On Tuesday, the EUR/USD pair reversed in favor of the US dollar, dropping nearly to the previous low. Traders are currently ignoring the level of 1.2513, and the wave situation is eloquent and interesting. We see that bulls are trying to regain control, and each successive upward wave has a higher peak than the previous one. However, the overall rise of the European currency is very weak, and peak updates are usually only 10-20 points. The same goes for the downward waves. Their lows are higher than the previous ones but by only 10-20 points. This means bearish traders stay in the market and wait to regain control.

Thus, today, the European currency will rise to 1.2535 or 15-20 points higher. If we observe a decline today and a break from the previous day's low, the "bullish" trend will end. In this case, we should expect a decline to the 127.2% Fibonacci correction level at 1.2440 and a close below it, further increasing the chances of the euro's decline continuing.

Yesterday, the news background was quite weak. The ZEW indices in Germany and the European Union were released, but they hardly interested traders. The US inflation report is due today, and the dollar may make a sharp move today (down on the charts). In recent months, inflation in America has increased, and the Federal Reserve remains fairly hawkish regarding this indicator. If the FOMC rate does not rise next week, the market will expect it to increase by another 0.25-0.50% by the end of the year. Jerome Powell has repeatedly stated that returning inflation to 2% is the central bank's main goal, and it would be strange to see them stop halfway. Therefore, if inflation rises in August, the Fed will raise the rate another 1-2 times. This will provide an information background supportive of the dollar's rise.

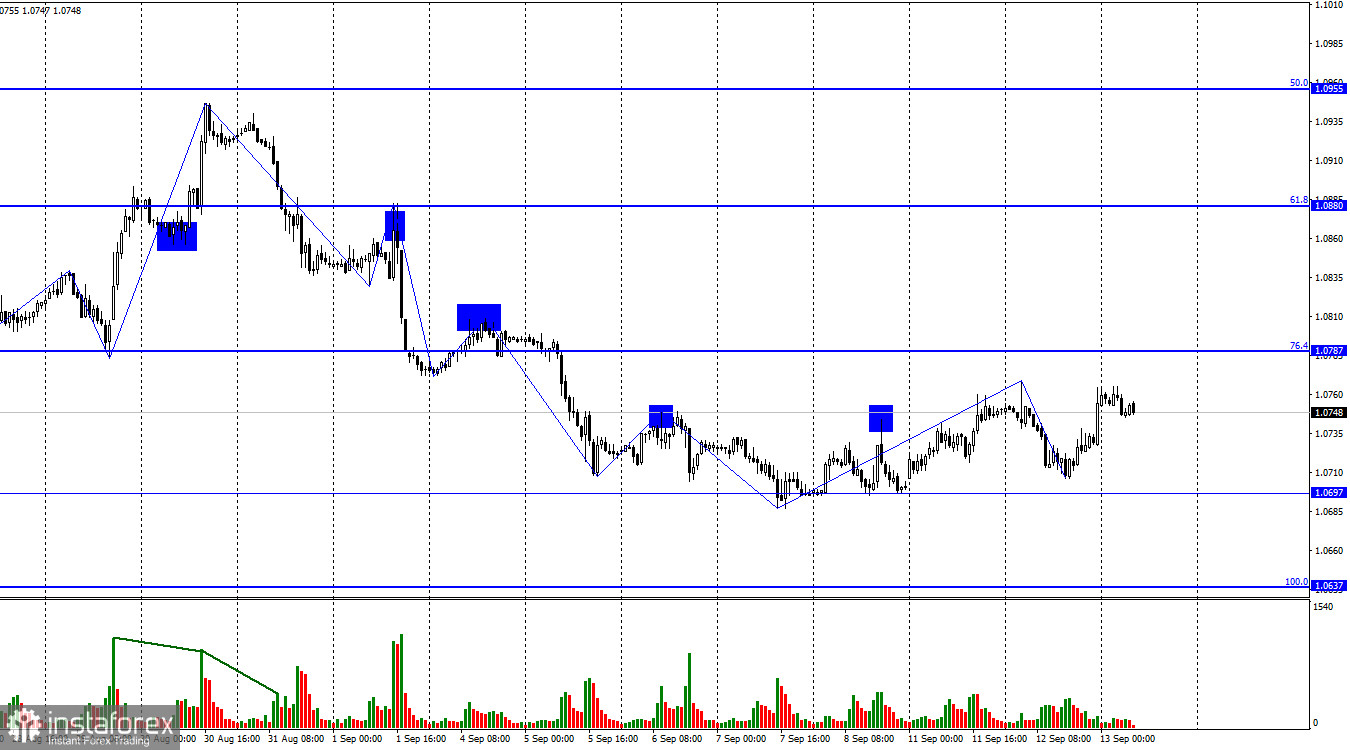

On the 4-hour chart, the pair briefly closed above the descending trend corridor but then resumed its decline. This is a somewhat strange moment, but breaking through two levels on the way down and breaking the previous low indicates a "bearish" trend. Thus, a decline in quotes may continue towards the next correction level of 100.0% at 1.0639. There are no emerging divergences today in any of the indicators. The rise of the European currency can be expected after closing above the descending corridor.

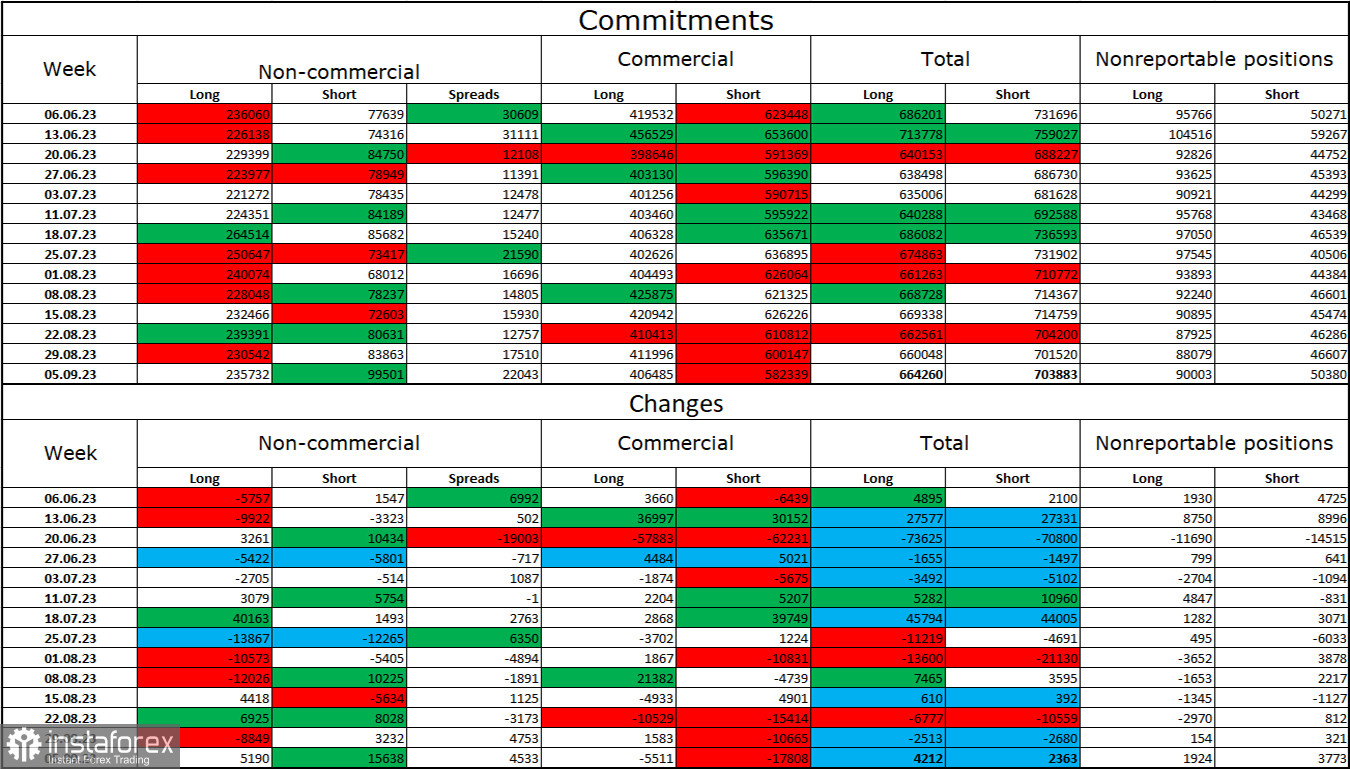

Commitments of Traders (COT) report:

In the last reporting week, speculators opened 5190 long contracts and 15638 short contracts. The sentiment of large traders remains "bullish," but it has been weakening in recent weeks and months. The total number of long contracts speculators hold is now 235,000, while short contracts number 99,000. The situation will change in favor of the bears over time, but bearish traders are not too actively attacking the bulls. The high value of open long contracts suggests that professional traders may close them soon, as there is a significant imbalance in favor of the bulls. The current figures allow for continuing the euro's decline in the coming weeks. The ECB is increasingly signaling the completion of its tightening procedure.

Economic Calendar for the US and the European Union:

European Union - Industrial Production Volume (09:00 UTC).

US - Consumer Price Index (CPI) (12:30 UTC).

On September 13, the economic calendar contains one secondary and one important entry. The impact of the news background on traders' sentiment today can be quite strong, especially in the second half of the day.

Forecast for EUR/USD and trading recommendations:

Sales of the pair are possible today in the range of 1.0760-1.0787, with a target 50-60 points lower. Buying today can be considered upon closing above the level of 1.0787, with a target 50-60 points higher. Alternatively, consider buying on a rebound from the level of 1.0697 with a nearby target.