The Reserve Bank of Australia (RBA) will hold its meeting tomorrow, with its interest rate decision scheduled for publication at 04:30 (GMT).

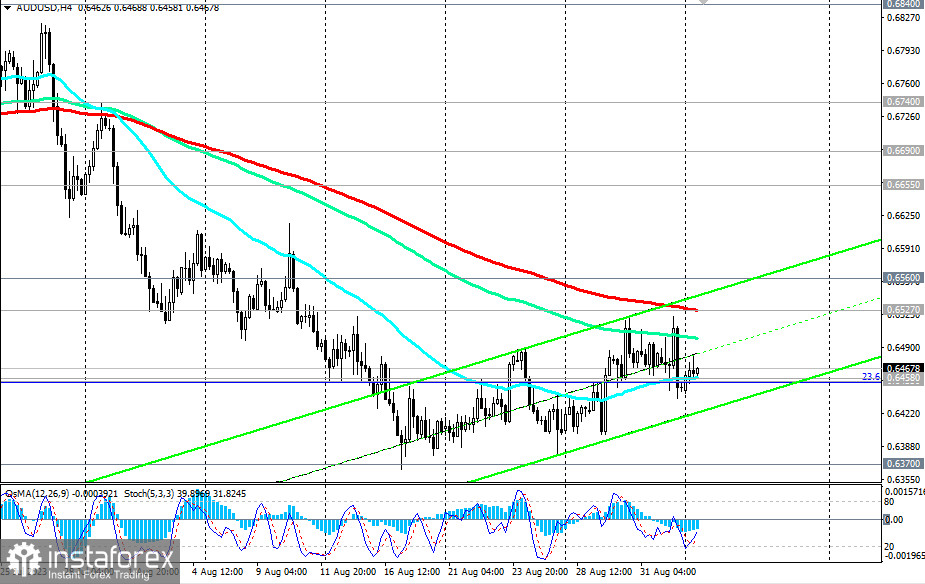

In the meantime, AUD/USD is currently correcting upwards, most likely due to the weakening of the U.S. dollar. However, the overall trend remains bearish in the context of medium and long-term trends, staying below the key resistance levels of 0.7010 (200 EMA on the weekly chart) and 0.6690 (200 EMA on the daily chart). A break below today's and Friday's lows at 0.6443 and 0.6438 could signal a resumption of short positions on AUD/USD.

In this case, the pair will move inside the downward channels on the daily and weekly charts, towards their lower boundaries and levels of 0.6300, 0.6285, 0.6200, and 0.6170 (2022 lows), with an intermediate target at the local support level of 0.6370.

On the other hand, an alternative scenario for the resumption of long positions has already emerged: the price has broken through the important short-term resistance level of 0.6458 (200 EMA on the 1-hour chart).

A break above the crucial resistance levels at 0.6527 (200 EMA on the 4-hour chart) and 0.6560 (50 EMA on the daily chart) could trigger further corrective growth with targets at medium-term resistance levels of 0.6655 (144 EMA on the daily chart) and 0.6690 (200 EMA on the daily chart).

However, only a break above the key resistance levels of 0.7000, 0.7010 (200 EMA on the weekly chart), and 0.7040 (38.2% Fibonacci level of the correction wave from 0.9500 to 0.5510) will bring AUD/USD into the long-term bull market zone.

Support levels: 0.6458, 0.6455, 0.6400, 0.6370, 0.6300, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6500, 0.6527, 0.6560, 0.6600, 0.6655, 0.6690, 0.6700, 0.6740, 0.6800, 0.6840, 0.6900, 0.6925, 0.7000, 0.7010, 0.7040