The cryptocurrency market capitalization has stabilized near the $1 trillion mark. However, daily trading volumes have barely reached $24 billion, preventing significant price movements in major cryptocurrencies. Considering the absence of significant macroeconomic or local news, let's examine the current positions of market leaders to determine potential short-term targets.

It's worth noting that despite significant institutional investor interest, Ethereum continues to maintain a high level of correlation with BTC. Given this, any movement in the leading altcoin will be linked to the Bitcoin situation and, consequently, macroeconomic factors.

On-chain Data

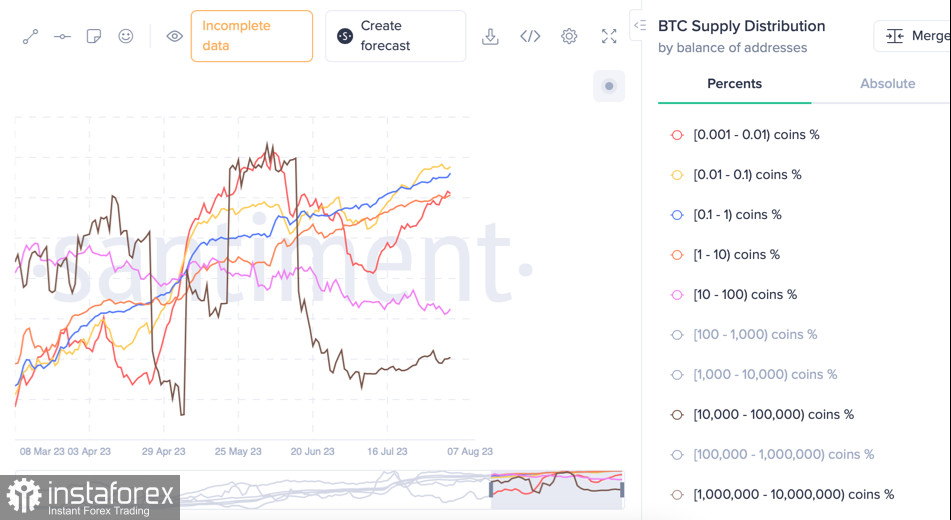

Despite low trading activity in the cryptocurrency market, investors continue to actively accumulate BTC and ETH. It's reported that the number of BTC addresses with non-zero balances has reached a new all-time high of 48.5 million. On-chain resources show a trend of accumulation of BTC by all major categories of investors, including "whales" who preferred to sell above $29,000.

A similar situation is observed with Ethereum, indicating a high level of trust in the leading altcoin and its fundamental value. However, due to the downward trend, the percentage of ETH holders with unrealized losses has reached 44%, up from the initial 27% in early July. Despite this, as the price of ETH decreases, demand increases, in part due to the deflationary nature of the asset following the Merge upgrade.

BTC/USD Analysis

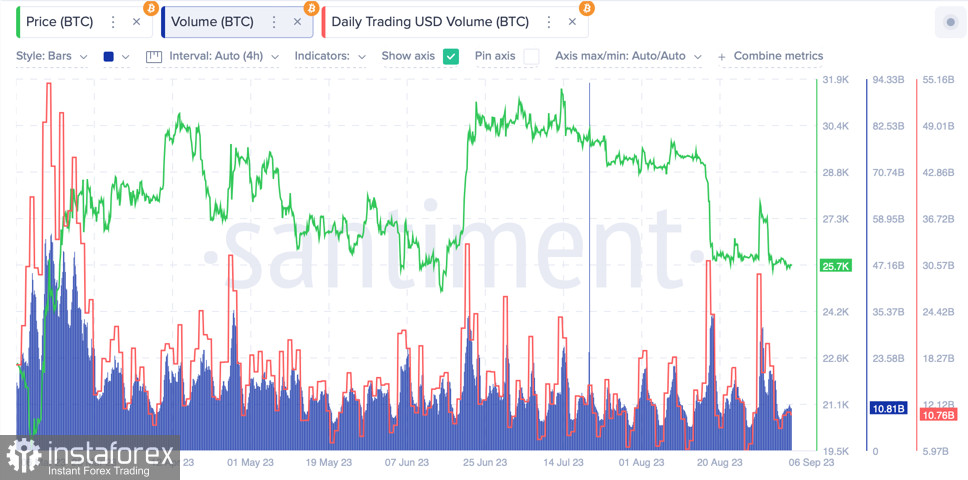

As of September 6th, Bitcoin is trading near the $25,700 level, with daily trading volumes around $10.7 billion, accounting for slightly less than half of the cryptocurrency market's trading activity. The asset continues its downward movement and gradually approaches the $25,500 level, which is the key support zone at this stage of the price movement.

Additionally, there is a significant reduction in volatility in BTC and the overall cryptocurrency market. Consequently, we are witnessing minimal price movement in Bitcoin, and the absence of significant fundamental factors only exacerbates this trend. As a result, the BTC market is becoming increasingly manipulative. As of mid-August, for a 5% price movement, a market maker needs only 460 BTC.

When determining potential targets for BTC, it's essential to understand that setting a stop-loss should be above the potential impulse during increased volatility. On the 4-hour chart, there is a gradual narrowing of the price movement corridor, which may lead to an impulsive breakout beyond the range. The "triangle" is a figure of uncertainty, so the price may make an impulsive rise to the $26,500 level or test the support level at $25,000.

Fundamentally, Bitcoin remains in a downward trend, as indicated by the MACD indicator, as well as the stochastic and RSI, which are near the level of 20, typical of seller dominance. Major trading activities for BTC can be expected next week when CPI data will be published. Labor market data can also provoke a local surge in activity, but there will be no significant changes in the price movement structure of BTC.

ETH/USD Analysis

The first thing to remember when determining potential price movements for ETH is to first analyze BTC. This asset will dictate the overall direction of the market. Over the past few days, Ethereum's dominance level has dropped to 19.21%, while Bitcoin's influence has only increased.

As of September 6th, ETH/USD is trading near the $1,628 level, with daily trading volumes around $ billion. The price movement structure of the altcoin differs slightly from BTC, but sellers still dominate, as indicated by the MACD indicator. Among the nearest bear targets, the psychological level of $1,600 should be highlighted, which would open the way to $1,550 for sellers.

On the 4-hour chart, we also observe reduced trading activity and a gradual narrowing of the price range. This means that, like BTC, the price can shoot in either direction. As already noted, when breaking below $1,600, it will be a key level. If the price makes an upward impulse, the $1,660–$1,680 levels will become a key area of interest for buyers.

Conclusion

It is likely that the formation of "triangles" on BTC and ETH will occur roughly at the same time. The key difference will be in the potential price movement and target levels. Volatility on both assets is gradually reaching a minimum, increasing the risk of impulsive price movements. Overall, these price movements won't have a determining impact as investors may want to wait for inflation data on September 13th.