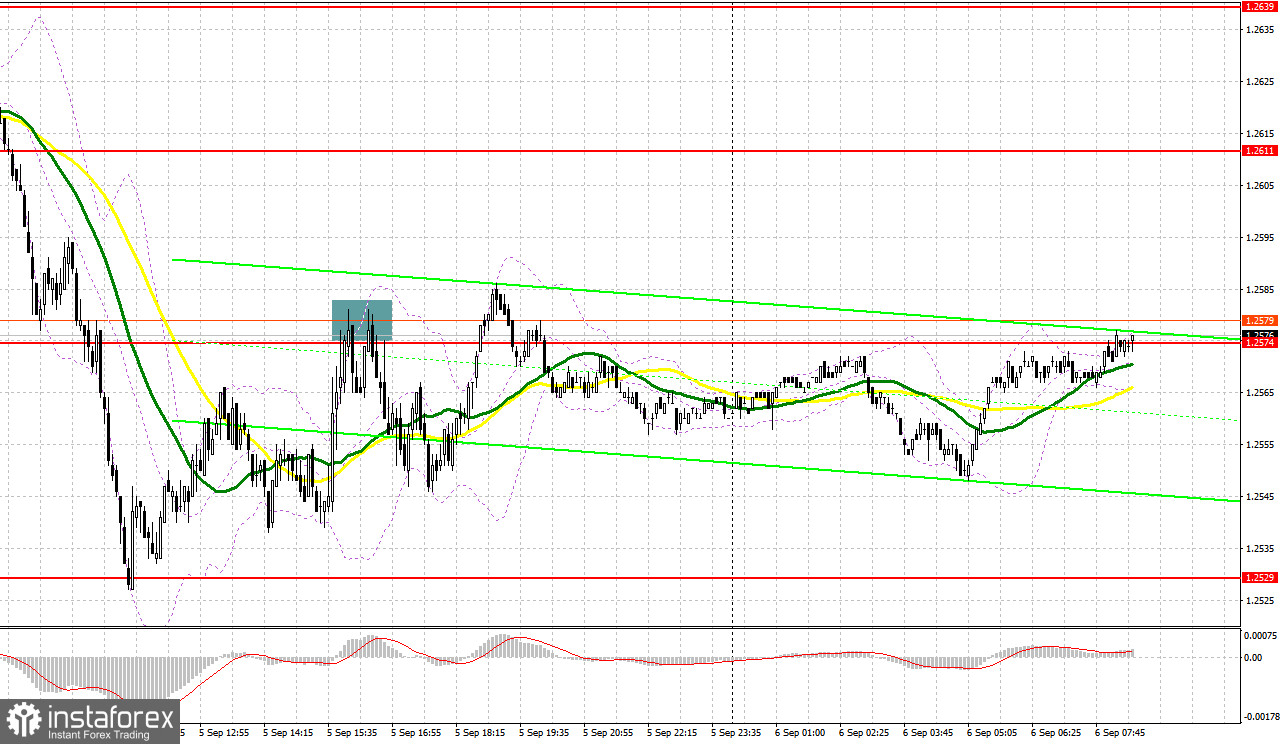

Yesterday, the instrument formed several entry signals to the market. Let's look at the 5-minute chart and figure out what happened there. In my previous forecast, I drew attention to the 1.2577 level and recommended making market entry decisions from it. A decrease and a false breakout at this level produced a buy signal, but after an upward correction by 15 points, the currency pair came under pressure again. A breakout and a retest of 1.2577 meant a sell signal, which led to a drop in the price by more than 50 pips. In the second half of the day, the bears' defense of the 1.2574 resistance provided an excellent entry point for selling the pound further along the trend. This led to another move of the price down by 30 pips.

What is needed to open long positions on GBP/USD

Yesterday, traders were discouraged by weak data from the UK, especially the service PMI as business activity lost momentum in August. Following the PMI report, GBP/USD updated monthly lows and secured a bearish trend for GBP/USD. Today, the bulls will get a chance to recover many losses. Bank of England's Governor Andrew Bailey is due to deliver a speech during hearings of the special Treasury committee. If the head of the central bank signals a firm commitment to a hawkish monetary policy, the pound may receive support and strengthen its position. The PMI data for the UK's construction sector won't significantly sway the market.

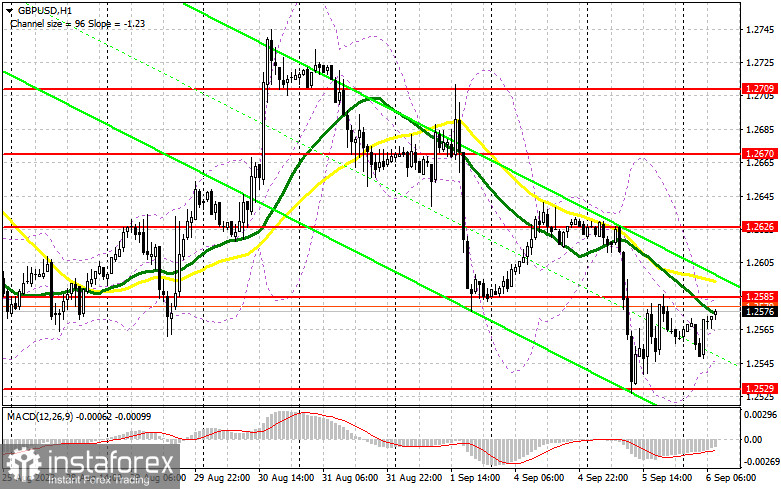

Under current conditions, it's best to act around the nearest support of 1.2529, where a false breakout will signal market entry into long positions with a recovery to about 1.2585, where the pound is currently trading. There, the moving averages are siding with sellers. A breakout and consolidation above this range will boost buyers' confidence, suggesting long positions and preserving chances to reach 1.2626. The higher target would be the 1.2670 area, where I plan to take profits. If GBP/USD declines to 1.2529 and buyers are absent there, the pressure on the pound will persist. In this case, we could assume the probability of a further significant drop in the pair. In such a case, only the defense of the next area at 1.2488 and a false breakout there will signal opening long positions. I plan to buy GBP/USD immediately on a dip only from the 1.2419 low, bearing in mind an intraday correction of 30-35 pips.

What is needed to open short positions on GBP/USD

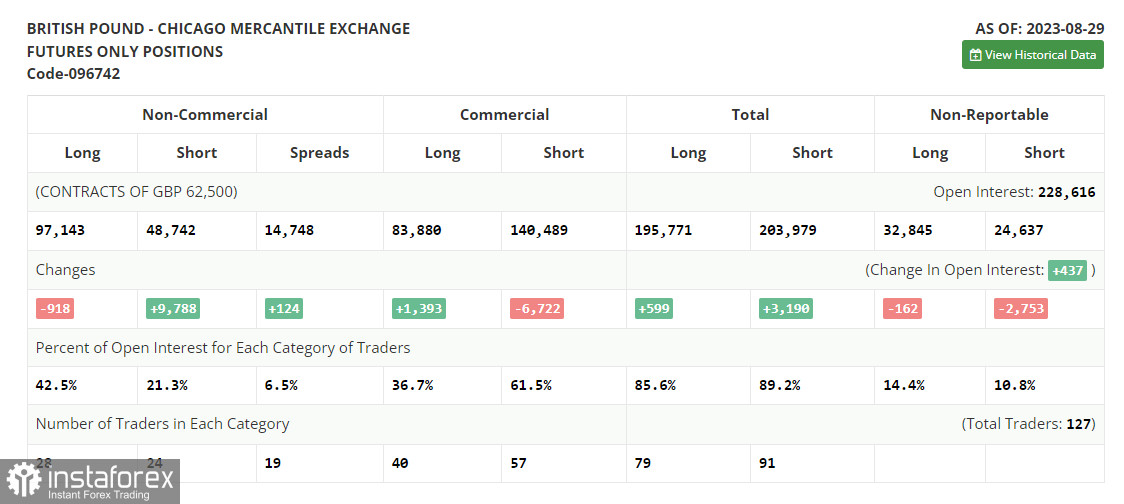

The bears need to defend the nearest resistance at 1.2585, where the moving averages are passing. I will act there only after an unsuccessful consolidation, which will signal a sell opportunity. GBP/USD may decline lower towards 1.2529. A breakout and a bottom-up retest of this range will deal a more serious blow to the bulls' positions, allowing for a renewal of a one-month low at 1.2488. The further target remains the 1.2444 area, where I will take profits. In the scenario of GBP/USD growth and lack of activity at 1.2585, and considering Bailey's speech might have a clear hawkish tone, the buyers might attempt to re-enter the market. In that case, I will postpone selling until a false breakout at 1.2626. If there's no downward movement there either, I will sell the pound immediately on a rebound from 1.2670, but only anticipating the price correction down by 30-35 pips within the day.In the COT report (Commitment of Traders) for August 29, there was a reduction in long positions and an increase in short positions. The strong US labor market and the speech by Fed Chairman Jerome Powell were the main reasons for the sharp increase in short positions on GBP/USD. Considering that recent UK data has been quite dismal, indicating a potential future recession, the pound sterling is likely to remain under selling pressure this fall. However, this could benefit the buyers. Indeed, the lower the pound, the more attractive it becomes for medium-term buying. The difference in central bank policies will continue to make a positive impact on GBP/USD. The latest COT report indicates that non-commercial long positions decreased only by 918 to the level of 97,143, while non-commercial short positions grew by 9,788 to 48,742. As a result, the spread between long and short positions jumped by 124. GBP/USD closed last week lower at 1.2624 versus 1.2741 a week ago.

Indicators' signals

Moving Averages

The instrument is trading below the 30 and 50-day moving averages. It indicates a possible decline in GBP/USD.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD goes down, the indicator's lower border around 1.2535 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.