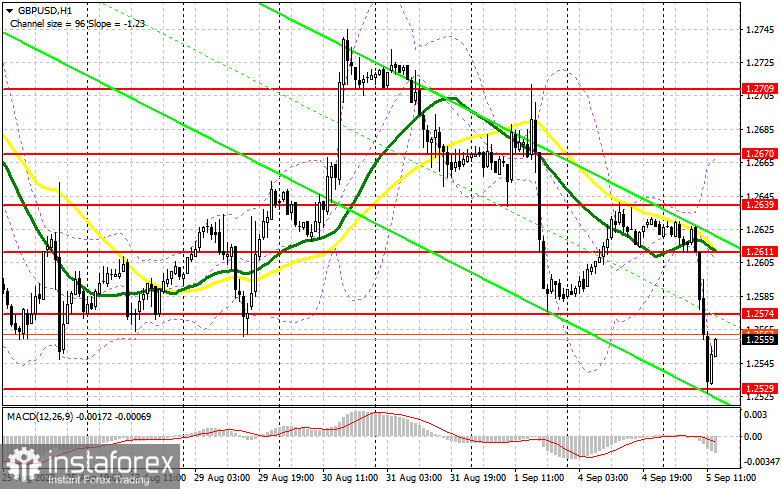

In my morning forecast, I drew attention to the level of 1.2577 and recommended making decisions on market entry based on it. Let's look at the 5-minute chart and analyze what happened there. The drop and the formation of a false breakout at this level resulted in a buy signal, but after a 15-point upward correction, pressure on the pair resumed. The breakthrough and retest of 1.2577 - a sell signal - led to a decline in the pair by more than 50 points.

To open long positions on GBP/USD, the following is required:

Activity in the UK services sector began to contract in August, as is already known from the final PMI index. This also negatively affected the composite PMI, only intensifying the pressure on the pair. Considering that in the second half of the day, we can only expect figures on changes in US manufacturing orders and the IBD/TIPP economic optimism index, it is unlikely that pound buyers will be able to use this data. However, after updating the lows, significant purchases keep the day's intrigue alive. I plan to act during the American session only after a drop and the formation of a false breakout in the new support area at 1.2529. Only this will signal a buy, with the target being resistance at 1.2574, also formed in the first half of the day. A breakthrough and consolidation above this range will restore confidence to buyers, maintaining the chance to reach 1.2611, where moving averages that favor sellers are located. The more distant target is 1.2639, where I will take profit. In the scenario of a decline to 1.2529 and the absence of buyers in the second half of the day, especially against the backdrop of strong US data, pressure on the pound will return, along with the likelihood of further pair depreciation. In this case, only defending the next area at 1.2488 and a false breakout at that level will signal opening long positions. I plan to buy GBP/USD immediately on a rebound only from the minimum of 1.2444, with a 30-35 point correction target within the day.

To open short positions on GBP/USD, the following is required:

To consolidate control over the market, bears need to defend the nearest resistance at 1.2574. After an unsuccessful consolidation, I will only act further in the market, which will signal a sell with the prospect of a decline to 1.2529 - support formed during the first half of the day. The breakthrough and retest from below-up of this range will deliver a more serious blow to the bullish positions, providing an opportunity to update monthly lows in the area of 1.2488. The more distant target remains at 1.2444, where I will take profit. In the scenario of GBP/USD growth and the absence of activity at 1.2574 in the second half of the day, buyers may make their presence felt. For this reason, I will postpone sales until a false breakout at 1.2611. Without a downward movement there, I will sell the pound immediately on a rebound from 1.2639, but only counting on a pair correction down by 30-35 points within the day.

Indicator Signals:

Moving Averages

Trading is taking place below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The period and prices of moving averages considered by the author are on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator, around 1.2530, will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.