Ethereum Bulls Keep Pushing Up Towards $3,000 Target Level

Delve into the recent movements of Ethereum against the US dollar to uncover valuable trading insights. With a focus on technical indicators and market sentiment, this analysis navigates the dynamics of ETH/USD, offering practical scenarios for both bullish and bearish outcomes.

Key Takeaways

- ETH/USD exhibits strong bullish momentum, propelled by recent price surges and favorable market sentiment.

- Technical analysis reveals critical support and resistance levels, guiding traders in identifying entry and exit points.

- By considering potential bullish and bearish scenarios, traders can adapt their strategies to dynamic market conditions effectively.

Technical Market Outlook

The ETH/USD pair has made a local high at the level of $2,929 and is currently consolidating the recent gains in a narrow range above of the last swing high on the H4 time frame chart. The bulls broken above the supply zone, so the levels of $2,714 and $2,690 will now act as the technical supports. The H4 time frame momentum is strong and positive, which supports the short-term bullish outlook for ETH, however, the current market conditions are extremely overbought and there is a visible Bearish Divergence created between the price and the momentum oscillator. The next target for bulls is seen at the level of $3,000.

Key Levels to Watch

- Resistance: Monitor psychological round numbers and previous highs for potential resistance levels.

- Support: EMA 100, DEMA 50, and historical price structure provide critical support zones for assessing market bounces.

Intraday Indicator Signals:Technical indicators overwhelmingly favor buying opportunities, with bullish sentiment prevailing in both short-term and recent trends:

- 20 out of 23 technical indicators are showing Buy signal, 2 are showing Sell signal, 1 is Neutral

- 17 out of 18 moving averages are showing Buy signal, 1 are showing Sell signal

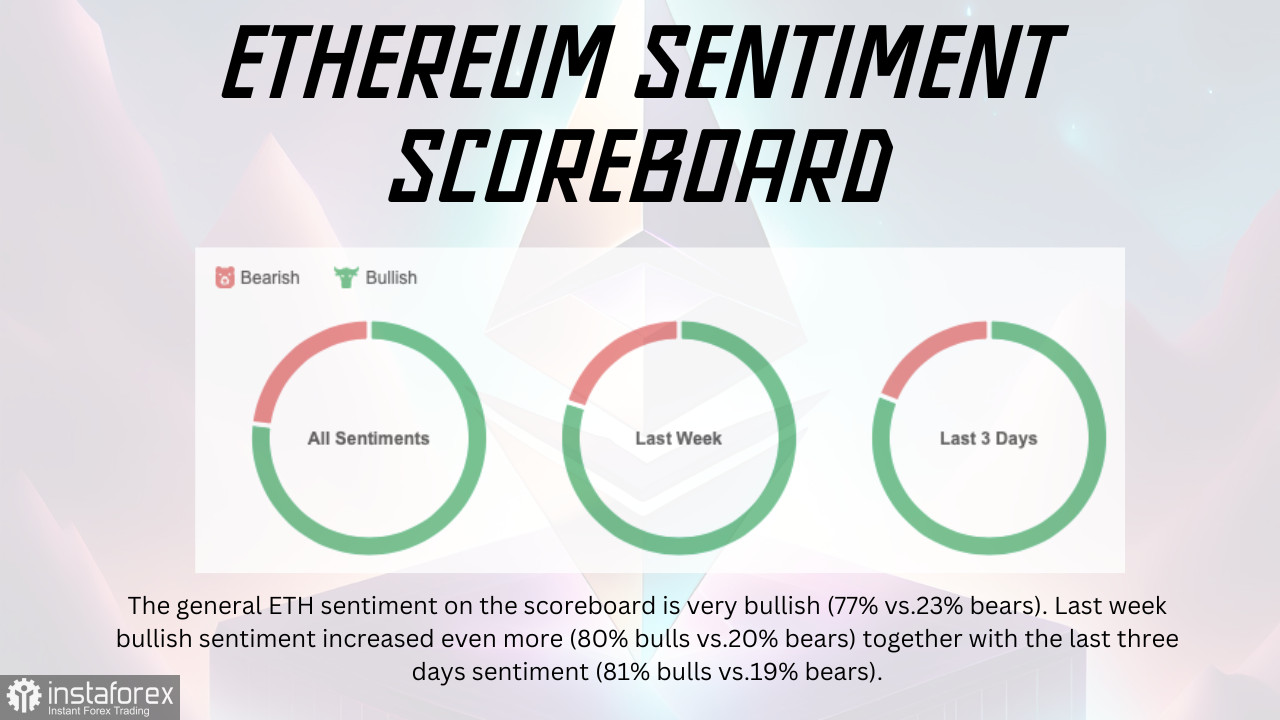

Sentiment Scoreboard:Market sentiment leans heavily towards the bullish side, reflecting confidence in Ethereum's upward trajectory. Recent increases in bullish sentiment underscore optimism among traders.

Weekly Pivot Points:

Pivot points provide essential reference levels for assessing trend reversals and identifying key support and resistance zones.

- Resistance levels: WR3 - $3,041, WR2 - $2,929

- Support levels: WS1 - $2,865, WS2 - $2,824

Bullish Scenario:

- Continued Momentum: Sustained bullish momentum, coupled with RSI confirmation above 70, could propel prices towards new highs.

- Support Levels: Upholding support above EMA 100 and DEMA 50 strengthens the bullish bias, offering entry points for traders.

- Break of Resistance: Overcoming immediate resistance levels opens the door for further upside potential, initiating a new bullish phase.

Bearish Scenario:

- RSI Reversal: A downturn in RSI, especially below 70, signals a potential bearish reversal, prompting caution among traders.

- Break Below Support: Violation of EMA 100 and DEMA 50 undermines the bullish bias, triggering reevaluation of market strength.

- Bearish Divergence Confirmation: Confirmation of bearish divergence suggests unsustainable highs, potentially leading to corrective price action.

Useful Links

Important Notice

The begginers in forex trading need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp market fluctuations due to increased volatility. If you decide to trade during the news release, then always place stop orders to minimize losses.

Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes. For successful trading, you need to have a clear trading plan and stay focues and disciplined. Spontaneous trading decision based on the current market situation is an inherently losing strategy for a scalper or daytrader.