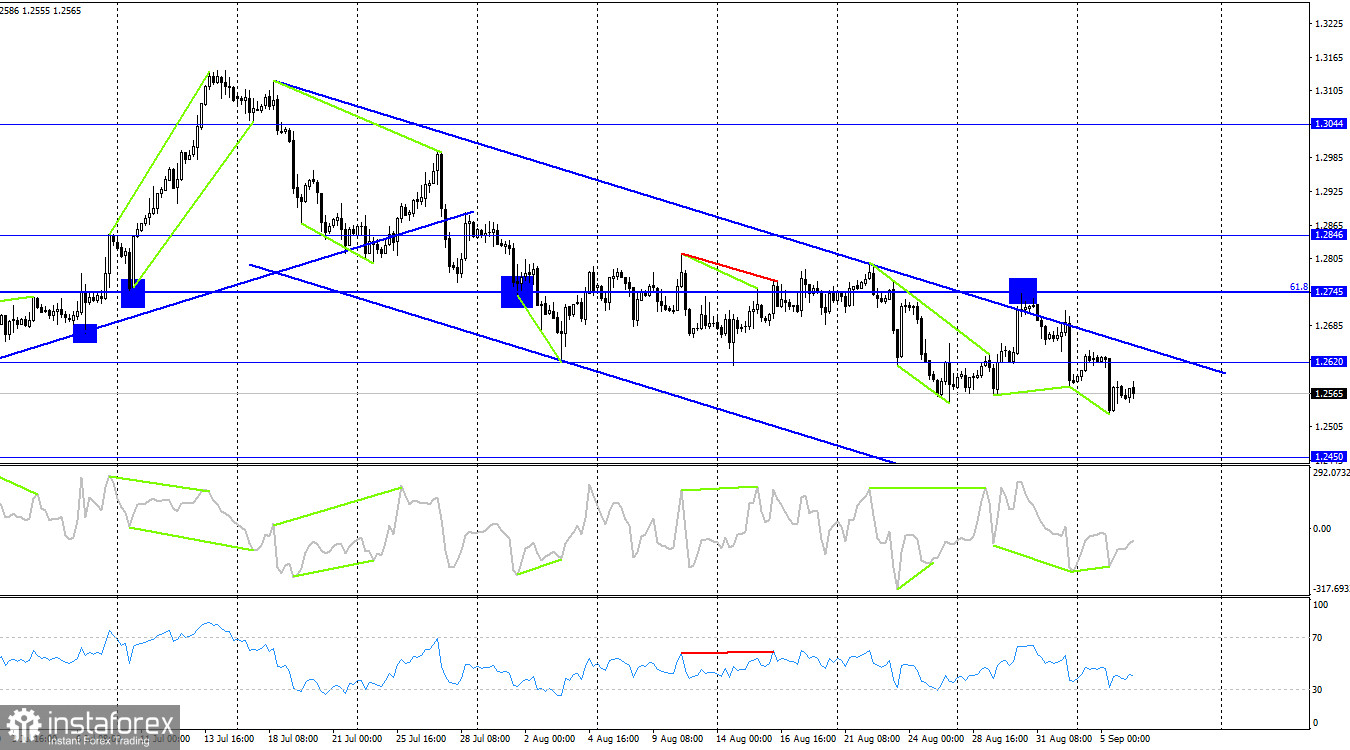

On the hourly chart, the GBP/USD pair executed a new reversal in favor of the US dollar on Tuesday, falling to nearly the level of 1.2513. On Wednesday, it almost returned to the corrective level of 100.0% (1.2590), but there was no follow-through. A rebound of quotes from this level will favor the US currency and a resumption of the decline towards 1.2513. Closing above 1.2590 will favor the British pound and some growth towards the level of 1.2720, although this is a rather distant target.

Yesterday did not change the wave situation. A new downward wave has formed, supporting the bearish trend. Thus, one can expect a new decline in the pound quotes, especially if there is no consolidation above the 1.2590 level. There are currently no signs of the bearish trend coming to an end.

The information background for the pound was relatively weak yesterday, but the pound still fell significantly. Today, the most important report of the day will be the ISM Non-Manufacturing Business Activity Index. At about the same time, the S&P Business Activity Index for the same sector will be released. These two indices could influence traders' sentiment. Judging by the forecasts, a decline in both indices should be expected, but forecasts can be a tricky business. I believe that the forecasts could easily be exceeded, which would allow the dollar to continue strengthening. If not, then both pairs could form signals to buy - closing above the nearest levels from above, which would activate bullish traders.

On the 4-hour chart, the pair consolidated above the descending trend corridor. However, a rebound of quotes from the corrective level of 61.8% (1.2745) worked in favor of the US currency and a resumption of the decline. Consolidation below the level of 1.2620 further increases the likelihood of a decline towards the next level of 1.2450. The bullish divergence of the CCI indicator pushed the pair slightly upward but should not hinder the potential resumption of the decline.

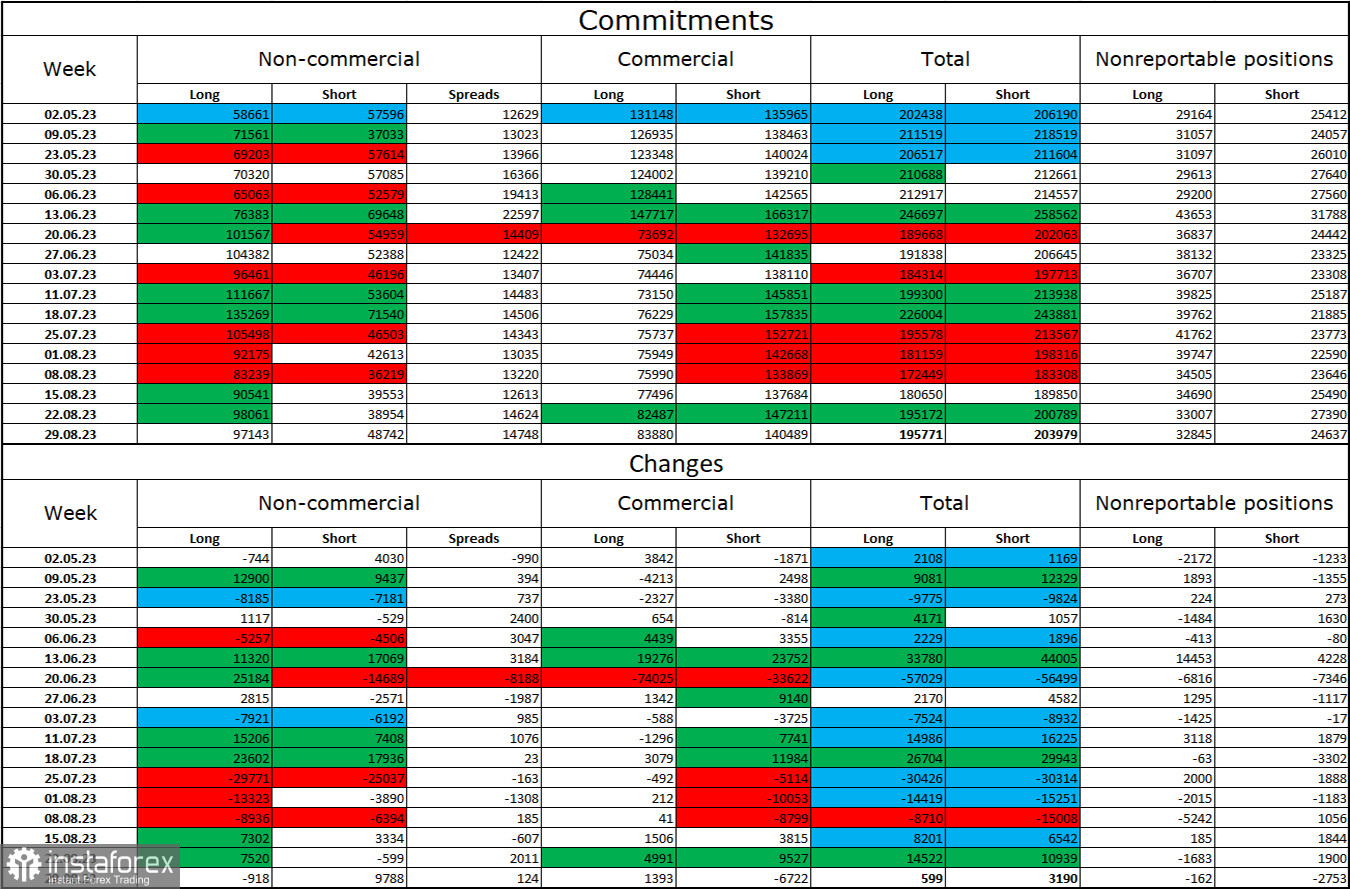

Commitments of Traders (COT) Report:

The sentiment of "Non-commercial" traders in the last reporting week has become less "bullish." The number of long contracts held by speculators decreased by 918 units, while the number of short contracts increased by 9788 units. The overall sentiment of large players remains "bullish," but there is now an almost twofold gap between the number of long and short contracts: 97 thousand versus 48 thousand. In my view, the British pound had good prospects for further growth a few weeks ago, but now many factors have turned in favor of the US dollar. I don't expect a strong rally in the British pound. Over time, I believe that bulls will continue to shed their Buy positions. The Bank of England may be the only entity capable of changing the market dynamics if it continues to raise interest rates beyond the planned timeline.

Economic Calendar for the US and the UK:

US - S&P Global Services PMI (13:45 UTC).

US - ISM Non-Manufacturing Purchasing Managers' Index (14:00 UTC).

US - Federal Reserve Beige Book (18:00 UTC).

On Wednesday, the economic events calendar includes three entries, with the ISM Index being the most significant. For the rest of the day, the impact of the news on market sentiment may be of moderate strength.

Forecast for GBP/USD and trader advice:

Shorting the British pound was possible with a close below 1.2590, targeting 1.2513. However, the pair fell short of this target by just 10 points. Nevertheless, you can still keep your positions open, especially if there is a bounce from 1.2590. For buying, I consider only one possible signal today - a close above the level of 1.2590. The target would be around 50-60 pips higher.