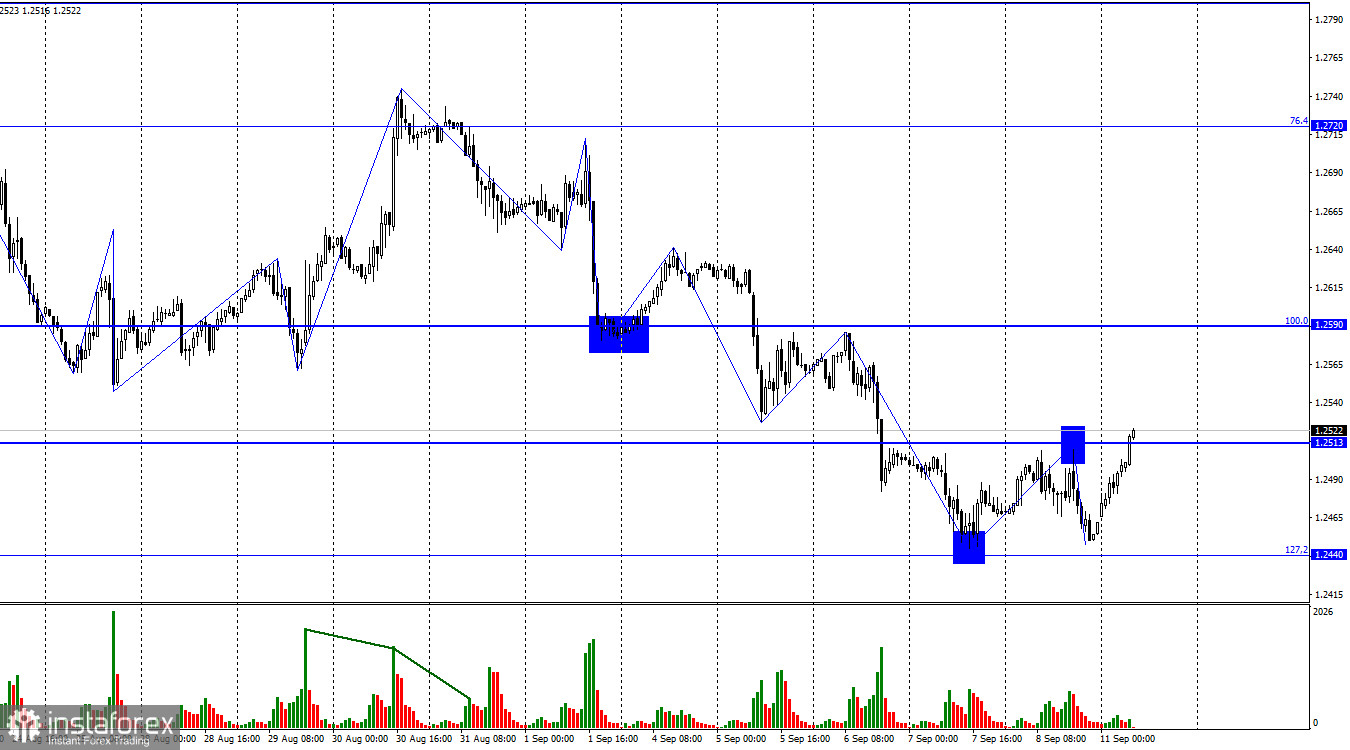

On the hourly chart, on Friday, the GBP/USD pair retraced to 1.2513, rebounded, and dropped to nearly the Fibonacci level of 127.2% (1.2440). Currently, a new retracement to the level of 1.2513 has occurred. Another rebound from it will favor the American currency and lead to a further decline towards the 127.2% Fibonacci level. Consolidation above will increase the chances of continuing the uptrend toward the next corrective level of 100.0% (1.2590).

The wave situation is starting to favor the bulls. On Friday, the downward wave failed to break the low of the previous wave, and today, the price has surpassed the peak of Friday's wave. Thus, we have received two signs of a trend reversal, and a consolidation above the level of 1.2513 will confirm this. I can say that the trend has a decent chance of becoming "bullish" this week, but its duration will depend on US inflation this week and the outcomes of the Bank of England and Fed meetings next week.

There is no significant news on Friday or Monday. However, on Friday, Lorie Logan (a representative of the FOMC) gave a speech in which she admitted that the rate would not be raised next week. She also noted that the "September pause" would not signify the end of the tapering process. The FOMC announced a move towards tapering every other meeting earlier. Therefore, the absence of a rate hike next week will not be unexpected. Logan's rhetoric cannot be considered "dovish." The US currency still has excellent growth opportunities this week. An acceleration in US inflation in August could change the stance on rates for many FOMC members. Inflation may close in "positive" territory for the second consecutive month.

On the 4-hour chart, the pair has established itself above the descending trend corridor. However, a rebound from the 61.8% Fibonacci retracement level at 1.2745 favored the US currency and led to a resumption of the decline. A rebound from the level of 1.2450 has favored the British pound, and now a rise towards the upper line of the descending trend corridor is possible. A strong rise in the pound can only be expected after the quotes consolidate above the corridor. The third consecutive "bullish" divergence on the CCI indicator has helped the pound start its ascent.

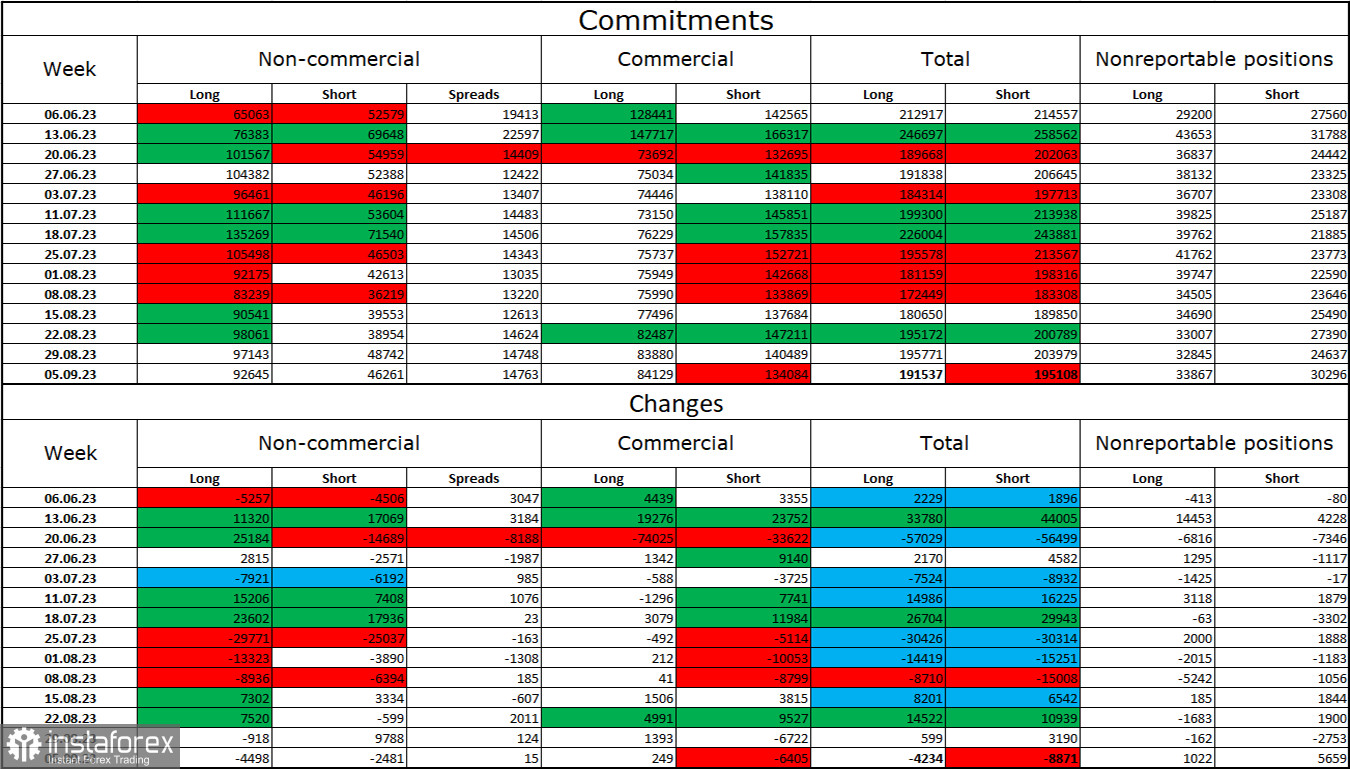

Commitments of Traders (COT) report:

The sentiment among "Non-commercial" traders in the last reporting week has become less bullish. The number of long contracts held by speculators decreased by 4498 units, while the number of short contracts decreased by 2481. The overall sentiment of major players remains bullish, and there is a double gap between the number of long and short contracts: 92 thousand versus 46 thousand. The British pound had good prospects for further growth a few weeks ago, but now, many factors have favored the US dollar. I do not expect a strong rise in the pound soon. Over time, the bulls will continue to reduce their buy positions. The Bank of England can only change the market situation if it continues to raise interest rates longer than planned.

News calendar for the US and the UK:

On Monday, the economic events calendar did not contain any entries. For the rest of the day, the influence of the news background on market sentiment will be absent.

Forecast for GBP/USD and trading advice:

Selling the British pound is possible today on a bounce from 1.2513, with a target of 1.2440. For buying, I consider only one signal possible today – consolidation above the level of 1.2513 with a target of 1.2590.