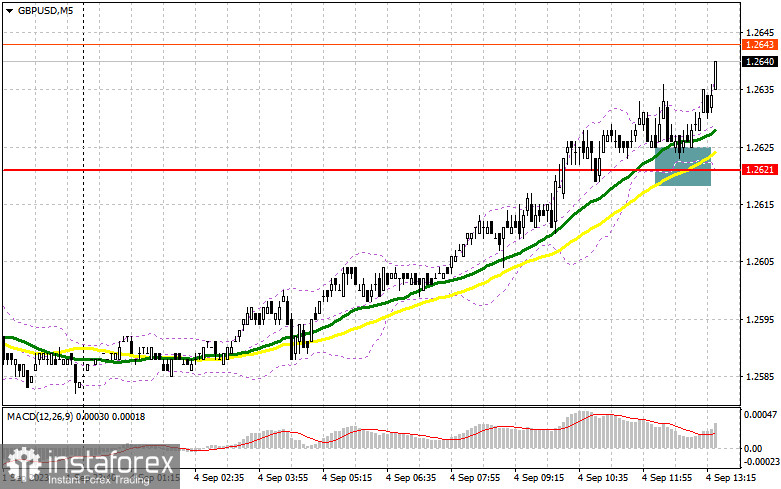

In my morning forecast, I drew attention to the level of 1.2621 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The breakthrough of 1.2621 did occur, but a proper top-down retest of this level never took place, and in the conditions of a bearish Friday market, buying the pound on such a signal was impractical and risky. In the second half of the day, the technical picture was reviewed.

To open long positions on GBP/USD, the following is required:

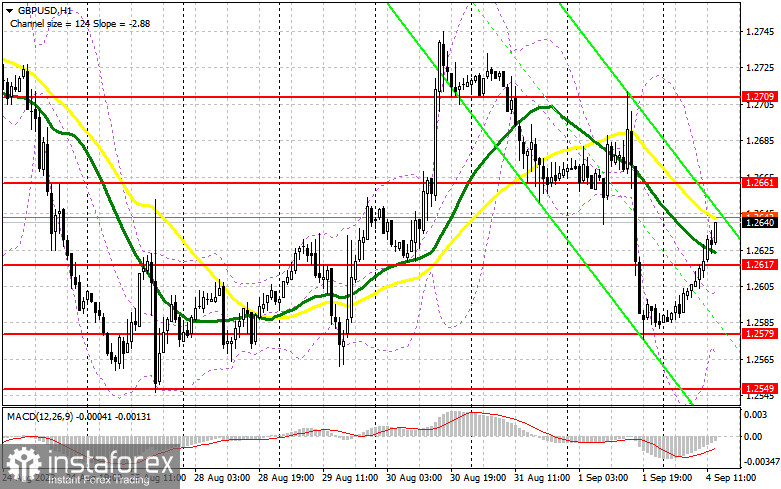

In the United States, today is a holiday, so volatility may be quite limited, even though pound buyers have already done quite a lot, and more is optional from them. The overlap of part of Friday's decline may be met with active pound selling, so I plan to act during the American session only after a drop and the formation of a false breakout in the area of the new support at 1.2617. This will provide a buy signal, with the target being resistance at 1.2661, where slightly below the moving averages are located, favoring sellers. Breaking and holding above this range will strengthen buyers' confidence, maintaining the chance to reach 1.2709. The more distant target remains at the 1.2761 area, where I will take profit. In the scenario of a decline to 1.2617 and the absence of buyers in the second half of the day, especially against the backdrop of the US holiday, pressure on the pound will return, along with the likelihood of a pair's decline. In such a case, only the defense of the next area at 1.2579 and a false breakout at this level will signal the open long positions. I plan to buy GBP/USD immediately on a rebound only from the minimum of 1.2549, with the goal of a 30-35 point correction within the day.

To open short positions on GBP/USD, the following is required:

Bears need to defend the nearest resistance at 1.2661, where slightly below the moving averages are located. I will act there only after an unsuccessful consolidation, providing a sell signal with the prospect of a decline to the 1.2617 area – the support formed during the first half of the day. Breaking and reverse testing from bottom to top of this range, which I did not see with the purchases in the first half of the day, will deal a more serious blow to the bulls' positions, allowing compensation for today's growth and an update to 1.2579. The more distant target remains at the minimum of 1.2549, where I will take profit. In the scenario of GBP/USD rising and the absence of activity at 1.2661 in the second half of the day, which is more likely, I will postpone the sales until a false breakout at 1.2709. If there is no downward movement, I will also sell the pound immediately on the rebound from 1.2761, but only with the expectation of a pair's correction down by 30-35 points within the day.

Indicator Signals:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The period and prices of moving averages considered by the author are on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In the case of a decrease, the lower boundary of the indicator, around 1.2570, will act as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

• Bollinger Bands. Period 20

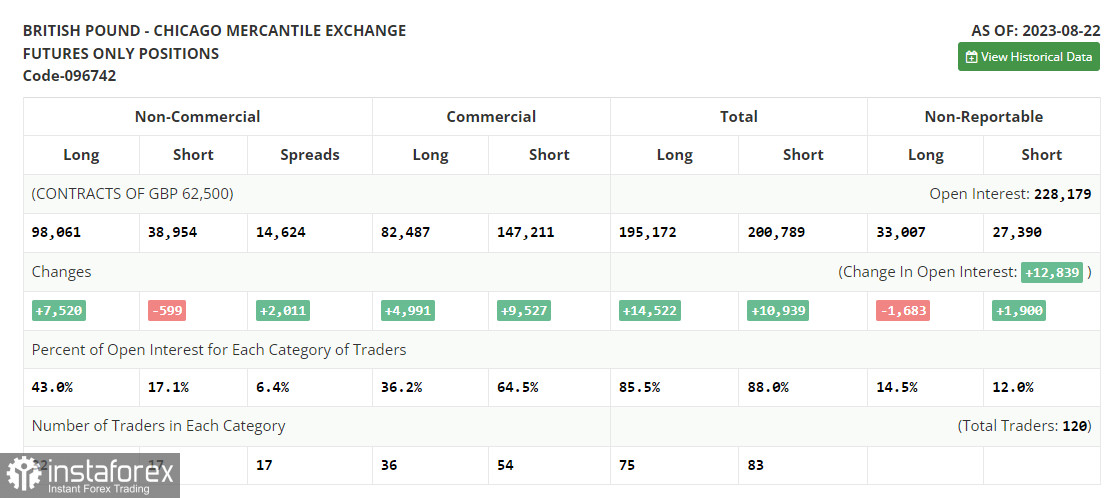

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.