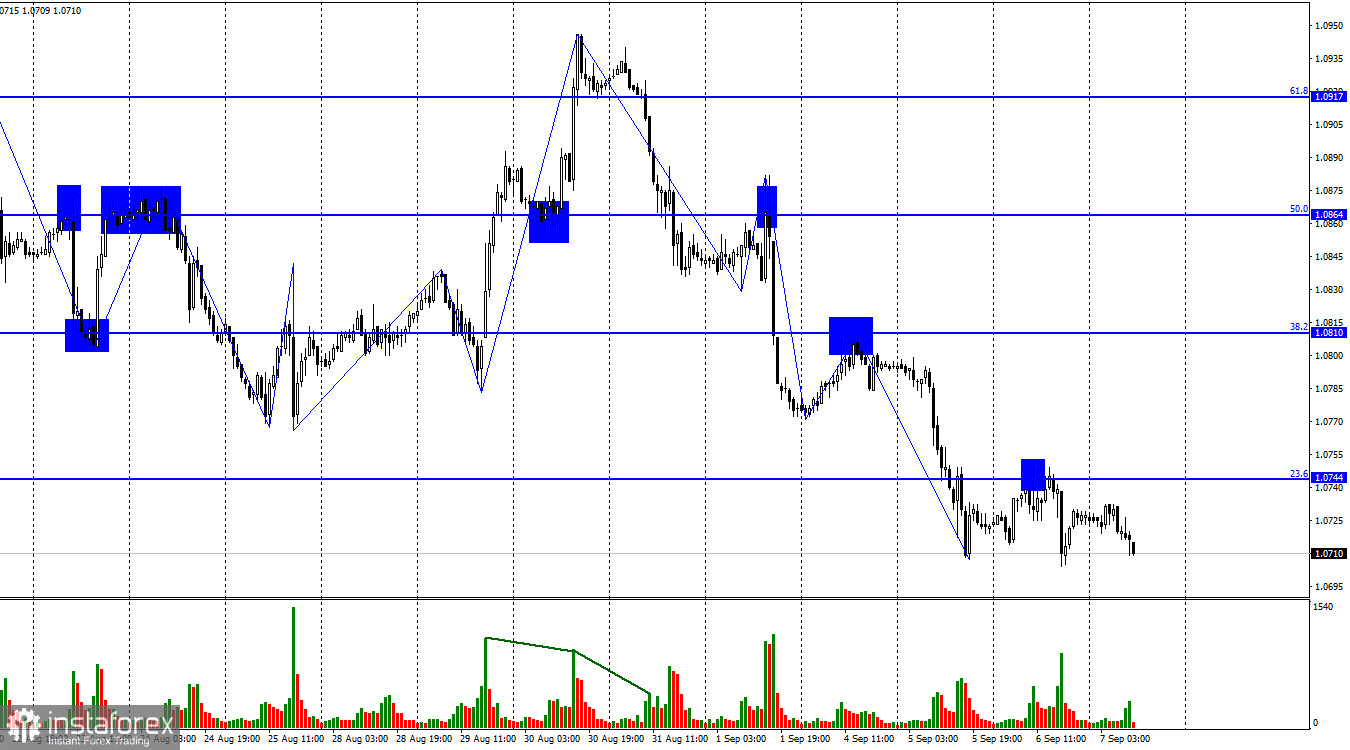

The EUR/USD pair returned to the corrective level of 23.6% (1.0744) on Wednesday, rebounded from it, reversed in favor of the American currency, and resumed its decline towards the corrective level of 0.0% (1.0637). If the pair manages to establish itself above the level of 1.0744, traders can expect some growth in the European currency towards the Fibonacci level of 38.2% (1.0810).

The waves still indicate a "bearish" trend. The recent upward wave turned out to be simply laughable and had no chance of changing the current trend. Since a new downward wave is currently being formed, there are no signs of the end of the "bearish" trend at the moment. These signs can only appear if the pair closes above the level of 1.0744. Then the last peak will be broken.

Yesterday, the information background was quite weak, and I will not consider reports that had no impact on traders' sentiment. I will only focus on the ISM index in the US services sector, which rose from 52.7 to 54.5, although traders expected a decline. Since expectations and reality did not coincide, another rise in the dollar was predictable.

Today, the final estimate of the GDP for the second quarter will be released in the European Union. The market expects a value of 0.3% q/q and 0.6% y/y. If expectations are met, nothing will change. If expectations are exceeded, the euro will have a chance to return to the level of 1.0744 and close above it. If the actual value is lower, then the euro may have a chance to drop even lower. In my opinion, it is still a favorable time for selling.

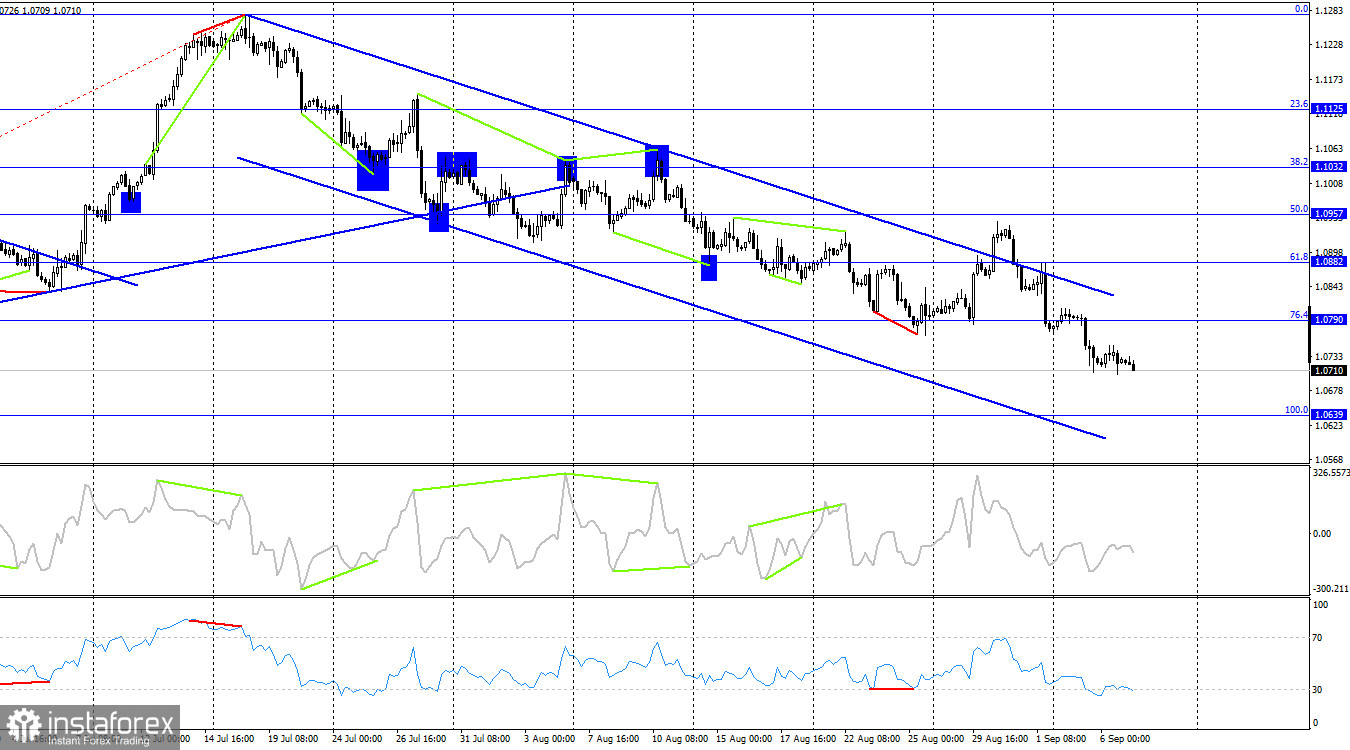

On the 4-hour chart, the pair has secured itself above the descending trend corridor and resumed its decline. This is a rather strange moment, but overcoming two levels on the way down and breaking the last low unequivocally indicates a "bearish" trend. Thus, the decline in quotes may continue toward the next corrective level of 100.0% (1.0639). There are no impending divergences observed today with any of the indicators.

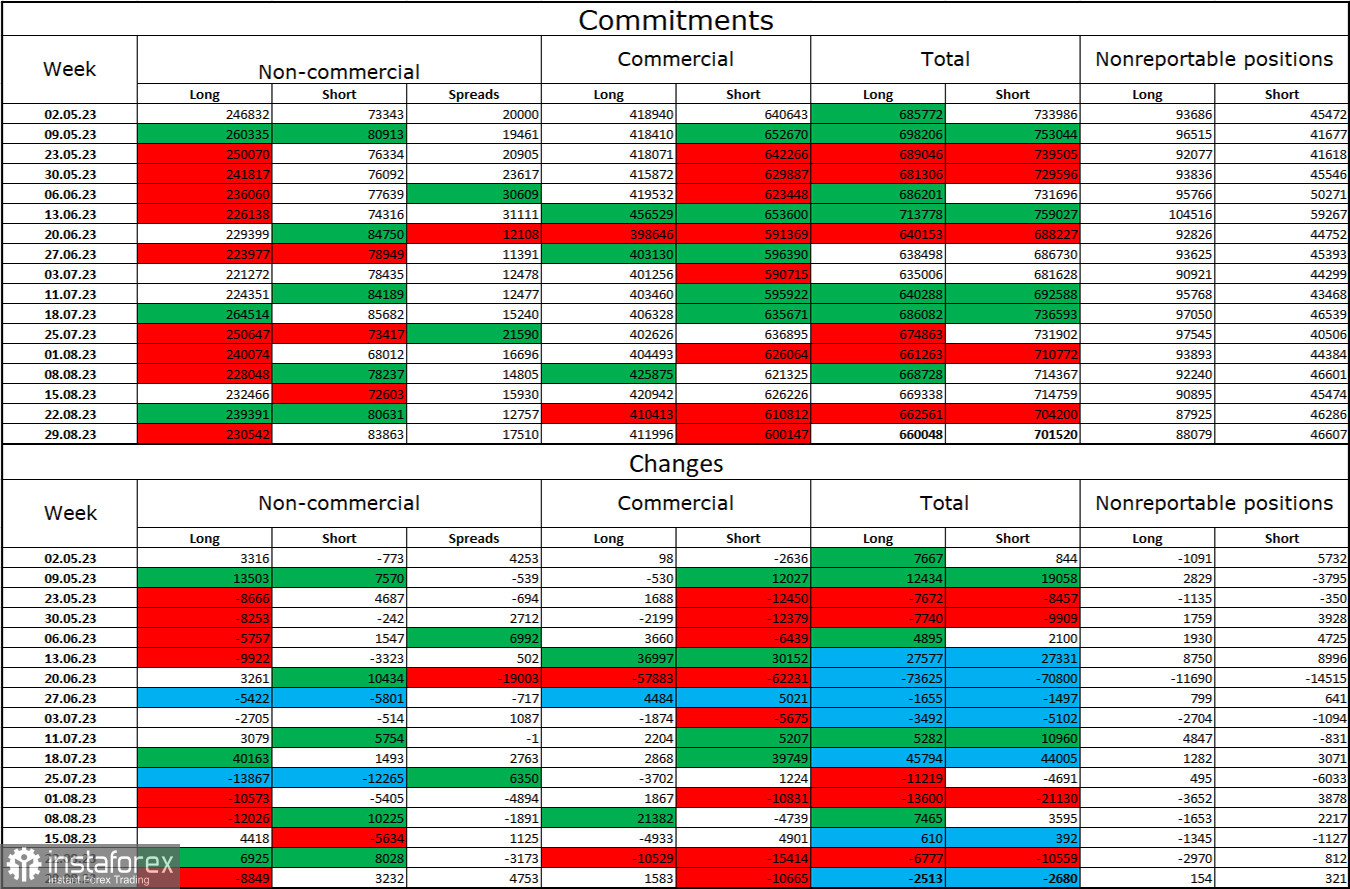

Commitments of Traders (COT) Report:

In the last reporting week, speculators closed 8,849 long contracts and opened 3,232 short contracts. The sentiment of large traders remains "bullish" and is not weakening too quickly overall. The total number of long contracts held by speculators now stands at 230,000, while short contracts amount to 83,000. I believe that the situation will continue to change in the opposite direction over time, but for now, bearish traders are not attacking the bulls too strongly. The high value of open long contracts suggests that professional traders may close them soon, as there is currently too much bias towards the bulls. I consider the current figures to allow for a continuation of the euro's decline in the coming weeks. The ECB is increasingly signaling the end of its tightening of monetary policy.

News Calendar for the United States and the European Union:

European Union - GDP in the second quarter (09:00 UTC).

United States - Initial Jobless Claims (12:30 UTC).

On September 7th, the economic events calendar includes two important entries, including the Eurozone GDP. The impact of the information background on traders' sentiment for the rest of the day may be moderate.

Forecast for EUR/USD and trader recommendations:

Sales could have been opened when closing below 1.0864 on the hourly chart, with targets at 1.0810 and 1.0744. The rebound from the level of 1.0810 allowed them to stay open. Currently, both targets have been met, but you can maintain sales with a target of 1.0637, as there has been a rebound from the level of 1.0744. Buying today is possible when closing above the level of 1.0744 with a target of 1.0810.