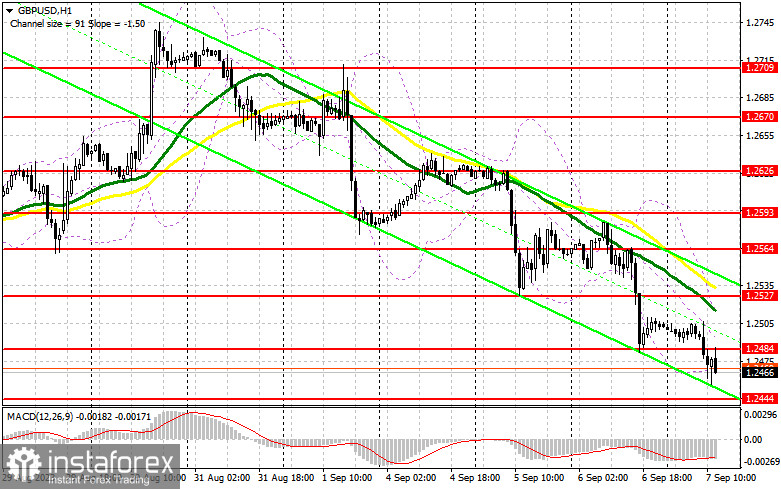

In my morning forecast, I drew attention to the level of 1.2484 and recommended making decisions based on it for market entry. Let's take a look at the 5-minute chart and analyze what happened there. The breakthrough and subsequent retest from below upwards of this range provided an excellent entry point for selling. When writing this article, the pair has dropped by about 20 points. In the second half of the day, the technical picture remains unchanged.

To open long positions on GBP/USD, the following conditions are required:

After Bailey's statements yesterday that it's time to end high interest rates, significantly fewer buyers are willing to buy the pound with such a strong dollar. It's not surprising that bulls did not show themselves around the support level of 1.2484, which has now turned into resistance. We need to think about how to reclaim it in the second half of the day. The focus is now on US statistics: figures for the weekly number of initial claims for unemployment benefits in the US are expected, which is unlikely to have a significant impact on the balance of power. Much more attention will be drawn to the speeches of FOMC members, including Patrick T. Harker, John Williams, and Michelle Bowman. If policymakers take a tough stance even after the recent US data, the pair's decline will likely continue.

For this reason, I plan to act against the bearish market only if a false breakout occurs at 1.2444, which would provide an entry point for buying with a subsequent rebound to 1.2484. A breakthrough and consolidation above this range will restore buyer confidence, providing a signal to buy with a target at 1.2527, where the moving averages are, favoring the sellers. The more distant target is the area around 1.2564, where I will take profits. In the scenario of further decline due to hawkish comments from Fed representatives and the absence of bulls at 1.2444 in the second half of the day, pressure on the pound will persist, along with the likelihood of further significant pair depreciation. In this case, only the defense of the next area at 1.2419, along with a false breakout there, will provide a signal to open long positions. I plan to buy GBP/USD only on a rebound from the minimum of 1.2395 with the aim of a 30-35 point intraday correction.

To open short positions on GBP/USD, the following conditions are required:

Bears need to defend the nearest resistance at 1.2484, which they handled well in the first half of the day. But it's worth understanding that we've already had one entry point, so it's still being determined that sellers will continue acting there as actively as in the morning. Only after an unsuccessful consolidation at 1.2484, similar to what I discussed earlier, can we get a signal to sell with the prospect of further decline to around 1.2444. A breakthrough and retest from below upwards of this range will deal a more serious blow to the bulls, providing an opportunity for a fresh monthly low at 1.2419. The more distant target remains the area around 1.2395, where I will take profits. In the scenario of GBP/USD rising and the absence of activity at 1.2484 in the second half of the day, buyers will attempt to re-enter the market. In that case, I will postpone selling until a false breakout occurs at 1.2527. If there is no downward movement there either, I will sell the pound immediately on a rebound from 1.2564, but only with the expectation of a 30-35 pip intraday correction.

In the COT report (Commitment of Traders), as of August 29th, there was a reduction in long positions and an increase in short positions. Strong US labor market conditions and comments by Fed Chairman Jerome Powell were the main reasons for a sharp increase in short pound positions. Given that recently, rather bleak statistics have been coming out of the UK, indicating an impending recession, pressure on the pound is likely to persist this autumn. However, buyers can take advantage of this, as the lower the pound, the more attractive it becomes for medium-term purchases. The difference in central bank policies will continue to have a positive impact on GBP/USD. The latest COT report indicates that long non-commercial positions decreased by only 918, to 97,143, while short non-commercial positions increased by 9,788, to 48,742. As a result, the spread between long and short positions increased by 124. The weekly closing price dropped to 1.2624 from 1.2741.

Indicator Signals:

Moving Averages

Trading is taking place below the 30 and 50-day moving averages, indicating further decline of the pair.

Note: The author considers the periods and prices of the moving averages on the H1 hourly chart, which differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator at around 1.2459 will act as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period - 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period - 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA - period 12. Slow EMA - period 26. SMA - period 9.

• Bollinger Bands. Period - 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.