Analysis of Macroeconomic Reports:

There are very few macroeconomic events expected on Tuesday. Nevertheless, there will be some. We will see economic sentiment indices from the ZEW Institute for Germany and the EU in Europe. A slight market reaction is possible in the case of a significant deviation from the forecasted values. More important events will occur in the United Kingdom, where we will have unemployment rates, jobless claims, and wages. The same rule applies here: the greater the deviation from forecasted values, the stronger the market reaction may be. Undoubtedly, British statistics are much more important than European ones, and in the United States, there will be no interesting events today.

It's also worth noting that wages in the United Kingdom continue to grow much faster than the Bank of England expects. The British regulator blames high wages for the slight decline in inflation. People in the UK have more money, so they spend more, and prices rise. However, the Bank of England has recently been signaling a possible end to tightening monetary policy. So, support for the pound today may only come from the jobless claims report, as a significant reduction is expected.

Analysis of Fundamental Events:

There is absolutely nothing to highlight among the fundamental events on Tuesday. Even minor events and speeches are not scheduled for today. Therefore, all attention is on British statistics. As we observed on Monday, the European currency may trade weaker than the pound. The most interesting events of this week are still ahead.

General Conclusions:

On Tuesday, novice traders should pay attention to the British package of macroeconomic statistics, which will be released in just an hour. These reports may be neutral, but there is a chance that they will surprise the markets. Therefore, the pound may move quite actively in the first half of the day.

Main Trading Rules:

- The strength of a signal is determined by the time it takes to form the signal (bounce or level break). The less time it took, the stronger the signal.

- If two or more trades based on false signals were opened near a certain level, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate many false signals or not generate any at all. But in any case, it is better to stop trading at the first signs of a flat.

- Trading transactions are opened between the start of the European session and the middle of the American session when all trades must be closed manually.

- In the 30-minute timeframe, trading based on MACD indicator signals is only possible when there is good volatility and a confirmed trend supported by a trendline or channel.

- If two levels are located too close to each other (from 5 to 15 points), they should be considered a support or resistance area.

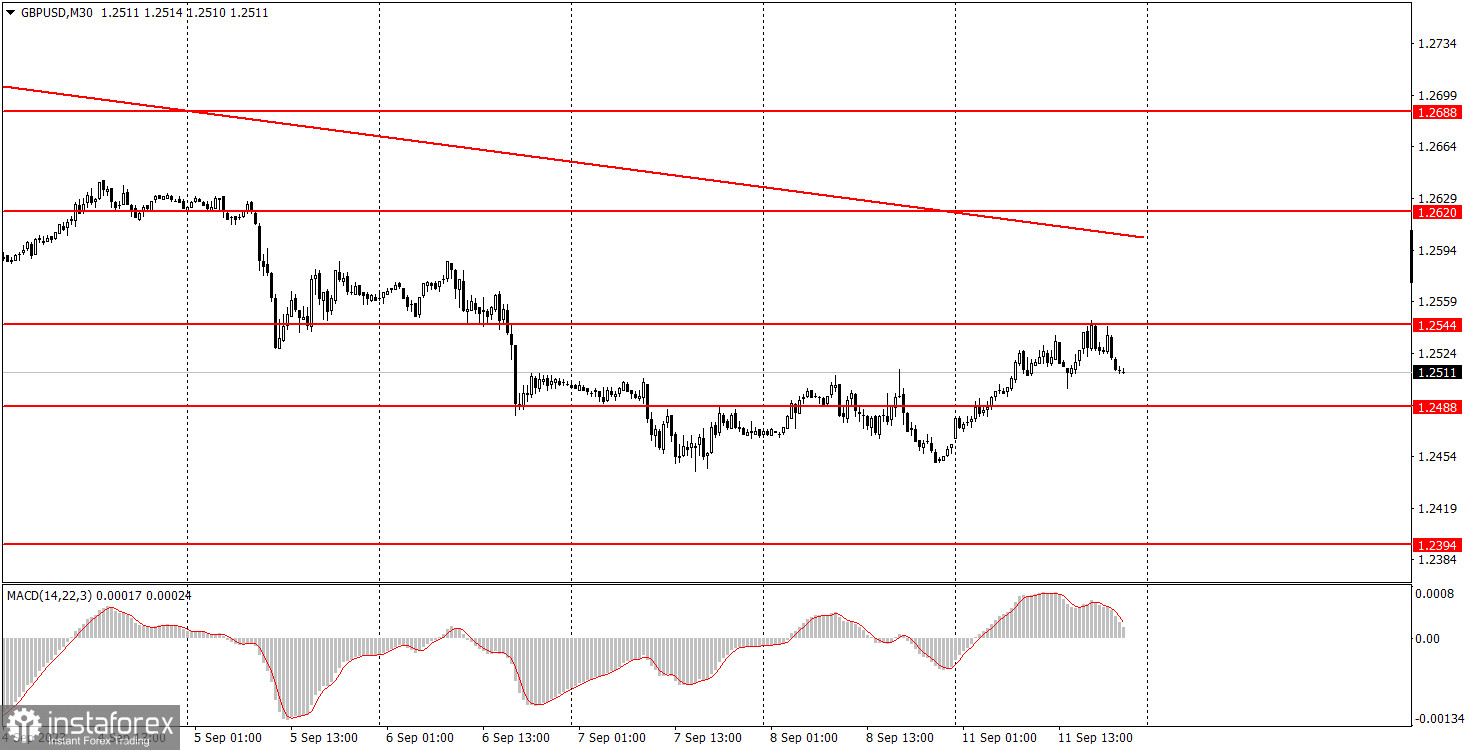

What's on the Charts:

Support and resistance levels - targets when opening buy or sell positions. Take Profit levels can be placed near them.

Red lines - channels or trendlines that display the current trend and show which direction is preferable for trading.

MACD indicator (14, 22, 3) - histogram and signal line - an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always included in the news calendar) can significantly impact the movement of currency pairs. Therefore, during their release, it is advisable to trade with extreme caution or exit the market to avoid a sharp price reversal against the previous movement.

Forex market beginners should remember that only some trades can be profitable. Developing a clear strategy and proper money management are the keys to success in trading over the long term.