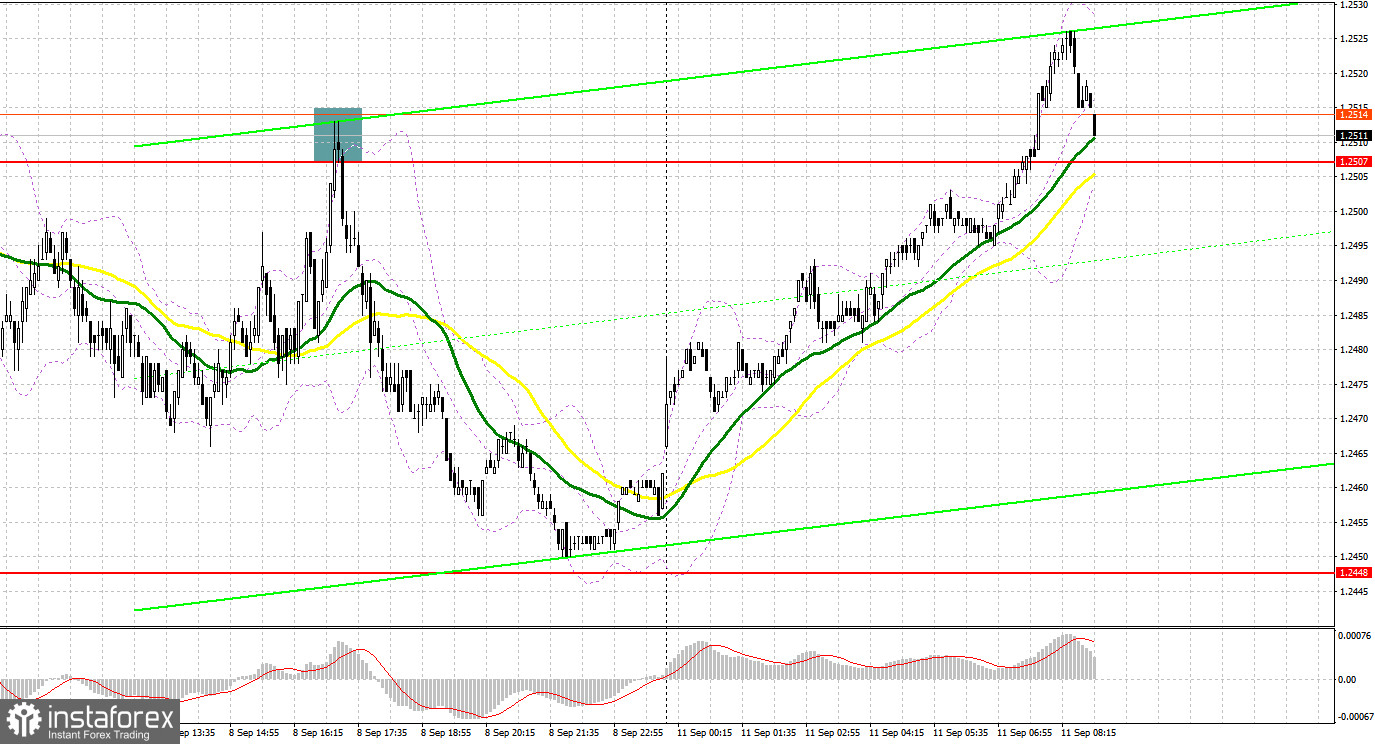

Last Friday, the instrument formed several market entry signals. Let's take a look at the 5-minute chart and see what happened there. In my morning forecast, I drew attention to the 1.2484 level and recommended making market entry decisions from it. A decline and false breakout at this mark produced a buy signal, but after rising by 15 pips, the pair was under pressure again. In the afternoon, a rise and a false breakout at at 1.2507 generated a sell signal, and the pound fell by more than 50 pips.

For long positions on GBP/USD:

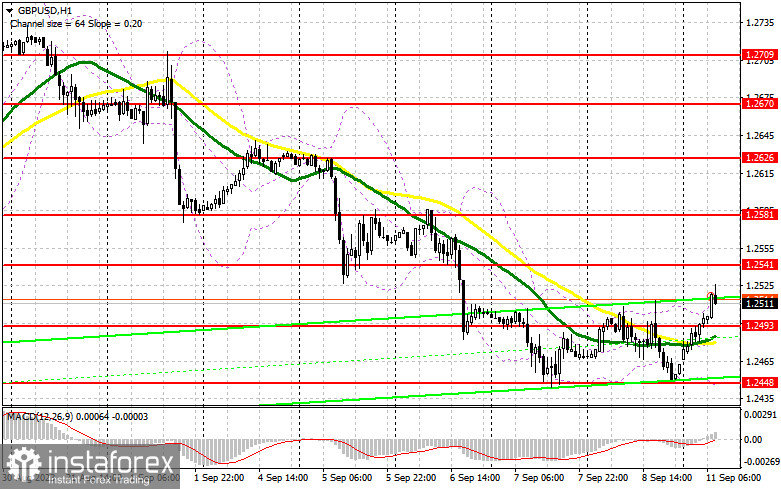

GBPUSD traded higher in today's Asian session, and the technical picture was revised. In the absence of economic reports, I will try to focus on buying near the new support at 1.2493, which is in line with the bullish moving averages. A false breakout will signal market entry into long positions with a recovery to 1.2541 - a new resistance formed at the end of last week. A breakout and consolidation above this range will boost buyers' confidence, suggesting long positions and preserving chances to reach 1.2581. This is where large sellers may step in. The higher target would be the 1.2626 area, where I plan to take profits. If GBP/USD declines and a lack of activity at 1.2493, the pressure on the pound will persist. In such a case, only the defense of the monthly low at 1.2448 and a false breakout there will signal opening long positions. I plan to buy GBP/USD immediately on a dip only from the 1.2419 low, bearing in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

The bears need to defend the nearest resistance at 1.2541, where I expect a breakout in the near future. I will act there only after an unsuccessful consolidation, which will signal a sell opportunity. GBP/USD may decline lower towards 1.2493. A breakout and an upward retest of this range will deal a more serious blow to the bulls' positions, providing an opportunity to fall to the next support at 1.2448. A more distant target remains a low of 1.2419, where I will take profits. If the pair rises and we see weak trading at 1.2541, which is quite possible in the current conditions, bulls will have a better chance of building on the upward correction. In this case, I will postpone selling until a false breakout at 1.2581. If downward movement stalls there, one can sell the British pound on a bounce from 1.2626, bearing in mind a 30-35-pips downward intraday correction.

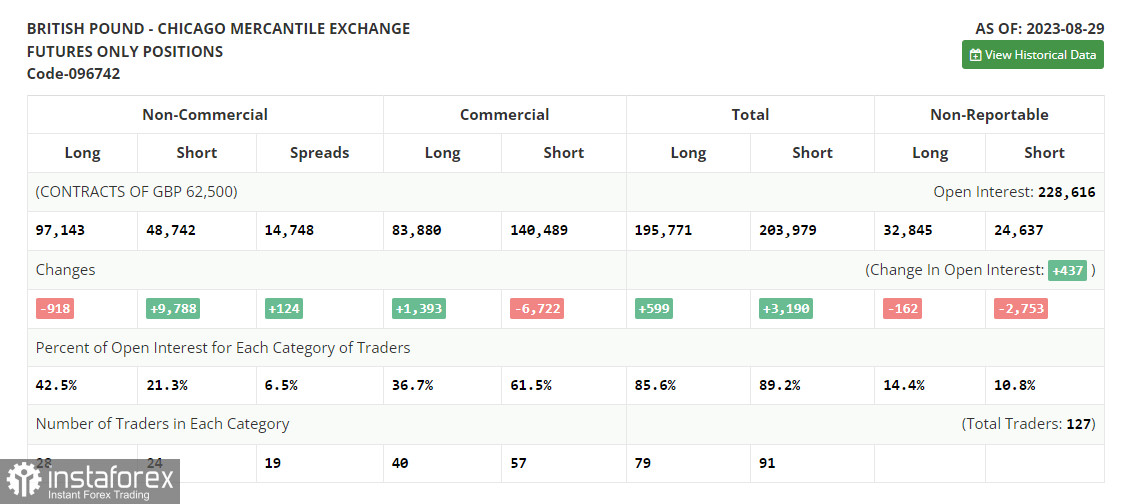

COT report:

In the COT report (Commitment of Traders) for August 29, there was a reduction in long positions and an increase in short positions. The strong US labor market and the speech by Fed Chairman Jerome Powell were the main reasons for the sharp increase in short positions on GBP/USD. Considering that recent UK data has been quite dismal, indicating a potential future recession, the pound sterling is likely to remain under selling pressure this fall. However, this could benefit the buyers. Indeed, the lower the pound, the more attractive it becomes for medium-term buying. The difference in central bank policies will continue to make a positive impact on GBP/USD. The latest COT report indicates that non-commercial long positions decreased only by 918 to the level of 97,143, while non-commercial short positions grew by 9,788 to 48,742. As a result, the spread between long and short positions jumped by 124. GBP/USD closed last week lower at 1.2624 versus 1.2741 a week ago.

Indicator signals:

Moving Averages

Trading is taking place slightly above the 30 and 50-day moving averages, indicating that the bulls are trying to return to the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower band around 1.2448 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.