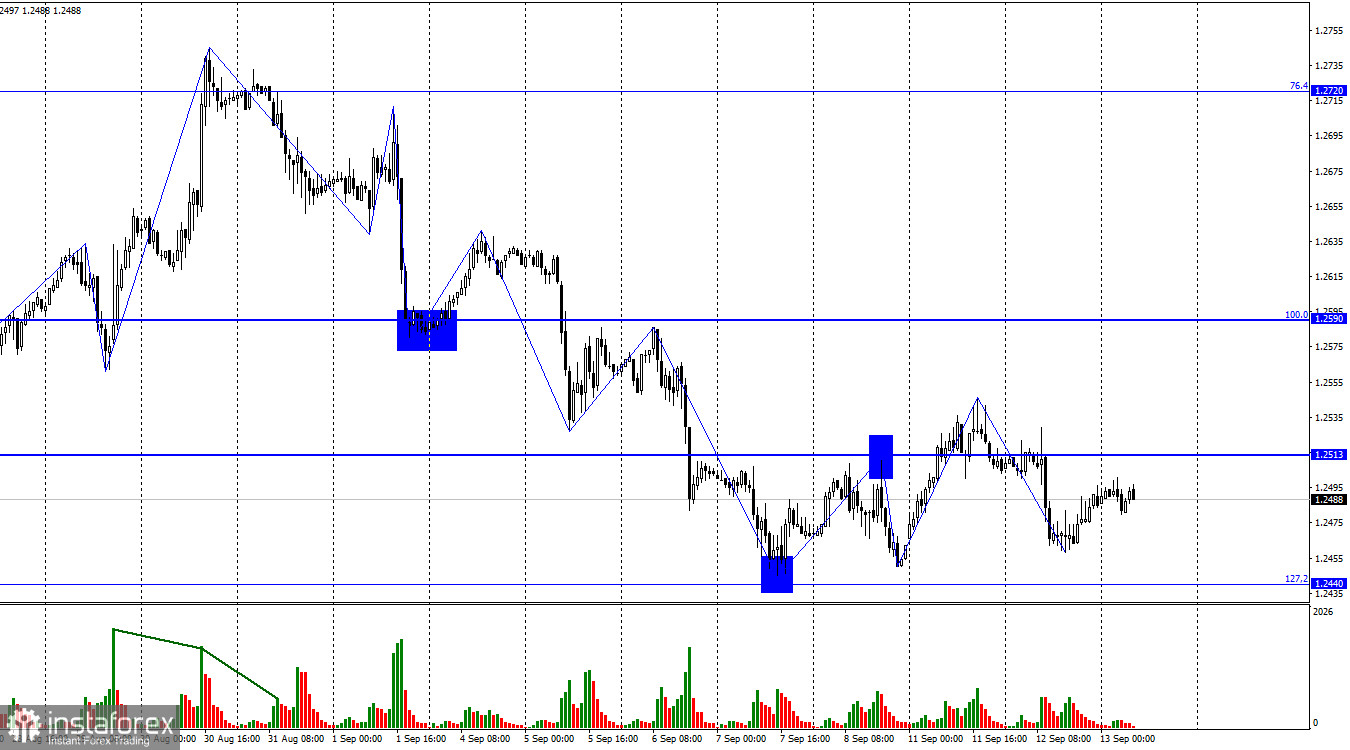

On the hourly chart, the GBP/USD pair experienced a new decline on Tuesday and almost broke the previous day's low. However, the British pound later recovered slightly. I want to draw attention to the recent downward wave, which in size turned out to be almost the same as the last upward wave. And it is also much larger than the previous downward wave. This suggests that bearish traders are regaining control. Today, I believe there is a high probability of a decline to the Fibonacci level of 127.2% at 1.2440, which will mean breaking through the last two lows and, with a high probability, will lead to a resumption of the "bearish" trend.

However, the dollar will need support for growth. The only support for it can come from the report on American inflation, as it is the most important event on Wednesday. But also, the GDP data in the UK, which will be released very soon, could give a certain impetus to today's movement. It is unlikely that GDP in Britain will show growth in July. Still, American inflation may accelerate again, raising the market's expectations of further tightening by the Federal Reserve next week. The Fed's rate could rise to 5.75% as early as September, providing support for the dollar for several more weeks.

A "head and shoulders" pattern will also form if the pair declines today. Ideally, the pound's quotes rise to 1.2513, rebound from it, and then continue to fall. The British pound is still weak, and the bulls have no reason for significant purchases. Next week, the Fed may disappoint, while the Bank of England may provide some positive news. Therefore, it should not be assumed that the pair cannot rise under any circumstances.

On the 4-hour chart, the pair continues to decline despite the earlier closure above the descending trend corridor. The rebound of quotes from the level of 1.2450 worked in favor of the British pound, but the rise is very weak. A new rebound will once again allow us to expect growth towards the upper line of the corridor. A stronger rise in the British pound can only be expected if the quotes consolidate above the corridor. Closing the pair's rate below the level of 1.2450 will increase the chances of further decline in the pound towards the Fibonacci level of 50.0% at 1.2289.

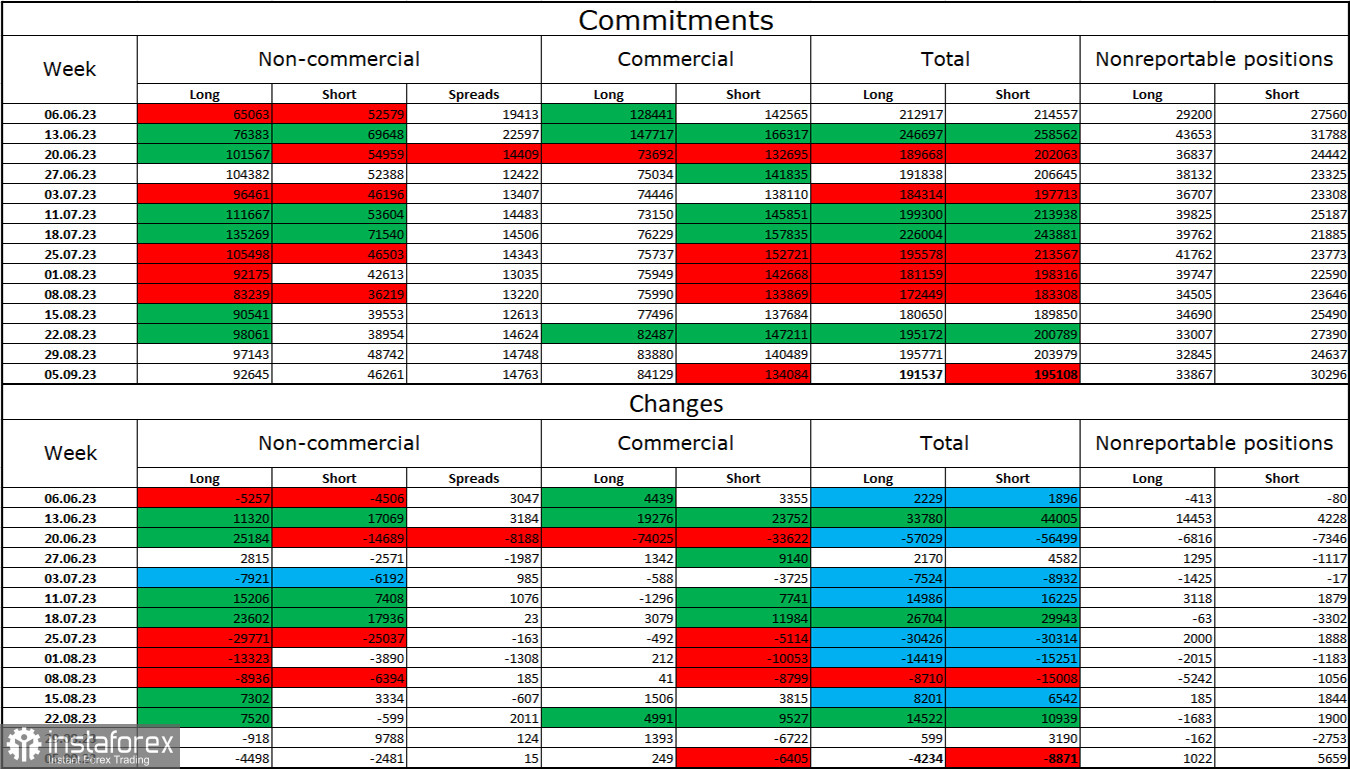

Commitments of Traders (COT) report:

The sentiment of "Non-commercial" traders has become less "bullish" over the past reporting week. The number of long contracts held by speculators decreased by 4498 units, while the number of short contracts decreased by 2481. The overall sentiment of large players remains "bullish," and there is a two-fold gap between the number of long and short contracts: 92,000 versus 46,000. The British pound had good prospects for further growth a few weeks ago, but now, many factors have favored the US dollar. I do not expect a strong rise in the pound sterling soon. Over time, bulls will continue to get rid of buy positions. The Bank of England can change the situation in the market if it continues to raise the rate longer than planned.

Economic Calendar for the US and the UK:

UK - GDP in July (06:00 UTC).

UK - Industrial Production Volume (06:00 UTC).

US - Consumer Price Index (CPI) (12:30 UTC).

On Wednesday, the economic calendar contains three entries, each of which can impact the pair. For the remainder of the day, the influence of the news background on market sentiment may be of moderate strength.

Forecast for GBP/USD and trading recommendations:

Sales of the British pound are possible today when rebounding from the level of 1.2513 with a target of 1.2440 or when closing below 1.2440. For purchases today, a rebound from the level of 1.2440 with a target of 1.2513 or closing above 1.2513 with a target of 50-60 points higher will be required.