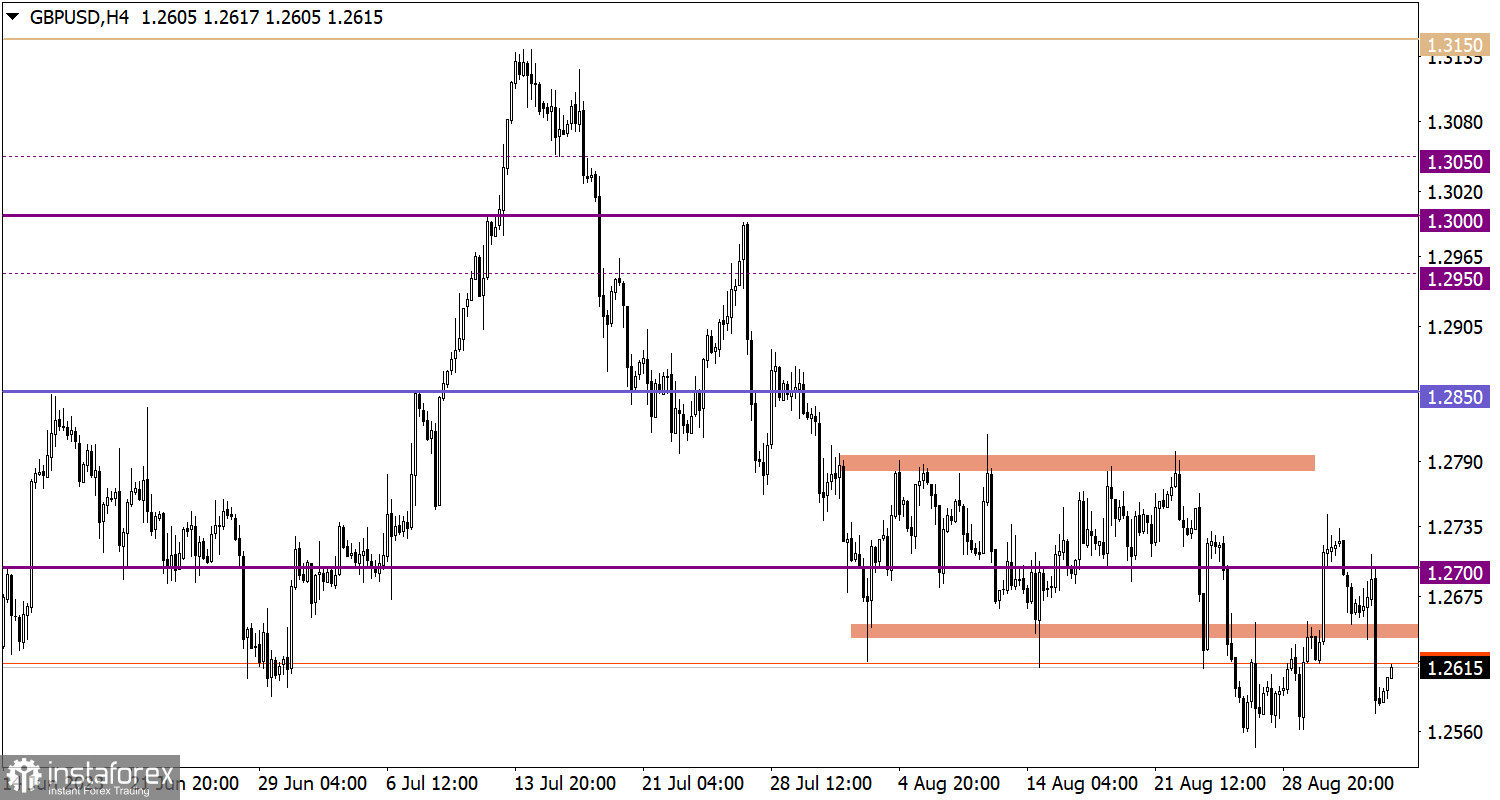

GBP/USD sharply shifted downwards during Friday's trading. As a result, the quote almost reached the local low of the current correction cycle.

Economic Calendar for September 4

Monday, as usual, is accompanied by an empty macroeconomic calendar. No major statistical data releases are expected.

Also, due to a national holiday in the United States, banks, funds, and exchanges are closed, which may have a negative impact on trading volumes.

EUR/USD Trading Plan for September 4

Considering the current oversold condition of the euro and the support level represented by the local low, it can be assumed that the price may begin to rebound or stagnate. In this case, an increase in the quote above the 1.0800 mark is expected. As for the downward scenario, to continue the previously established inertia cycle, it will be sufficient to keep the quote below the 1.0750 level.

GBP/USD Trading Plan for September 4

After a sharp price change, an overheating of short positions in the British pound occurred, which may indicate the possibility of an upcoming pullback. The support level around 1.2550 can be considered as a reference point. As for the possibility of continuing the downward cycle, this scenario will be considered if the price remains stable below the 1.2550 mark.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.