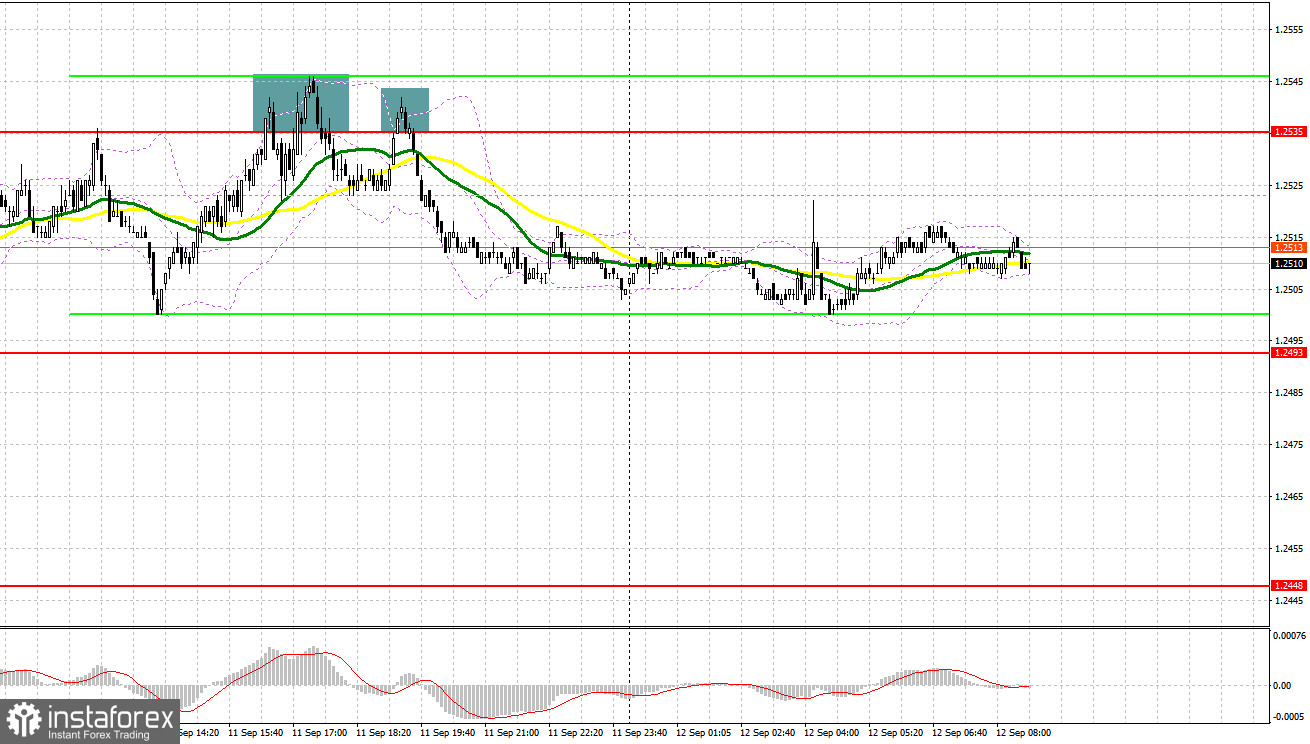

Yesterday, the instrument formed several entry signals to the market. Let's examine the 5-minute chart and delve into what happened there. In my morning forecast, I drew attention to the 1.2541 level and recommended making market entry decisions from it. The pound continued to rise after the Asian session, but the pair failed to reach 1.2541. For this reason, the technical picture was slightly revised for the second half of the day. Another unsuccessful consolidation above 1.2535 during the US session produced a sell signal, sending the price down by almost 30 pips.

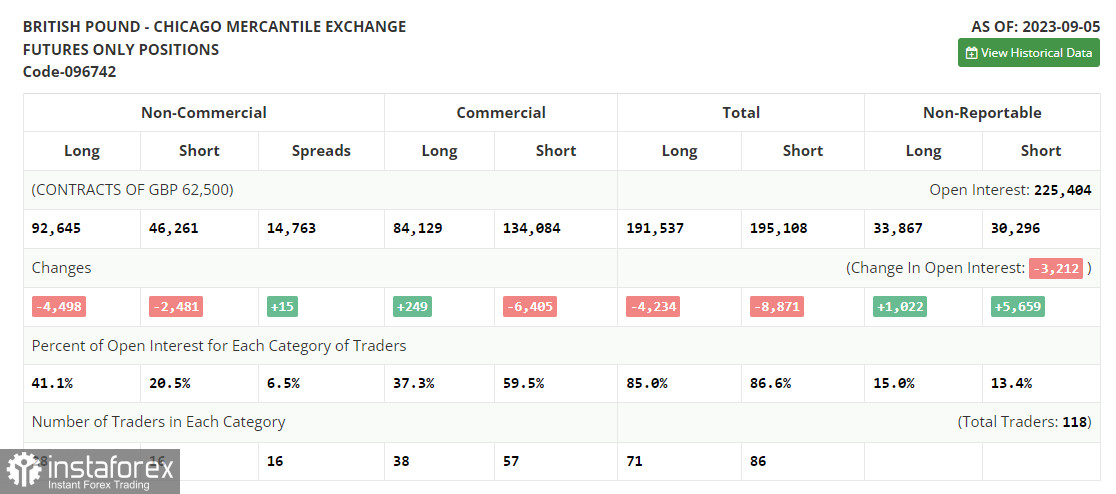

COT report:

Before we look at the technical picture of the pound, let's see what happened in the futures market. In the COT report (Commitment of Traders) for September 5, there was a reduction in both long and short positions. Remarks by Bank of England Governor Andrew Bailey certainly caused quite a stir, and the pound dropped further as a result. Buyers were not pleased with Bailey's hints at an end of the currency cycle of policy tightening, as it is evident that the US Federal Reserve, which has made much more progress in combating inflation, has no intention of doing so. The difference in central bank policies maintains the dollar's appeal and exerts downward pressure on the pound. However, this could benefit the buyers. Indeed, the lower the pound, the more attractive it becomes for medium-term buying. The latest COT report indicates that non-commercial long positions decreased only by 4,498 to the level of 92,645, while non-commercial short positions fell by 2,481 to 46,261. As a result, the spread between long and short positions only increased by 15. GBP/USD closed last week lower at 1.2567 versus 1.2624 a week ago.

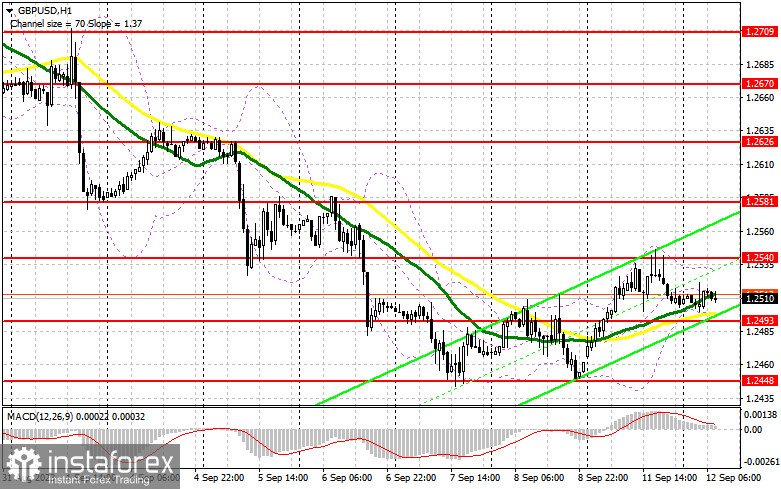

For long positions on GBP/USD:

The UK labor market data will be released today. If we see a decline in jobless claims and a drop in the unemployment rate - the pound may trade higher. A rise in average earnings will also have a positive impact on the pair. If we receive disappointing data, I expect a move towards 1.2493, and the bulls will have to defend this mark. A false breakout near the new support at 1.2493, which is in line with the bullish moving averages, would serve as a buy signal, aiming for a recovery towards 1.2540, established from yesterday. A breakout and a downward test of this range, bolstered by good data, will signal a buy opportunity and increase demand for the pound, providing a chance for it to hit a new high at 1.2581. In case the pound climbs above this range, we can talk about a breakout to 1.2626, where I will be taking profits. If GBP/USD declines and a lack of activity at 1.2493, the pound will be under pressure and fall further. In such a case, only a false breakout around 1.2448 will signal a buying opportunity. I will open long positions directly on a rebound from 1.2419, aiming for a correction of 30-35 pips within the day.

For short positions on GBP/USD:

Yesterday, bears did everything they could as they prevented the bulls from consolidating near the daily highs. It would be nice to see a breakout to 1.2540 in the first half of the day, which could happen after the UK labor market data. A false breakout at this level forms a sell signal, anticipating a decline and a test of the support at 1.2493, established from yesterday. A breakout and an upward retest of this range would give bears an advantage, providing an entry point for selling to reach 1.2448. A more distant target would be the area around 1.2419, where traders may lock in profits. If the pair rises and bears show weak activity at 1.2540, bulls will maintain control, leading to an ascending correction. In this case, only a false breakout near the next resistance at 1.2581 may give an entry point for short positions. If there is little activity there, it is better to sell the pound from 1.2626, expecting an intraday rebound of 30-35 pips.

Indicator signals:

Moving Averages

Trading is taking place around the 30-day and 50-day moving averages, indicating a sideways market trend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD grows, the indicator's upper band at 1.2493 will serve as resistance. If GBP/USD falls, the indicator's lower band near 1.2530 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.