On the market, it's not enough to know the direction of the asset's future movement; it's crucial to choose the right time. Ahead of the release of U.S. employment data for August, investors seriously believed that the worst was behind for gold. According to Commerzbank's research, bullish positioning in the precious metal increased fourfold compared to the previous week, and capital inflow into ETFs amounted to $5.2 billion. The market genuinely anticipated a signal of the end of the Federal Reserve's monetary tightening cycle, and it seems to have been mistaken.

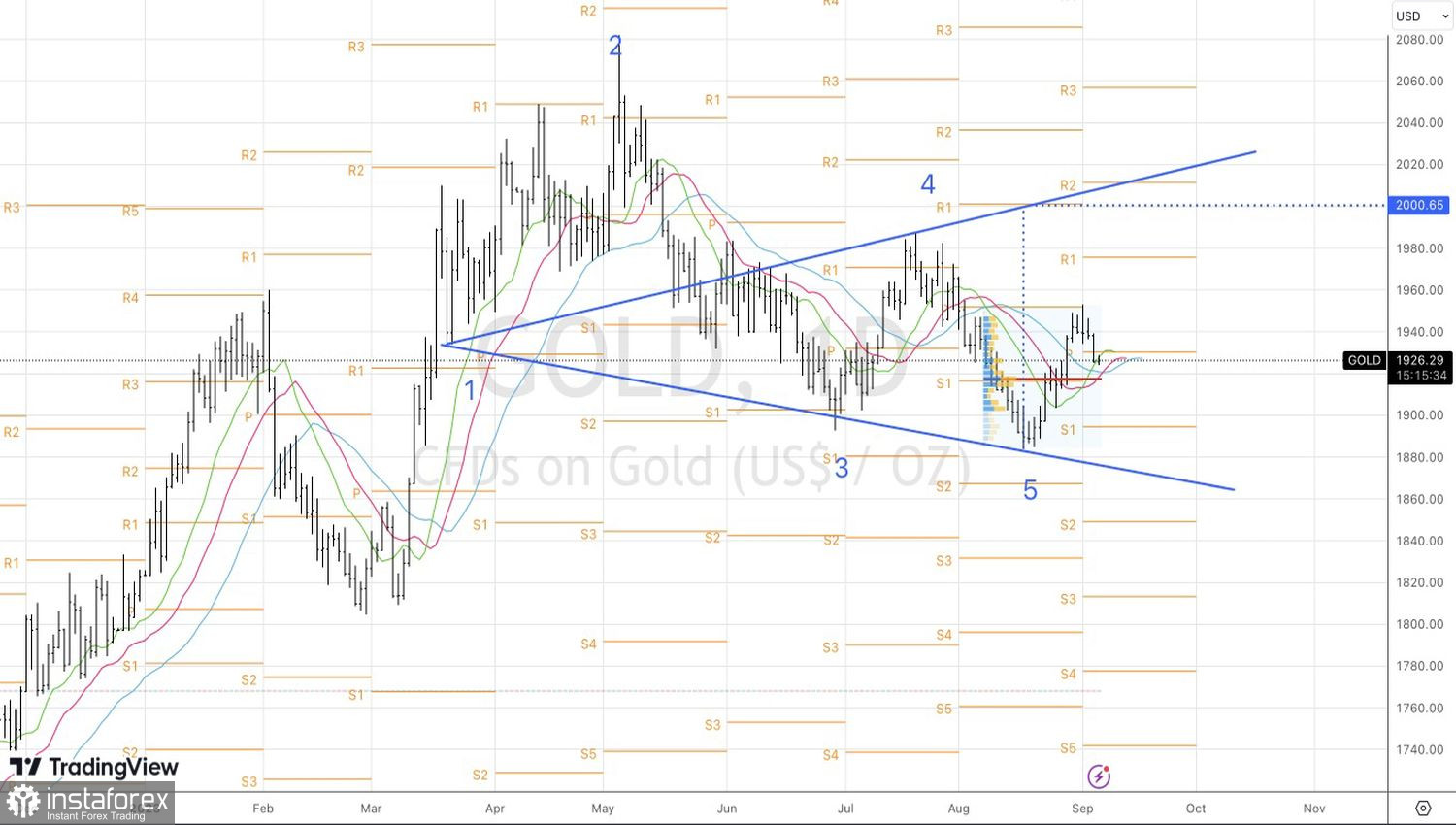

The reaction of XAU/USD to U.S. employment statistics is illustrative. Initially, quotes jumped up, but their inability to stay above 1950 became the first sign of weakness for the bulls. Despite the rise in unemployment to 3.8%, the possibility of an increase in the federal funds rate to 5.75% was not ruled out. Comments from FOMC officials support this notion. For instance, Christopher Waller believes that high inflation could still return, and Loretta Mester asserts that there might be an increase in borrowing costs.

Together with the massive issuance of Treasury and corporate bonds, strong business activity statistics in the service sector, and the implementation of the Fed's quantitative tightening program, fears about the return of high inflation are driving up U.S. Treasury yields. This creates a tailwind for the U.S. dollar and a headwind for gold.

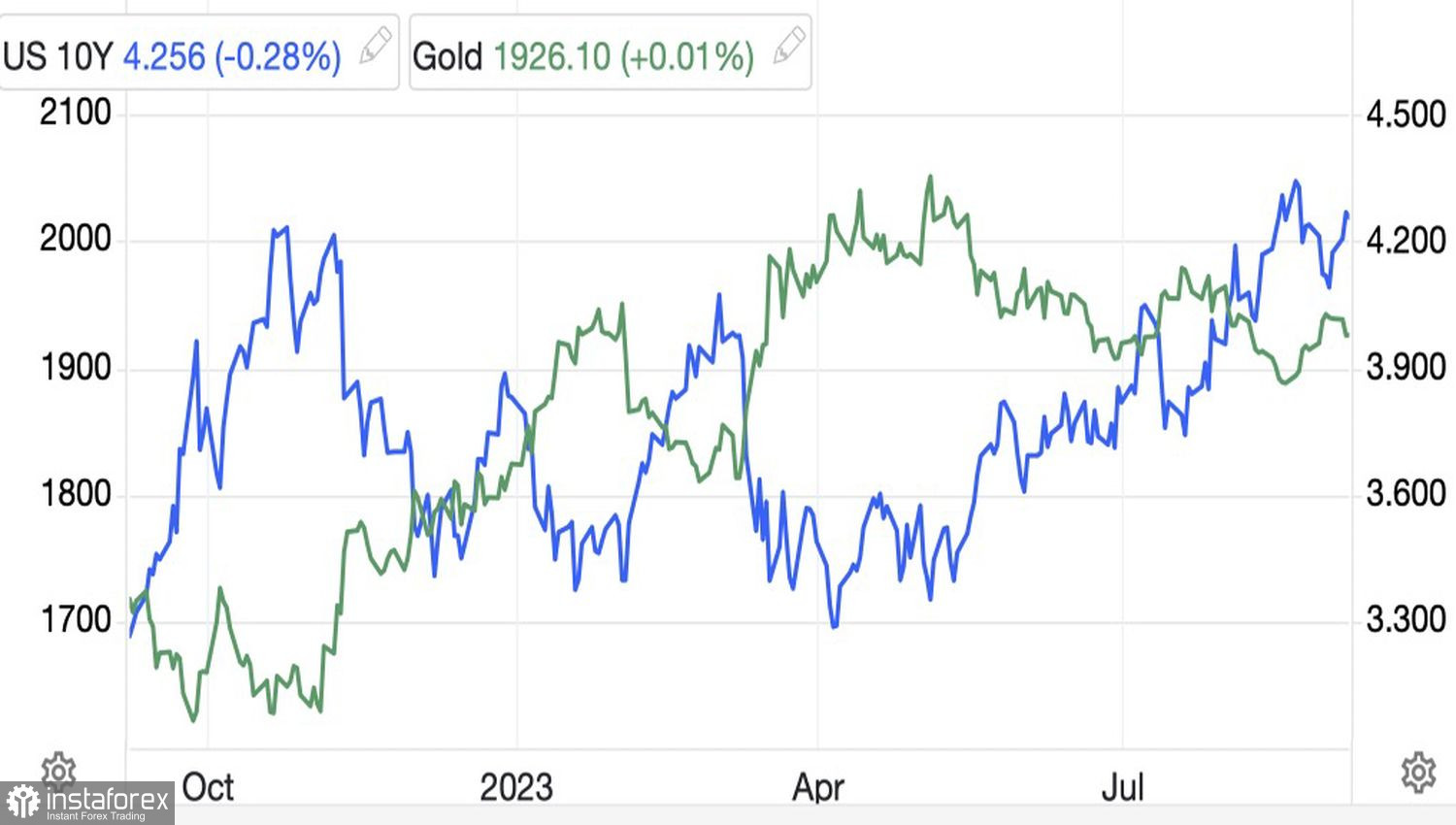

Dynamics of gold and U.S. Treasury Bond yields

While unlike other monetary tightening cycles, the relationship between the precious metal and real Treasury yields is not as pronounced, the rise in bond market rates halts the attacks by the XAU/USD bulls. At the same time, JP Morgan expects an increase in correlation during the central bank's transition from a passive position to a reduction in the federal funds rate. During such periods, real yields typically fall, and gold rises.

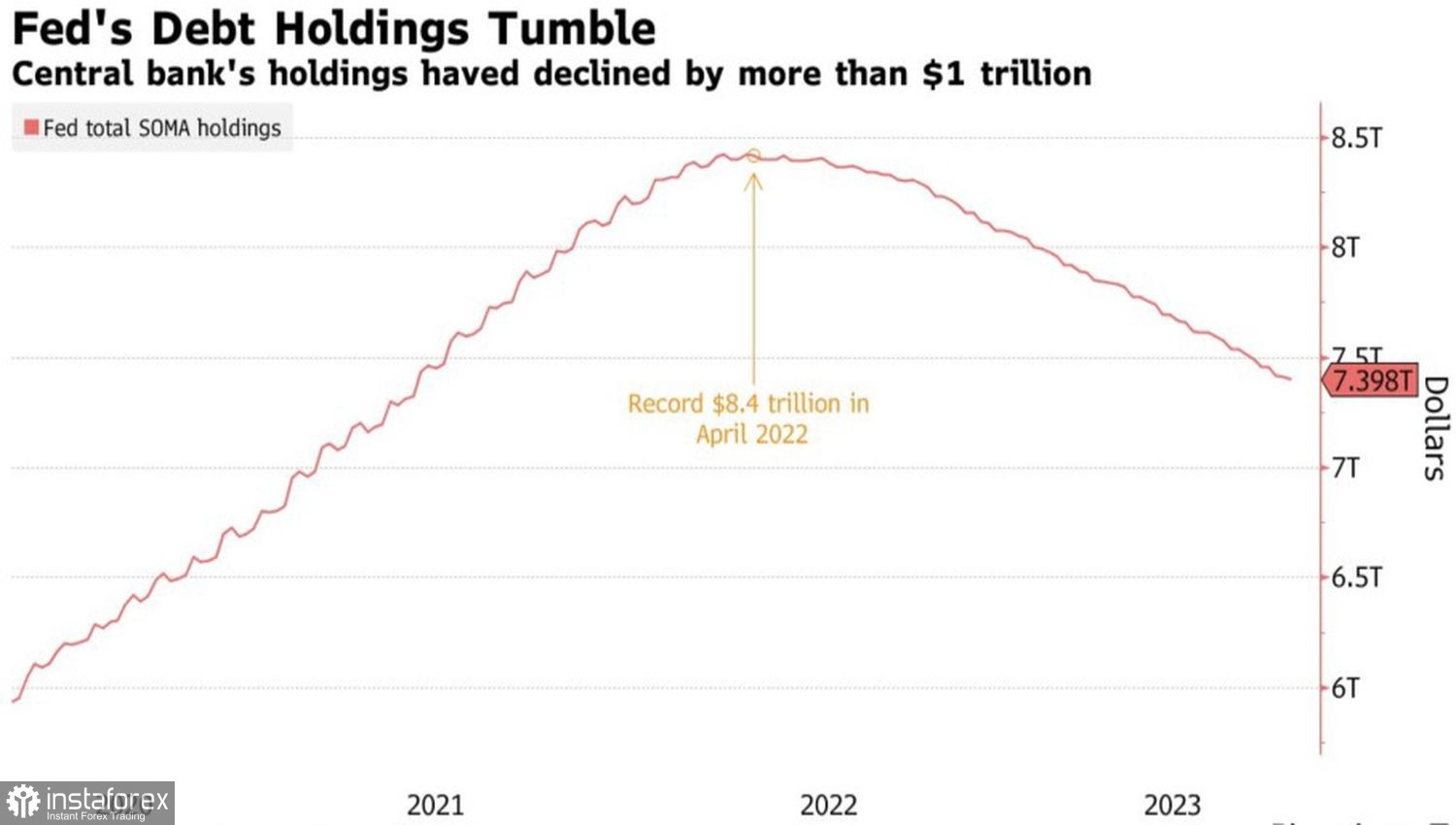

However, we are not there yet. Concerns about a new surge in consumer prices will prompt the Federal Reserve to keep the intrigue about further federal funds rate hikes. Perhaps not in September, but in December or early 2024. At the same time, the central bank is unwinding its balance sheet as part of QT, which contributes to the rally in Treasury yields.

Dynamics of the Fed's balance sheet

In reality, finding buyers for bonds is quite challenging. So why wouldn't Jerome Powell and his team bring down stock indices to divert money from equities? A drop in the S&P 500 would be seen as a deterioration in global risk appetite, boosting demand for a safe haven like the U.S. dollar.

All of this will happen in due course. To slow inflation down to 2%, the Federal Reserve will need to significantly cool down the economy. If that happens, gold will be able to shine brightly once again.

From a technical standpoint, the inability of the bears in the precious metal to storm the fair value at $1917 per ounce or to push quotes back above $1932 are reasons to buy.