US futures slipped after failing to sustain at their recent highs. The S&P 500 futures dipped by 0.3%, while the tech-heavy NASDAQ dropped by nearly 0.5%. Oracle's report of slowing cloud sales weighed on tech stocks, causing its shares to plummet by 10%. The company also highlighted risks associated with tech sector investments. The euro and the British pound weakened amid fears of rising stagflation in Europe.

Today, the spotlight is on tech stocks. Apple Inc. is set to announce its new product line, while SoftBank-owned chipmaker Arm Ltd. gears up for this year's largest IPO.

As mentioned earlier, the euro and the pound traded around 0.3% below their previous close against the US dollar, ignoring news that UK wage growth remained at record highs signaling persistent inflation. This could force the Bank of England to raise interest rates again, contradicting recent statements by its governor that rates had almost peaked.

Investor confidence in Germany's economy has improved. However, the overall sentiment remains negative and has been revised downwards, intensifying concerns about Germany lagging in economic development.

Tomorrow, US inflation data will be released, which might significantly affect markets. Current sentiments suggest little hope for a breakout in stock indices. According to a New York Fed survey, US consumer inflation expectations in August remained largely stable. Meanwhile, households are more concerned about their finances and the job market. Wednesday's Consumer Price Index report will provide insights into how far the Federal Reserve might need to go to bring inflation back to target. Economists predict a 0.6% rise in inflation for August, while core inflation remains steady at 0.2%. If inflation metrics remain firm, it will intensify pressure on the US stock market, triggering a sell-off in risk assets.

Asian stocks showed mixed results, with Chinese shares dipping again. A boost from news about Country Garden Holdings Co. getting approval for bondholder payment extensions wasn't enough to lift investor sentiment. The yuan remained stable after China's central bank set its daily rate below 7.20 against the US dollar, indicating reluctance to allow the yuan to weaken excessively.

As for commodities, oil rose, trading near its highest level this year ahead of today's important reports that could give a deeper insight into the market's balance sheet. Gold was little changed.

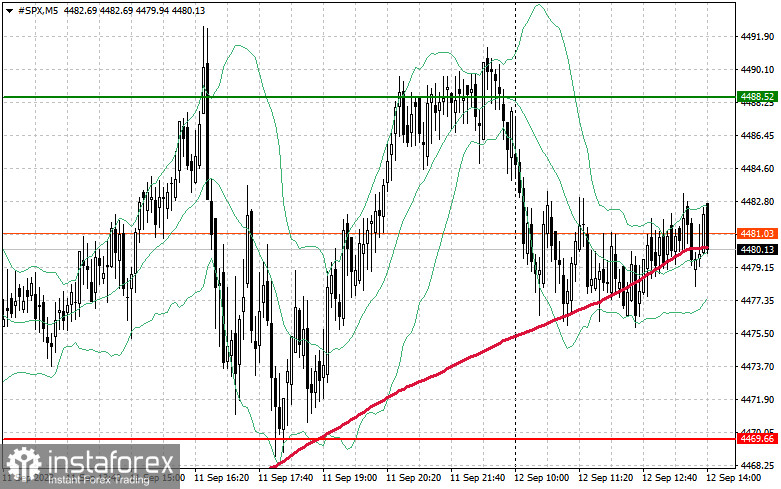

As for the S&P 500, demand for the index rebounded. Bulls should push the price to $4,488. After that, they may reach $4,515 from this level. Bulls also should maintain control over $4,539, reinforcing the bullish trend. If the index declines amid reduced risk appetite, bulls will have to protect $4,469. Breaching this level, the price may move back to $4,447, paving the way to $4,427.