Overview of macroeconomic reports

There are hardly any economic events on Wednesday, with only one important report among them. We believe that there is no special reason to pay attention to the Construction PMIs of Germany, the European Union, and the United Kingdom. The report on retail sales in the EU is relatively important but rarely provokes a market reaction. The "Beige Book" in the United States is only a summary of economic reviews, which rarely contain important information. The S&P Business Activity Index for the U.S. service sector will publish its second, final value, which is objectively less significant than the first. You should only focus on the ISM index in the United States. However, it will only trigger a reaction if its figures significantly deviate from forecasts.

Overview of fundamental events

There is practically nothing to highlight from Wednesday's fundamental events. If we assume that on Tuesday, the market reacted to European Central Bank President Christine Lagarde's silence regarding the interest rate, then representatives of the ECB's Governing Council will not be able to offer anything new to the market. Federal Reserve official Lorie Logan will speak in the evening but this is when beginners should have already left the market. We likely won't receive any important information today.

Bottom line

On Wednesday, traders should pay attention to the ISM report in the United States; all other events are clearly secondary of importance and are unlikely to stir some market reaction. Therefore, both pairs may continue to move somewhat chaotically, with a downtrend and frequent upward rebounds.

Main rules of the trading system:

- The strength of the signal is calculated by the time it took to form the signal (bounce/drop or overcoming the level). The less time it took, the stronger the signal.

- If two or more trades were opened near a certain level due to false signals, all subsequent signals from this level should be ignored.

- In a flat market, any currency pair can generate a lot of false signals or not generate them at all. But in any case, as soon as the first signs of a flat market are detected, it is better to stop trading.

- Trades are opened in the time interval between the beginning of the European session and the middle of the American one when all trades must be closed manually.

- On the 30-minute timeframe, you can trade based on MACD signals only on the condition of good volatility and provided that a trend is confirmed by the trend line or a trend channel.

- If two levels are located too close to each other (from 5 to 15 points), they should be considered as an area of support or resistance.

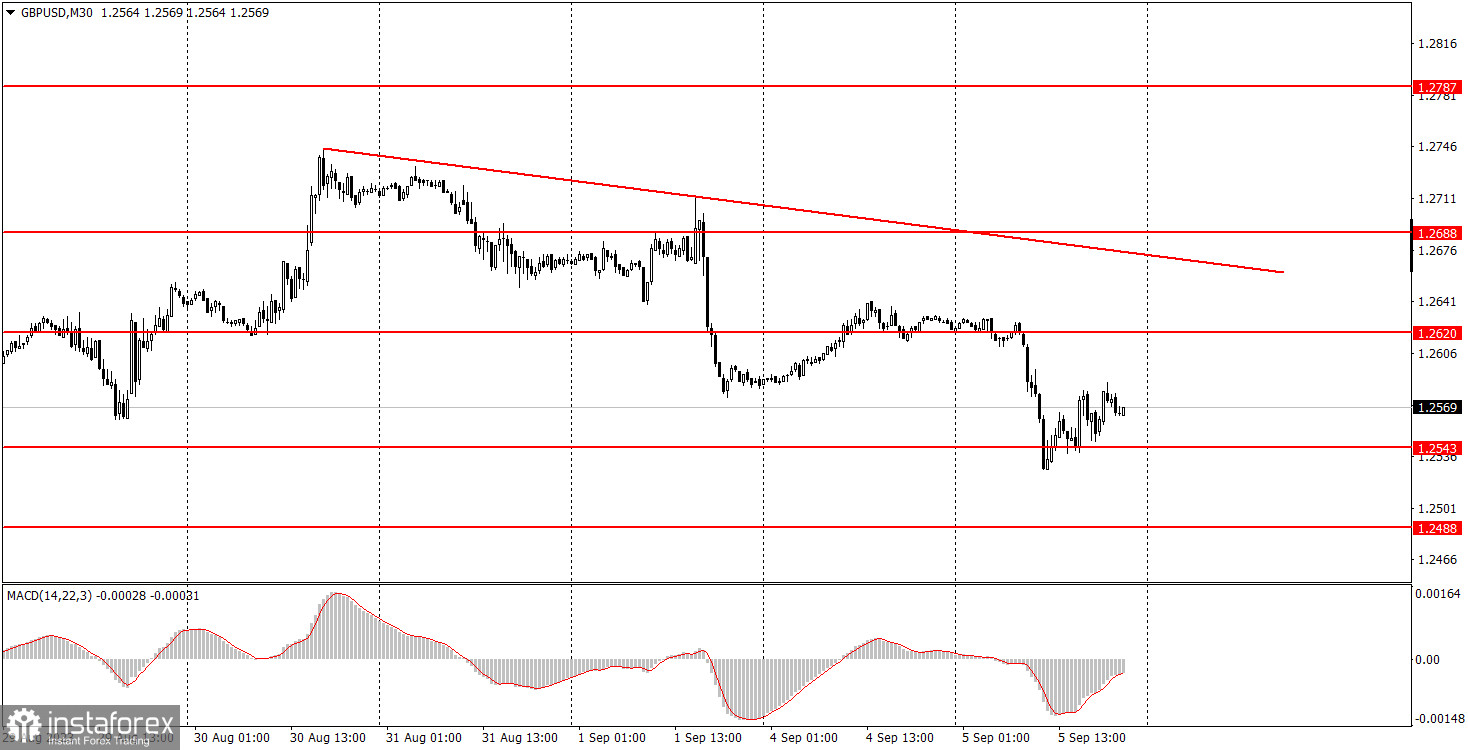

Comments on charts

Support and resistance levels are levels that serve as targets when opening long or short positions. Take Profit orders can be placed around them.

Red lines are channels or trend lines that display the current trend and show which direction is preferable for trading now.

The MACD (14,22,3) indicator, both histogram and signal line, is an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of a currency pair. Therefore, during their release, it is recommended to trade with utmost caution or to exit the market to avoid a sharp price reversal against the previous movement.

Beginners trading in the forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is the key to success in trading over a long period of time.