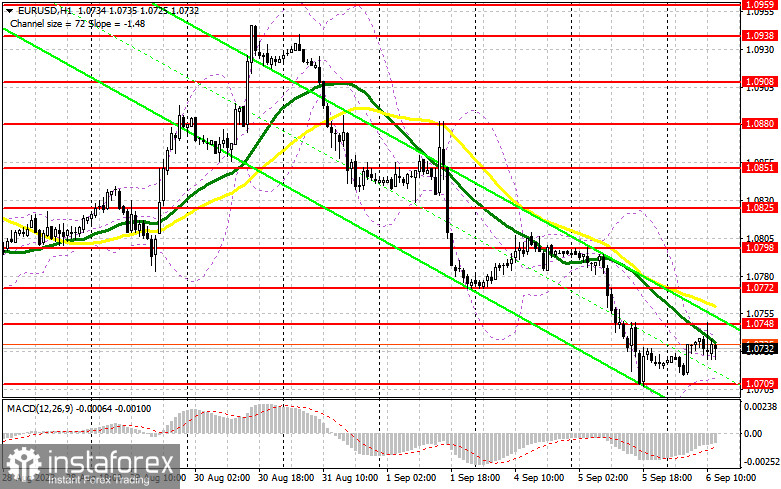

In my morning forecast, I pointed out the level of 1.0748 and recommended making trading decisions based on it. Let's take a look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout around 1.0748 did occur, but I refrained from entering short positions because there was nowhere to place a stop order, and the risk/reward ratio was already too unfavorable. The technical picture did not change for the second half of the day.

To open long positions on EUR/USD, the following is required:

The terrible report on changes in industrial orders in Germany and the decline in retail sales in the Eurozone prevented euro buyers from consolidating above 1.0748. However, judging by the chart, the bulls are not ready to give up this idea and are aiming for another attempt to reach this level in the second half of the day. That's why I haven't revised the technical picture. During the American session, quite important figures for the US ISM non-manufacturing business activity index and the composite PMI index are expected. Good data will likely put pressure on the euro, leading to a sell-off in the pair with a retest of 1.0709. This is the level I plan to act upon.

The formation of a false breakout at 1.0709 will confirm a suitable entry point for long positions to recover towards 1.0748, the resistance tested earlier in the day. This level also coincides with the moving averages, which are currently favoring the bears. A breakthrough and a top-down test of this range could happen quite quickly, as the bears have already defended this level once, and weak US statistics will boost demand for the euro, giving it a chance to surge to 1.0772. The ultimate target will be the area around 1.0798, where I plan to make a profit. In the event of a decline in EUR/USD and a lack of activity at 1.0709 in the second half of the day, the bears will retain control of the market. In this case, only a false breakout formation around 1.0669 would signal a euro purchase. I will open long positions only after a rebound from 1.0637 with the target of a 30-35 point intraday upward trend correction.

To open short positions on EUR/USD, the following is required:

Sellers managed to defend 1.0748 and are now targeting 1.0709. However, much depends on the US activity figures. Poor data will likely lead to another upward surge in the pair. Therefore, only another false breakout at 1.0709, hopefully, more successful than in the first half of the day, will provide a selling signal, opening the way to the support area of 1.0707. Only after a breakthrough and consolidation below this range, as well as a bottom-up retest, do I expect to get another selling signal aiming for 1.0669, where larger buyers are expected to appear. The ultimate target will be the area around 1.0637, where I will take profit. In the event of an upward move in EUR/USD during the American session and a lack of bears at 1.0748, the bulls will have a chance to build an upward correction against the bearish market. If this scenario unfolds, I will postpone short positions until a new resistance level at 1.0772. It can also be sold, but only after an unsuccessful consolidation. I will open short positions only after a rebound from 1.0798 with the target of a 30-35 point downward trend correction.

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating a bearish market.

Note: The author considers the period and prices of moving averages on the hourly chart (H1), which differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands:

In case of an uptrend, the upper boundary of the indicator around 1.0745 will act as resistance.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

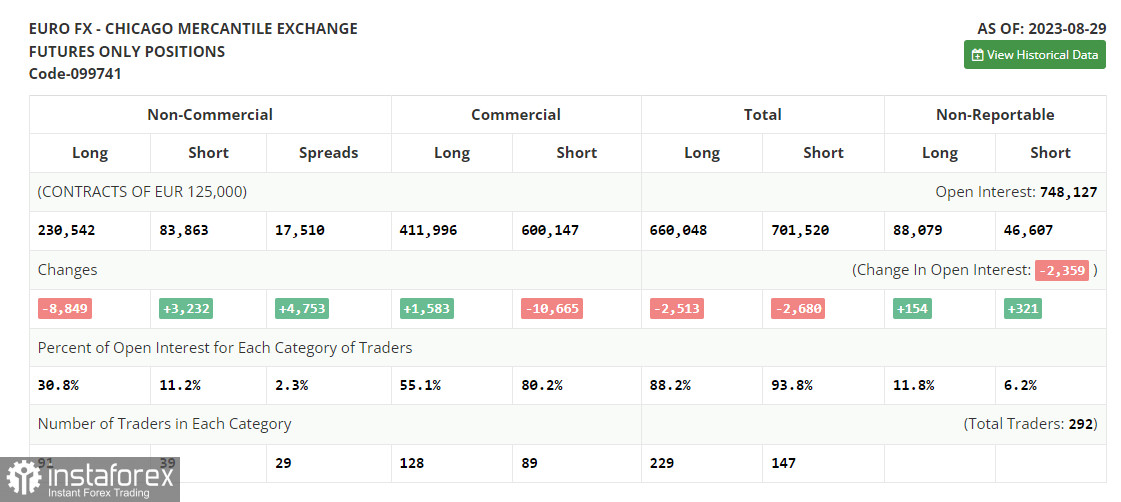

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.