The currency pair GBP/USD continued its decline on Thursday, even though there were practically no fundamental or macroeconomic reasons. Several interesting events were planned during the day, but only interesting events, nothing more. For example, the number of initial jobless claims in the US was 216 thousand, with a forecast of 234 thousand. The deviation from the forecast was small, so we did not see a strong market reaction. Also, yesterday afternoon and overnight, speeches were scheduled by the Federal Reserve's monetary committee members, Patrick Harker, Raphael Bostic, and Michelle Bowman. As you can easily guess, they did not announce anything extravagant, as the pair continued to move very weakly and steadily.

And what could Bowman or Bostic announce to the markets right now? It is evident to everyone that the next interest rate decision depends entirely on the next US inflation report. None of the Fed directors have "closed the door" to further rate hikes, and Jerome Powell openly stated in Jackson Hole the possibility of additional tightening by the end of the year. It is unlikely that Bowman or Bostic stated last night that interest rates would no longer rise. The opposite statement has been known to traders for a long time.

Thus, the dollar has an advantage over the British pound, whose Bank of England is also nearing the "end." This week, we already heard from Huw Pill that it is preferable to keep the rate at a high level for a long time rather than continue to raise it. Therefore, the Bank of England, like the ECB and the Fed, can raise the rate one more time by the end of the year. But it should be remembered that the Fed's rate is higher than the rates of the ECB and the Bank of England and has always been higher. Meanwhile, the dollar has been falling for a full 11 months. We still believe it's "time for justice to be restored."

Inflation in the US could accelerate in August.

The US inflation report will be released next Wednesday. If the July rise in the Consumer Price Index was seen as a coincidence or an error, a second consecutive acceleration could make the Fed nervous. According to official forecasts, inflation will rise to 3.4% in August. This is still a bit, but in this case, for the second month in a row, we will observe an acceleration in price growth, not a slowdown. In this case, the Fed could make two new monetary policy tightening moves this year.

Since the market has finally begun to soberly and somewhat objectively assess the fundamental background, accelerating inflation in the US could be interpreted as a signal to the regulator to continue tightening. And that's a bullish factor for the dollar. Of course, if inflation unexpectedly slows down, there will be much less talk of rate hikes. But the big question is: to what extent will inflation slow down? If it falls back to 3.2%, it will mean little to the Fed, as the time to reach the target level will again be extended. Therefore, practically any value above 3.3% y/y could trigger a new strengthening of the US dollar.

Furthermore, the US dollar may continue to appreciate in the background. Most factors currently favor the US currency, so nothing hinders its steady growth. All indicators in the 4-hour timeframe are pointing downward. In the 24-hour timeframe, the price has indeed crossed the Ichimoku cloud, which is also a strong bearish signal. The overbought condition of the pound will push it further down. The price will almost certainly drop to the 23rd level.

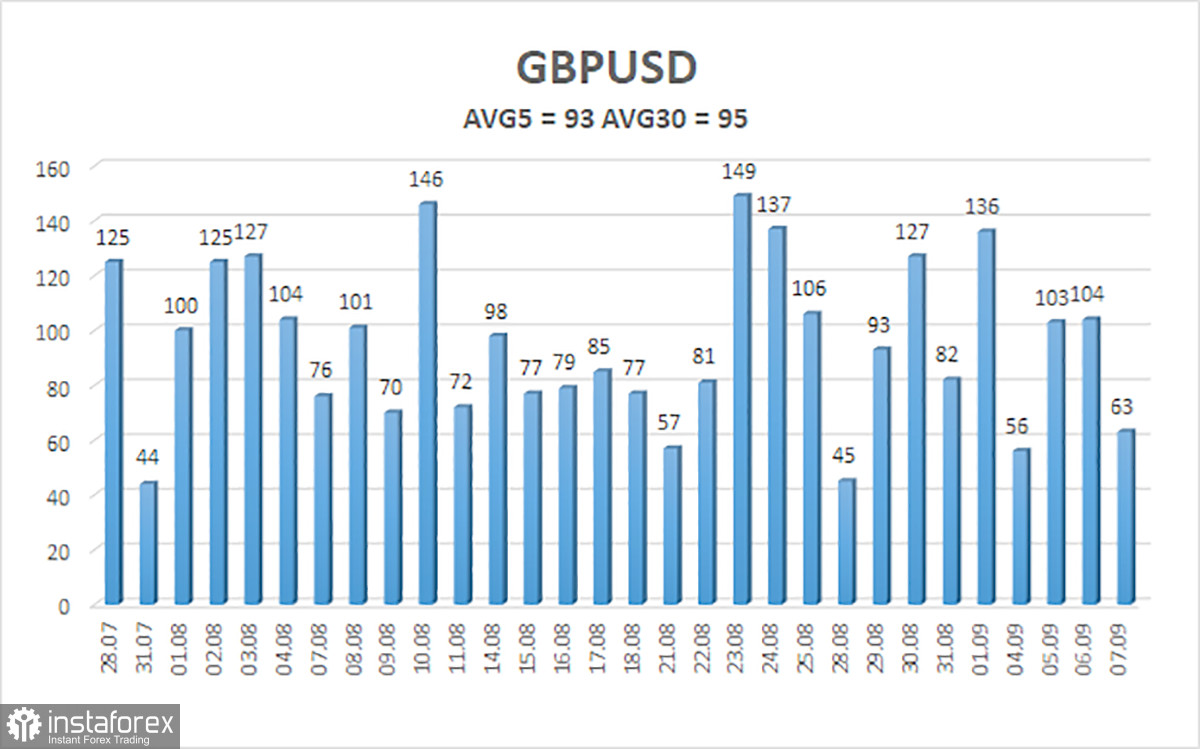

The average volatility of the GBP/USD pair over the last five trading days is 93 points. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, September 8th, we expect movement within the range delimited by the levels of 1.2397 and 1.2583. A downward reversal of the Heiken Ashi indicator will signal a resumption of the downward movement.

The nearest support levels:

S1 – 1.2482

S2 – 1.2451

S3 – 1.2421

The nearest resistance levels:

R1 – 1.2512

R2 – 1.2543

R3 – 1.2573

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair slowly declines. Therefore, at this time, new short positions should be considered with targets at 1.2421 and 1.2397 in case of a Heiken Ashi downward reversal. Long positions can be considered after the price firmly settles above the moving average line, with targets at 1.2634 and 1.2665.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the likely price channel in which the pair will move over the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold region (below -250) or overbought region (above +250) indicates an approaching trend reversal in the opposite direction.