Pound finds itself in a knockdown once again. The economic growth data published today in the UK mostly disappointed, putting pressure on the GBP/USD pair. Yesterday, traders ignored the mixed report on the UK labor market, as it could be interpreted both in favor of and against the pound. Market participants, however, were in no hurry to draw conclusions, adopting a wait-and-see stance ahead of today's releases (not only British but also American).

Today, the balance has preliminarily tilted in favor of the bearish scenario for GBP/USD. Preliminary – because a complete fundamental picture is still missing one puzzle piece, namely American inflation. But even now, certain conclusions can be drawn. The main conclusion is that the Bank of England is likely to keep all parameters of monetary policy unchanged at its upcoming meeting. The probability of this scenario has been increasing over the past few weeks. The starting point was the release of inflation data for July in the UK. The figures ended up in the 'red zone,' reflecting a significant decline in the Consumer Price Index—both the general and the core index.

After this, there were quite soft statements from the head of the English regulator and some of his colleagues. The essence of these statements boiled down to the fact that the central bank's policy is already restrictive, so additional steps to tighten monetary policy may not be needed. However, Andrew Bailey made an important caveat in his characteristic manner, noting that the Central Bank will make decisions on interest rates based on the dynamics of key macroeconomic indicators.

Several weeks have passed since Bailey's speech, during which the main data on inflation, the labor market, and the overall economy of Britain have been published. All these releases did not increase but, on the contrary, decreased the likelihood of a rate hike at the September meeting.

For example, against the backdrop of slowing July inflation, an increase in unemployment was recorded. According to data released yesterday, the unemployment rate in the UK rose to 4.3%. This can be seen as a negative trend since the indicator has been rising for the third consecutive month.

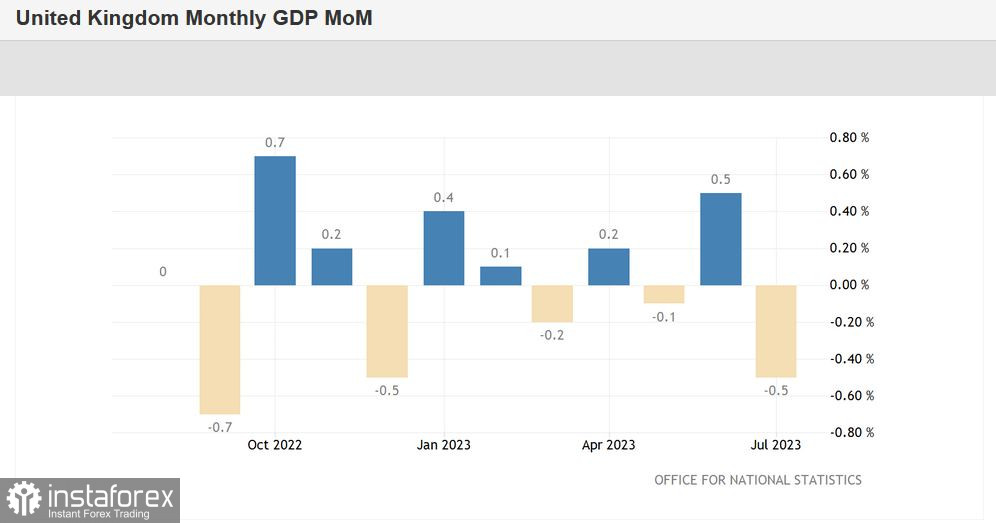

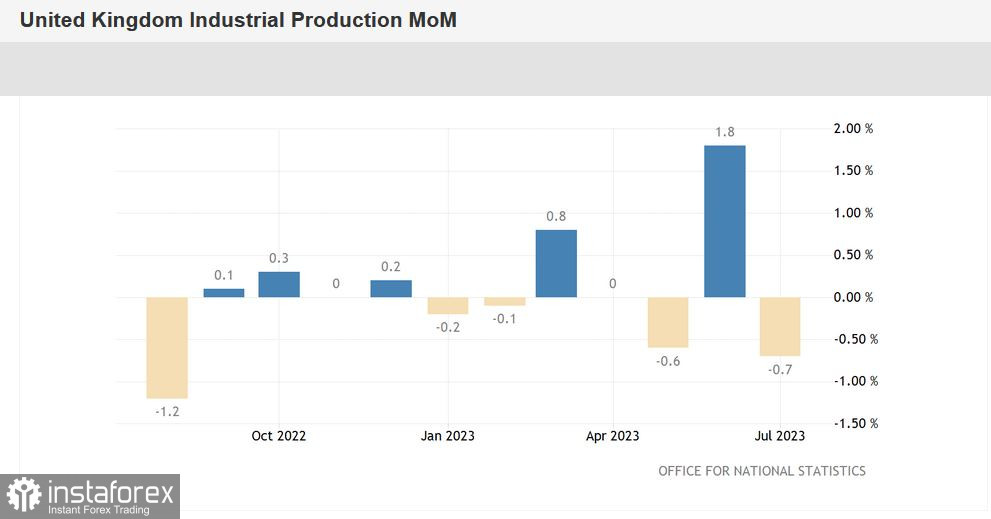

Today's reports have only added to the fundamental picture. In particular, it was revealed that the UK's GDP contracted by 0.5% in July on a monthly basis (the worst result since December 2022). In quarterly terms, the indicator also ended up in the 'red zone,' rising by 0.2% versus growth forecast of 0.4%. It was also announced that industrial production in July decreased by 0.7% on a monthly basis, with a forecasted decline of 0.4% MoM. This is also a multi-month low—the worst result since August 2022. In annual terms, production volume increased by 0.4%, with a growth forecast of 0.7%. The volume of manufacturing production decreased by 0.8% MoM (the weakest reading since August of last year).

Reacting to the published figures, the GBP/USD pair declined to the level of 1.2440, thereby updating a three-month price low. However, for the development of the bearish trend, this is clearly not enough—in this case, it is necessary to at least overcome the support level of 1.2410 (the lower line of the Bollinger Bands indicator on the daily chart) to open the path to the 1.23 figure. This did not happen. Traders of the pair remain cautious in anticipation of the release of inflation data in the United States.

According to forecasts, the overall Consumer Price Index (CPI) in the United States should demonstrate an upward trend, while the core CPI, on the contrary, should show a downward trend. It is worth noting that concerns about inflation acceleration in the United States have significantly increased recently amid the rise in the oil market. Brent crude oil confidently held above the $90 per barrel mark, following Saudi Arabia's decision to continue reducing daily production by 1 million barrels.

Moreover, today, Bloomberg, citing the latest OPEC report, reported that the global oil market is facing its largest deficit in 17 years. It is noted that, in the current quarter, OPEC countries produced an average of 27.4 million barrels per day—approximately 1.8 million barrels less than what consumers require (according to OPEC's calculations).

Obviously, the growth in the oil market will likely affect the dynamics of inflation growth in the United States, prompting a response from the Federal Reserve. If today's CPI report is in the 'green zone,' the likelihood of a rate hike by the Fed in November will increase to 60–70%, especially against the backdrop of recent events in the oil market.

Considering the significance of today's release, GBP/USD traders are in no hurry to open large positions on the pair, remaining cautious. However, if American inflation is on the side of the greenback, the British currency will obediently follow the quoted currency—as today's data has shown, the pound lacks 'its own' arguments to resist the pressure from the dollar bulls. Consequently, GBP/USD buyers have only one chance: a weakening of the greenback. Otherwise, sellers will not only test the 1.2410 target (the lower Bollinger Bands line on D1) but will also potentially target the 1.23 figure.