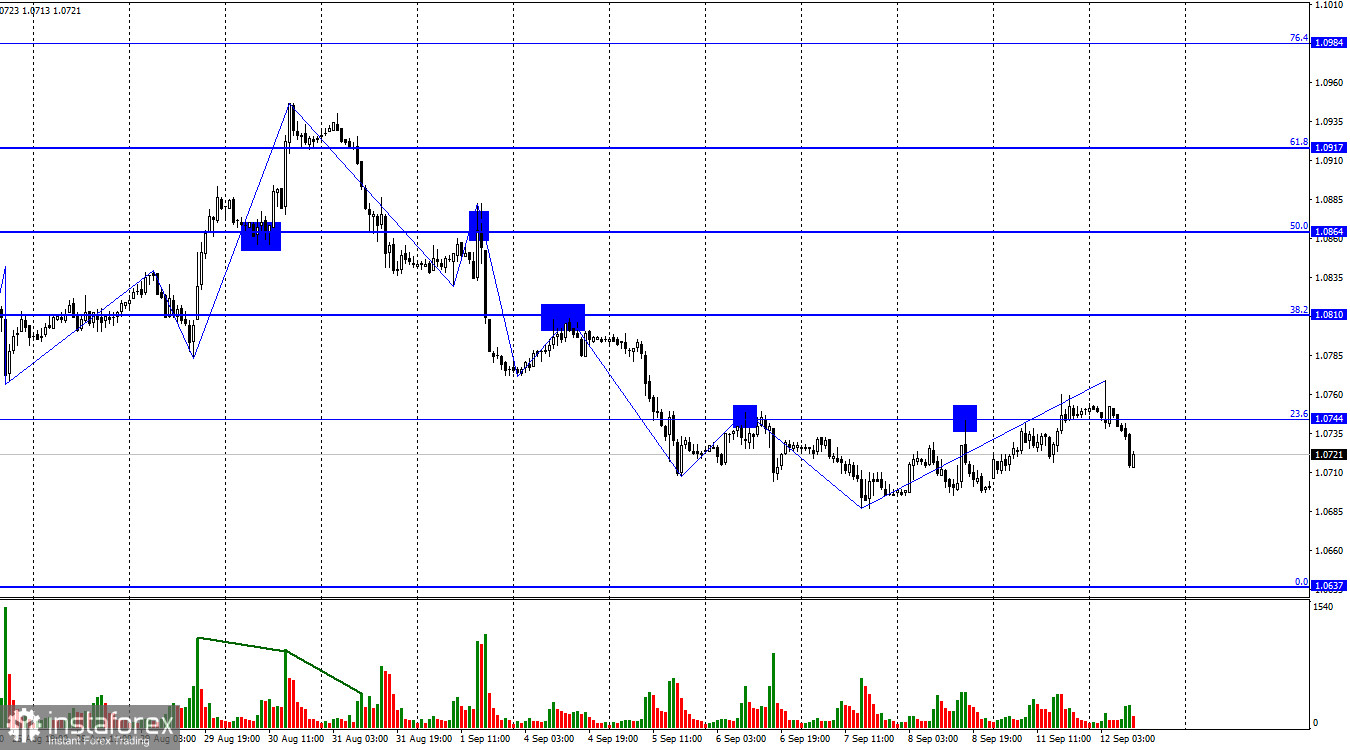

The EUR/USD pair rose above the corrective level of 23.6% (1.0744) on Monday but could not continue upward as the chart pattern required. On Tuesday, there was a reversal in favor of the US dollar and a consolidation below the level of 1.0744, which allows us to expect a resumption of the decline toward the Fibonacci level of 0.0% (1.0637). Bullish traders are currently very weak.

Waves continue to indicate a "bearish" trend despite breaking the peak of the last wave to the upside. The breakthrough happened, but the price could not continue to rise, so I am inclined towards horizontal movement for some time. Within horizontal movement, the peaks and lows of waves can be breached, but the movement in the same direction does not continue. All breakthroughs are formal. The same can happen with the last low, to which the pair needs to drop only 30 points. The low may be breached, but further decline is uncertain.

There were no significant news events on Monday, which explains the weak activity of traders. Market participants are waiting for the ECB meeting, scheduled for Thursday, and before that, they will see US inflation for August. These two events should be the focus of attention this week. Traders are not in a hurry, and there is no rush. We may observe horizontal movement until the second half of Wednesday.

The further course of events will depend on the unexpectedness of the inflation figure, the decisions made by the ECB, and statements by Christine Lagarde. Correction is not ruled out, and a drop is also possible. Everything will depend on the nature of the data that will be received.

On the 4-hour chart, the pair consolidated above the descending trend corridor but then resumed declining. This is quite a strange moment, but breaking through two levels on the way down and breaching the last low clearly indicates a "bearish" trend. Thus, the decline in quotes can be continued towards the next corrective level of 100.0% (1.0639). There are no imminent divergences observed in any of the indicators today. The rise of the European currency can be expected after it closes above the descending corridor.

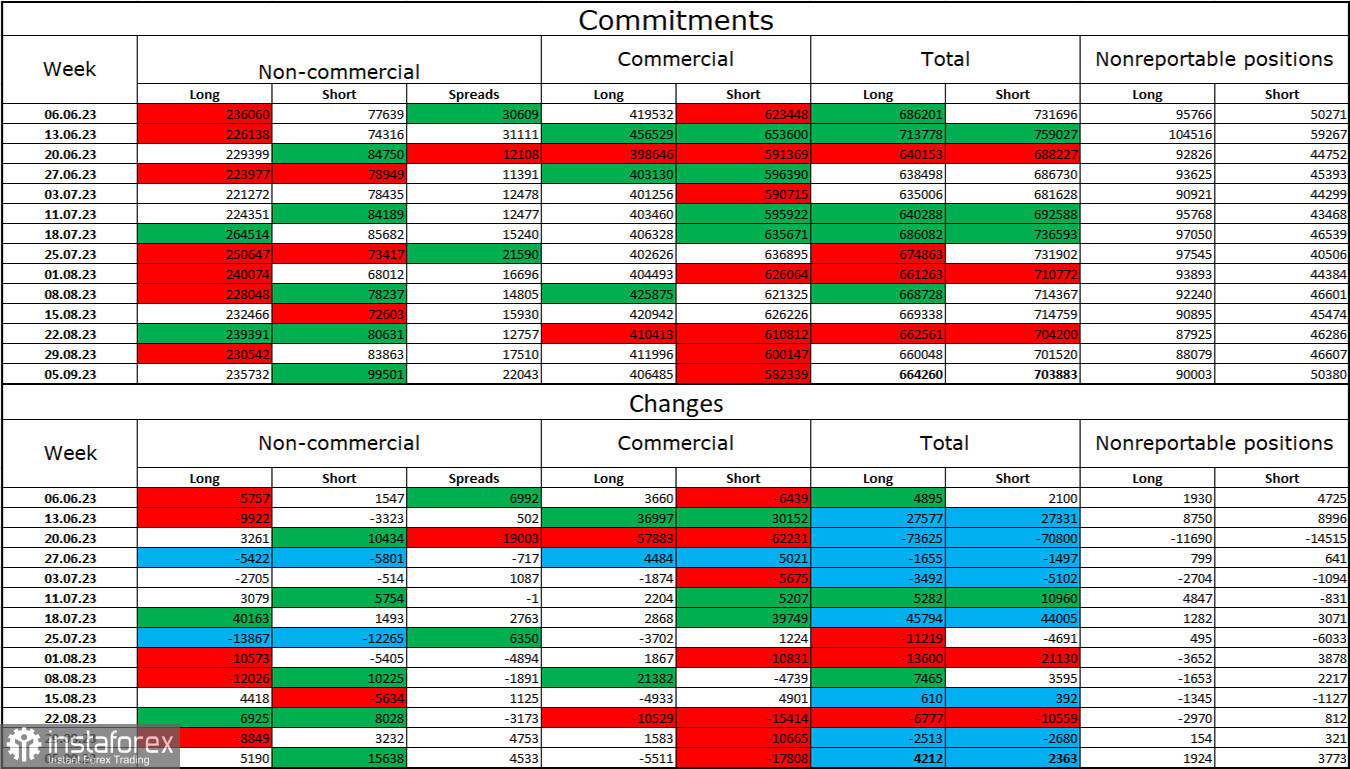

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 5,190 long contracts and 15,638 short contracts. The sentiment of major traders remains bullish but has weakened in recent weeks and months. The total number of long contracts speculators hold now is 235,000, while short contracts are 99,000. The situation will continue to change in the opposite direction over time, but bearish traders are not actively attacking the bulls. The high value of open long contracts suggests that professional traders may close them in the near future – there is too strong a bias towards bulls at the moment. I believe that the current figures allow for the continuation of the euro decline in the coming weeks. The ECB increasingly signals the completion of the QE tightening procedure.

News Calendar for the US and the Eurozone:

Eurozone - ZEW Economic Sentiment Index (09:00 UTC).

On September 12th, the economic events calendar contains one secondary entry. The impact of the information background on traders' sentiment will be absent today.

Forecast for EUR/USD and trading recommendations:

Sales of the pair are possible today upon closing below the correction level of 1.0744, with a target 50-60 pips lower. Buying today is possible upon closing above the level of 1.0744, with a target 50-60 pips higher. The pair may move horizontally today.