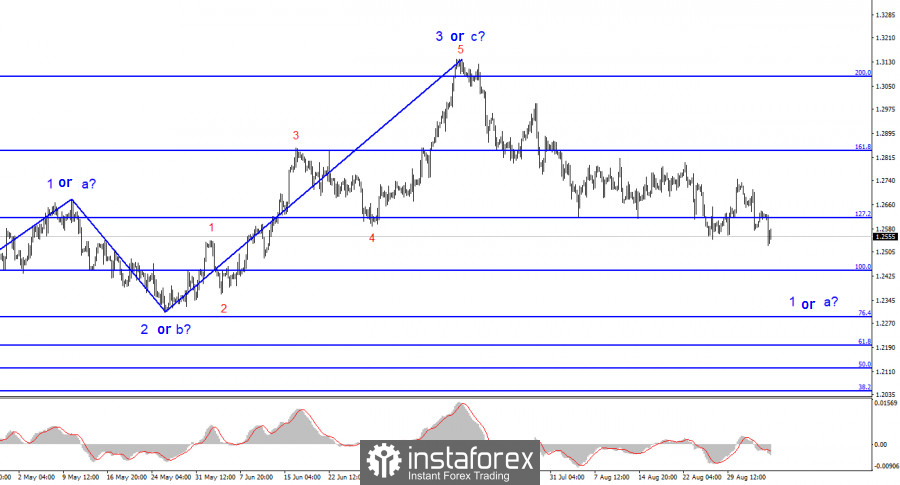

The wave analysis for the pound/dollar pair remains relatively simple and clear. The construction of the upward wave 3 or C is complete, and the theoretical new downward trend is now in progress, which could theoretically be wave D. Still, the probability of this is approaching zero. There are no grounds for the British pound to resume its rise. However, wave analysis has transformed into a more complex one, and wave 3 or C has taken on a more extended form than many analysts expected a few months ago. The upward trend could still take on a five-wave structure if the market finds new reasons for long-term purchases.

The internal wave structure of the first wave of the new trend looks complex, much more so than the euro/dollar pair. Nevertheless, the market sentiment is relatively clear. Despite the British pound's resistance to decline, there are few reasons for it to rise either. The latest important data from America was disappointing, but it has not been pleasing the markets for a long time in Britain. The pair will continue to decline following the euro currency.

The exchange rate of the pound/dollar pair fell by 70 basis points on Tuesday. In the euro/dollar review, I assumed that the decline in demand for the euro currency could have been caused by business activity indices, immediately dispelling this assumption. The situation is roughly the same for the British pound. Today, a report on business activity in the service sector for August was released in the UK, and its value turned out to be even higher than the initial estimate. However, the indicator still dropped below the key level of 50.0. In any case, this has been known for two weeks, so today the market is unlikely to have started reducing demand for the pound due to this report. There were no other reports. Thus, it is all about wave analysis. I want to remind you that the first wave of the descending trend does not look convincing, so it isn't easy to consider it completed. The decline may continue.

What does the British pound need to stop falling? Only one factor can save it from this - if the Bank of England raises the interest rate at the September meeting and signals to the markets that it is ready to continue tightening monetary policy. If the regulator pauses, this will further reduce demand for the pound. If Andrew Bailey or his colleagues speak in favor of slowing down the pace of tightening, this will reduce demand for the pound. Since the Bank of England's rate is already at 5.25%, it is logical for the market to expect the tightening to end. The decline of the British pound is quite logical and reasonable.

General conclusions.

The wave pattern of the pound/dollar pair suggests a decline within the framework of the descending trend. There is a risk of completing the current downward wave if it is wave D and not wave 1. In this case, the construction of wave 5 may begin from current levels. However, we are currently observing the construction of the first wave of the new section. At most, buyers can expect the construction of wave 2 or B. I still recommend selling with targets around the 1.2442 mark, corresponding to 100.0% Fibonacci.

The picture is similar to the euro/dollar pair on a higher wave scale, but there are still some differences. The downward correctional section of the trend is complete, and the construction of a new upward trend is continuing, which may already be completed or may take on a full five-wave structure.