EUR/USD

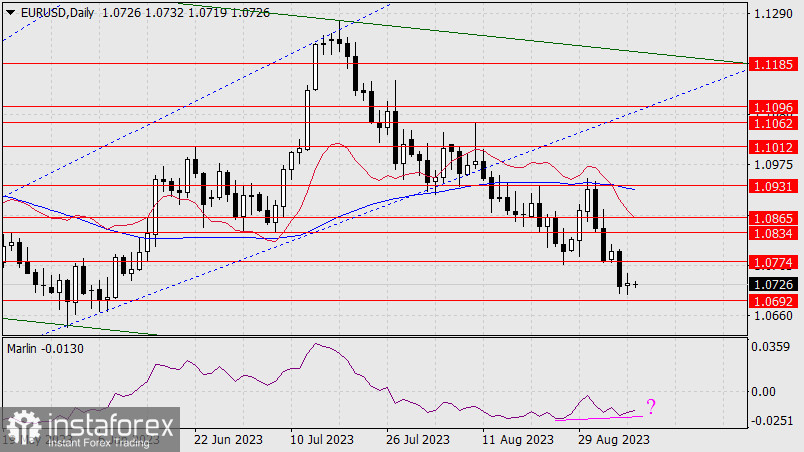

At the end of Wednesday, the euro moved by only 4 pips, which formally maintains the downtrend but shifts the indicators' readings towards a reversal. On the daily chart, we can see that the price and the Marlin oscillator are increasingly diverging. Even the possibility of reaching the target support at 1.0692 seems uncertain.

Yesterday, we found out that retail sales volumes in the euro area fell by 0.2% in July, and the US Composite PMI fell from 52.0 in July to 50.2 in August, which created a neutral situation. Today, eurozone GDP for the 2nd quarter is expected to rise by 0.3%, and initial data on US jobless claims are estimated to increase from 228,000 to 235,000. We expect external support for the euro.

However, in any case, the price's consolidation below 1.0692 will pave the way for the price to reach the target of 1.0613, and a consolidation above 1.0774 will open the nearest target range of 1.0834/1.0865.

On the 4-hour chart, the Marlin oscillator has turned upwards, and the price is currently in consolidation in the short-term. A reversal may be brewing. In order to rise further, the price needs to overcome resistance at the MACD line around the 1.0800 mark.