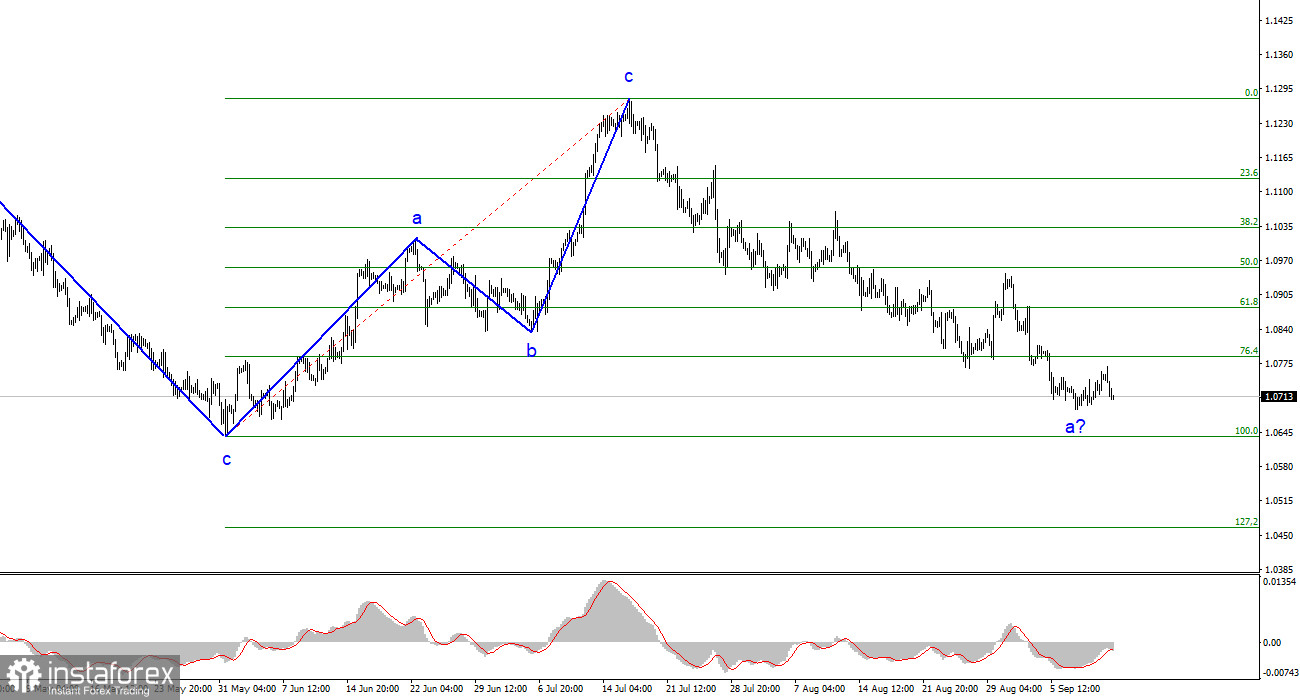

The wave analysis on the 4-hour chart for the euro/dollar pair remains quite clear. The upward trend, which began last year, has taken on a complex structure, with the past year showing only three-wave structures alternating. I've consistently mentioned that I expect the pair to hover around the 5-figure mark, where the construction of the last upward three-wave movement began. I still stand by my words. Another upward three-wave structure is complete, and the market is continuing to build a downward trend segment.

The recent price increase is a partial-fledged wave 2 or b. We saw a similar wave from August 3rd to 10th. This is likely an internal corrective wave 1 or a. If this is the case, the price decline may continue for some time within the framework of the first wave of the downward trend. This is not the end of the euro's decline, as constructing the third wave is still required. Five internal waves are already evident within the first wave, so its completion is approaching.

Economic statistics from the Eurozone could be much better.

The euro/dollar pair fell by 30 basis points on Tuesday, with the amplitude remaining relatively low. Just a day ago, there was confidence that the market had started building the second corrective wave, but at this point, this wave looks so unconvincing that I'm ready to retract my words. Let's not get ahead of ourselves; tomorrow, we have the US inflation report, and the day after that, the ECB meeting. Anything can happen, including increased demand for the euro. However, at this time, the pair is approaching its minimum levels in recent months. We're unlikely to look at an upward wave when the pair is falling.

Economic statistics from the European Union continue to disappoint. We recently learned that the pace of economic growth in the second quarter was only 0.1%, and today, the ZEW economic sentiment indices in Germany and the EU ended another month in negative territory. Despite a slight increase in the index in Germany, it stands at -11.4. It's hardly a positive value. On Monday, it was announced that Germany's economy would contract this year, unlike many other countries in the EU and the EU. So, at this point, Germany is not the EU's locomotive but rather a weight dragging down its economy. The euro isn't celebrating this news either and is gradually sinking.

General Conclusions:

Based on the analysis, the construction of the upward wave set is complete. I still consider targets in the range of 1.0500-1.0600 for the downward trend quite realistic. Therefore, I recommend selling the pair with targets around 1.0636 and 1.0483. A successful attempt to break through the 1.0788 mark indicates the market's readiness to continue selling, and we can now expect to reach the targets mentioned above, which I've been talking about for several weeks and months.

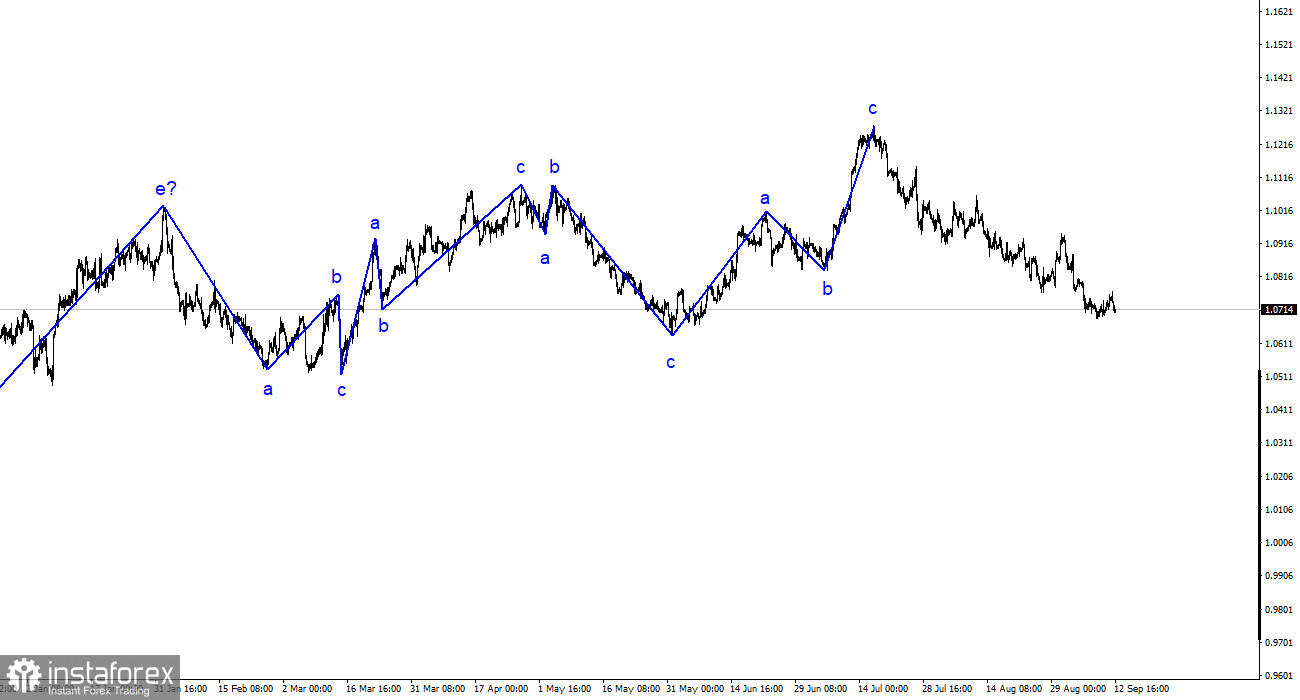

On a larger wave scale, the wave labeling of the upward segment of the trend has taken on an extended form but is likely complete. We've seen five upward waves, likely the structure of a-b-c-d-e. Next, the pair constructed four three-wave structures: two downward and two upward. It has likely entered the stage of building another downward three-wave structure.