"If stronger economic activity continues, it could lead to a resurgence in inflation," said Lorie Logan, the head of the Federal Reserve Bank of Dallas, on Thursday, adding that the strength of the labor market indicates that "we [the Fed] haven't finished the job of restoring price stability."

These important statements from the Fed representative came after positive macroeconomic data from the United States was published. For example, on Thursday, the U.S. Department of Labor released its weekly report stating that, for the reporting week (as of September 1), the number of initial jobless claims dropped to 216,000 (from 229,000 the previous week, with a forecast of 234,000), while continuing claims (for the week of August 25) fell to 1.679 million (from 1.719 million the previous week, with a forecast of 1.715 million).

Additionally, labor costs per unit of labor (in the 2nd quarter) were revised upward to +2.2% from the initial estimate of +1.6%, which is also a kind of leading indicator for consumer inflation in the medium term.

Furthermore, data published on Wednesday reflected growth in the August ISM Business Activity Index in the U.S. service sector (from the Institute for Supply Management) - reaching 54.5 (compared to 52.7 in July and a forecast of 52.5) after 53.9 in June, 50.3 in May, 51.9 in April, 51.2 in March, 55.1 in February, and 55.2 in January 2023. The U.S. service sector employs a significant portion of the country's population and contributes more to GDP than the manufacturing sector (78% versus 21% from the manufacturing sector and 1% from agriculture).

Positive macroeconomic statistics increase the chances of the U.S. economy avoiding a recession, while the Federal Reserve may still decide to further raise interest rates to continue the fight against high inflation.

Meanwhile, unemployment in the U.S. remains at pre-pandemic lows (3.8% in August), and average hourly wages continue to rise (+0.2% after increases of +0.4% in July and June, +0.3% in May, +0.5% in April, +0.3% in March, +0.2% in February, and +0.3% in January 2023), creating conditions for consumer inflation growth.

This, combined with positive GDP dynamics, is a bullish factor for the dollar as it prompts the country's central bank to adhere to a tight monetary policy.

Now, market participants, with a probability of about 43%, according to CME Group data, expect the Fed to raise its interest rate by 0.25% in November, although in September, it "may be appropriate" for the U.S. central bank to skip a rate hike, as Logan believes.

The high level of investor confidence that the Fed will maintain a hawkish stance and keep interest rates high for an extended period provides support to the U.S. dollar while limiting more active growth of its competitor among safe-haven assets—gold. As is known, gold prices are quite sensitive to changes in the credit and monetary policies of major central banks, especially the Fed.

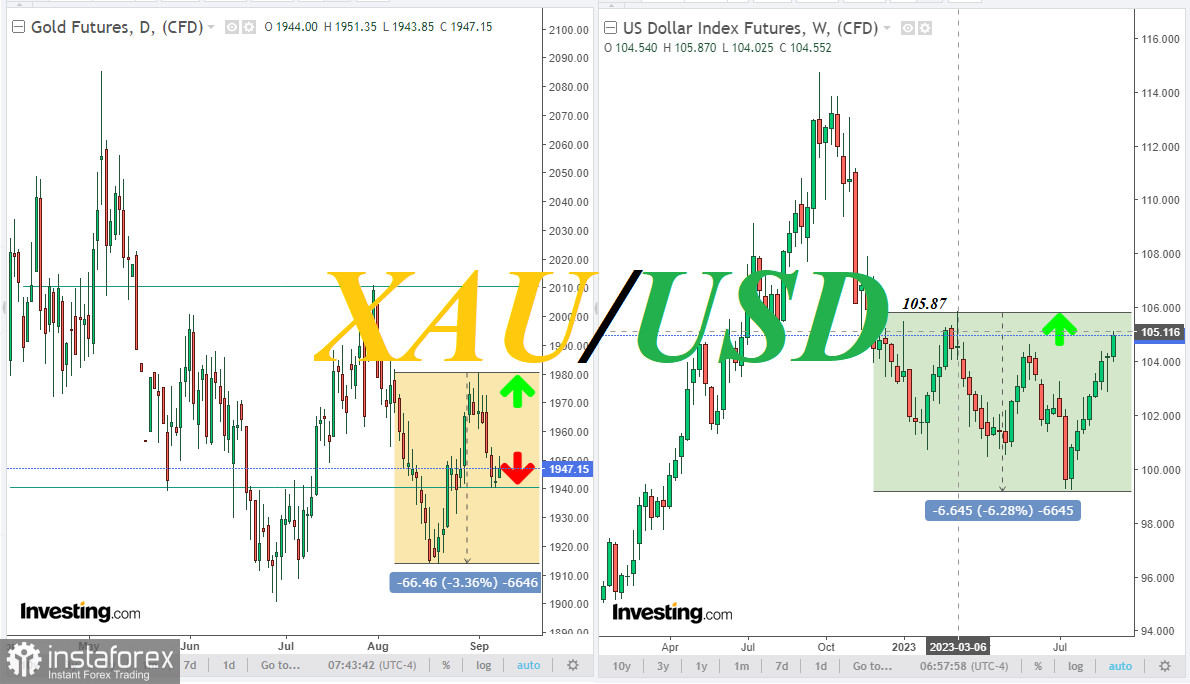

Thus, on Thursday, the DXY index reached its highest level since March 3 at 105.12, rising for the eighth consecutive week and maintaining a positive trend.

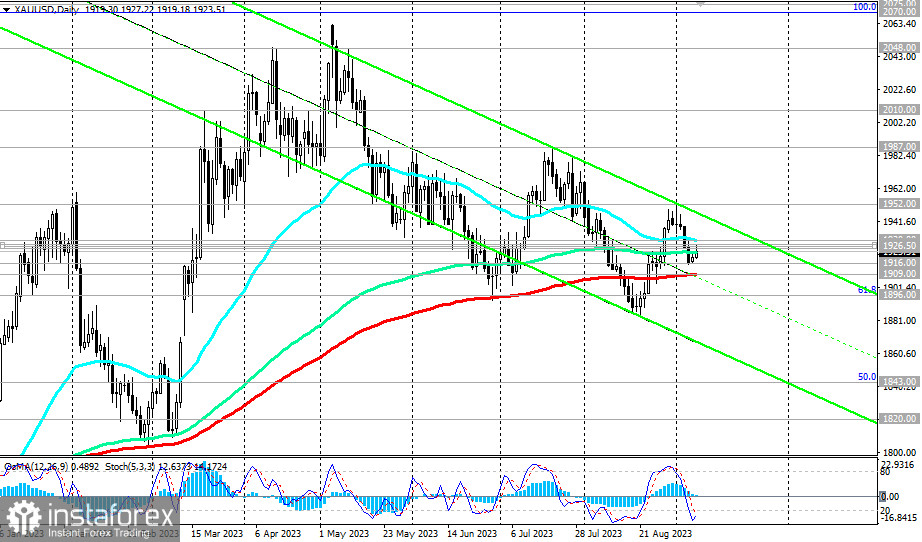

At the same time, the XAU/USD pair, after breaking through important support levels of 1927.50 and 1926.50 earlier in the week, entered a short-term bear market zone.

A more successful attempt to break through important support levels at 1909.00, 1900.00, and 1896.00 and further decline will lead XAU/USD into a medium-term bear market zone.

However, in conditions of sustained high inflation, ongoing geopolitical uncertainty, concerns about a global economic downturn, and deteriorating relations between the U.S. and China, demand for gold will also be supported.

Therefore, gold buyers and the XAU/USD pair could expect a resumption of their price growth near the support levels of 1909.00 and 1900.00.

Next week (Wednesday), fresh inflation data for the U.S. will be published.

If they once again indicate a resurgence in inflation (U.S. year-on-year inflation in July increased to +3.2% from +3.0% in June, although slightly below the forecast of +3.3%), this will prompt the Fed to, at the very least, keep interest rates at high levels, and at most, continue to raise them. This is undoubtedly a bullish fundamental factor for the dollar and a bearish one for U.S. stock indices and gold.

On Thursday, the ECB will make its decision on interest rates. If it also decides on another rate hike while maintaining a hawkish rhetoric regarding the prospects of its monetary policy, then gold prices will come under additional pressure.