No matter how strong the headwind is, gold continues to fight. Looking at the rapid rally of U.S. Treasury bonds and the strong position of the U.S. dollar, one might assume that the precious metal should be trading $100–200 per ounce cheaper. However, high demand for physical assets supports prices. Bulls in XAU/USD still have hope for further global economic slowdown.

China is increasing its gold reserves for the 10th consecutive month. Since then, it has acquired about 217 tons, bringing the total to 2165 tons. Record-high gold prices in Japan are boosting demand from retail investors. There are rumors that the U.S. dollar may rise to £170, the highest level since 1986. Why not buy gold in such conditions? ETFs oriented towards it continue to replenish their reserves, unlike global funds.

Dynamics of gold ETF stocks

Undoubtedly, demand for physical assets is important. However, it only provides the necessary buffer for XAU/USD bulls. For gold quotes to return above $2000 per ounce, the precious metal needs strong arguments. A weaker dollar or lower yields on U.S. Treasury bonds are required. This can only happen in the event of deteriorating macroeconomic statistics in the United States. And everything is heading in that direction.

The American Bankers Association forecasts a slowdown in U.S. GDP to less than 1% for three quarters starting October–December. Experts expect a soft landing and a 100 basis point reduction in the federal funds rate next year. Such estimates align with the market and suggest a decline in the USD index. Most experts polled by Reuters believe that the Federal Reserve will begin to loosen monetary policy in the second or third quarters of 2024. Gold enthusiasts just need to be patient, and they will reap their rewards.

Dynamics of gold in Japanese yen

If the medium and long-term prospects for XAU/USD look bullish, then on the short-term investment horizon, anything is possible. The further dynamics of gold will depend on the actions of the Federal Reserve, which, in turn, will be influenced by incoming data. And the first item on the agenda is the report on U.S. inflation for August.

It is expected that consumer prices will accelerate from 3.2% to 3.6%, while core inflation, on the contrary, will slow down from 4.7% to 4.3% YoY. In monthly terms, indicators will show growth of 0.6% and 0.2% respectively. The statistics are contradictory, and investors will find it difficult to react to it. It may be best to focus on core inflation. Its deceleration is a reason to buy XAU/USD.

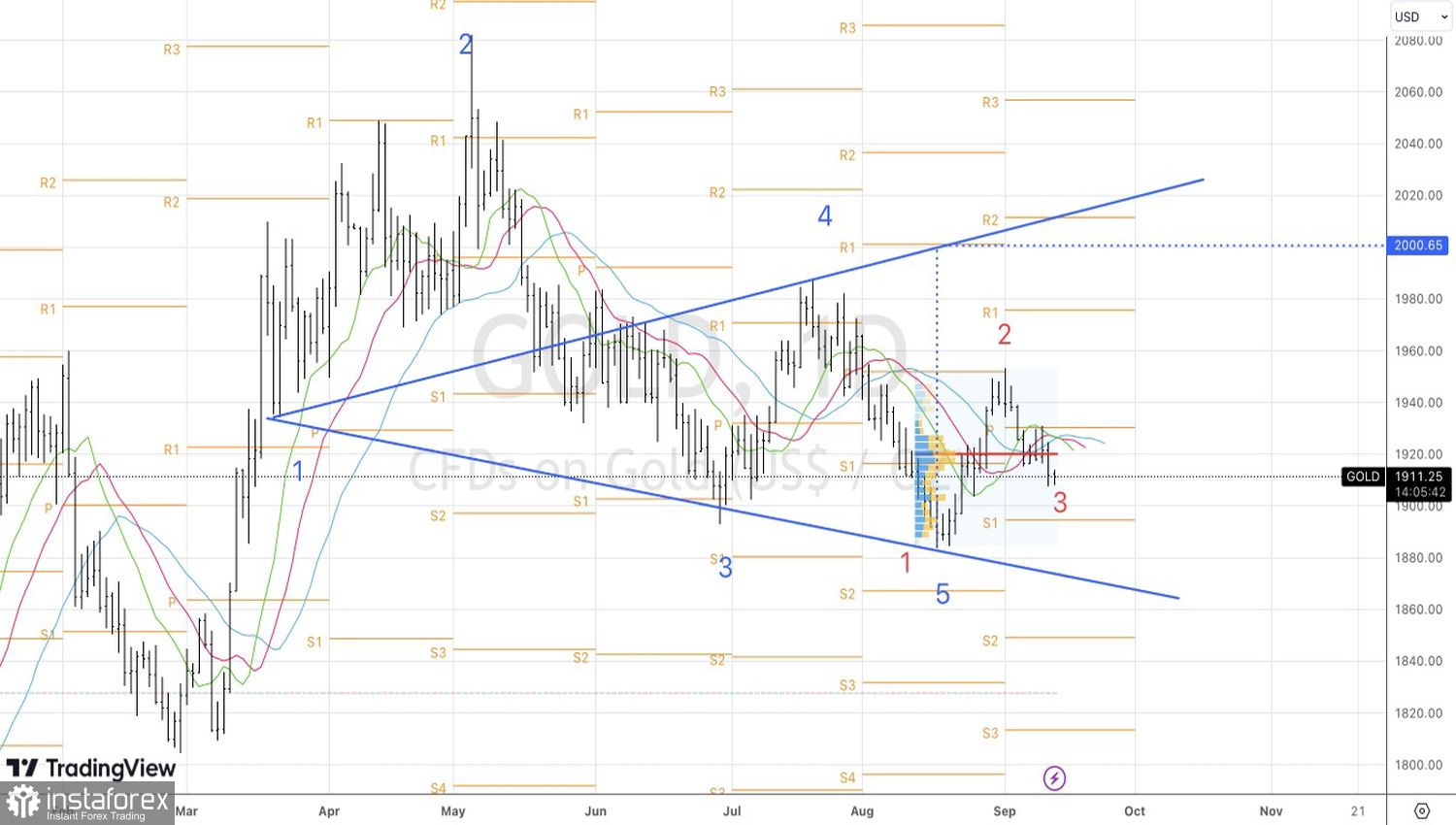

Technically, on the daily chart of the precious metal, a drop below fair value is a worrisome sign. However, if there is a rebound from pivot levels at $1903 and $1895 per ounce, a 1-2-3 reversal pattern may be formed. Together with Elliott Waves, they create a potent mix, allowing the bulls to advance. The recommendation is to buy on a rebound from support at $1903 and $1895 or a break of resistance at $1920.