Both euro and pound saw brief rebounds, following Friday's decline. It developed into a sideways movement not only due to the empty macroeconomic calendar, but also on the Labor Day holiday in the US.

Further movement will depend today on the Producer Price Index (PPI) data in the eurozone, which forecasts say could accelerate from -3.4% to -7.8%. However, recent inflation estimates suggest that the decline will not be as impressive, hinting at a slower decrease in inflation. This could be a precursor to further tightening of the ECB's monetary policy, which will result in euro rising a bit more, pulling pound along with it. But if the forecasts come true, dollar will start to rise.

If producer prices decline sharply, it will lead to a downward trend in inflation. In such conditions, the ECB may consider easing the monetary policy.

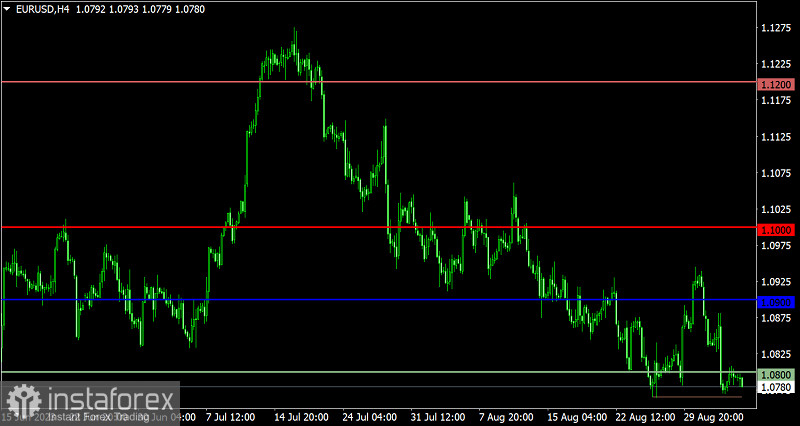

EUR/USD continues to decline despite several attempts at partial recovery. Updating the local low will likely lead to a surge in short positions, which will further weaken the pair. An alternative scenario will be considered if the price returns above 1.0800.

GBP/USD reached the previously passed level of 1.2650, along which the volume of long positions decreased. For the decline to continue, sellers need to overcome the support level of 1.2550.